- Canada

- /

- Food and Staples Retail

- /

- TSX:NWC

Don't Race Out To Buy The North West Company Inc. (TSE:NWC) Just Because It's Going Ex-Dividend

The North West Company Inc. (TSE:NWC) stock is about to trade ex-dividend in 3 days time. You will need to purchase shares before the 27th of September to receive the dividend, which will be paid on the 15th of October.

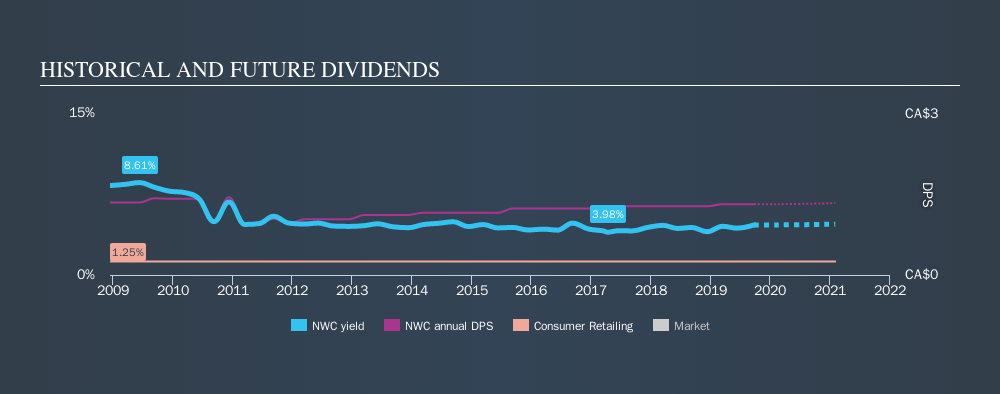

North West's next dividend payment will be CA$0.3 per share, and in the last 12 months, the company paid a total of CA$1.3 per share. Based on the last year's worth of payments, North West stock has a trailing yield of around 4.7% on the current share price of CA$28.28. If you buy this business for its dividend, you should have an idea of whether North West's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for North West

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. North West paid out 68% of its earnings to investors last year, a normal payout level for most businesses. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Over the last year, it paid out dividends equivalent to 206% of what it generated in free cash flow, a disturbingly high percentage. It's pretty hard to pay out more than you earn, so we wonder how North West intends to continue funding this dividend, or if it could be forced to the payment.

North West paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Were this to happen repeatedly, this would be a risk to North West's ability to maintain its dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. With that in mind, we're encouraged by the steady growth at North West, with earnings per share up 7.7% on average over the last five years. Earnings have been growing at a steady rate, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. North West's dividend payments are broadly unchanged compared to where they were ten years ago.

The Bottom Line

Is North West an attractive dividend stock, or better left on the shelf? Earnings per share have grown somewhat, although North West paid out over half its profits and the dividend was not well covered by free cash flow. It's not that we think North West is a bad company, but these characteristics don't generally lead to outstanding dividend performance.

Ever wonder what the future holds for North West? See what the five analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:NWC

North West

Through its subsidiaries, engages in the retail of food and everyday products and services in northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>