Loblaw (TSX:L) Valuation Spotlight as “No-Name” Discount Stores Pivot to No Frills Strategy

Reviewed by Kshitija Bhandaru

Just a year after launching its “no-name” discount pilot stores, Loblaw Companies (TSX:L) is closing two of the three locations, including Windsor. The company plans to reopen the Windsor site as a No Frills store soon.

See our latest analysis for Loblaw Companies.

Loblaw Companies’ decision to pivot away from its “no-name” discount store pilot comes amid a year of steady progress, highlighted by a robust 25.2% total shareholder return over the past twelve months and over 110% total return in three years. This suggests long-term momentum is building even as the share price has pulled back in recent weeks. The company’s recent business moves and sustained returns hint at an evolving strategy in a competitive retail landscape, with investors watching for the next phase of growth.

If you’re interested in where consumer-focused companies are finding their edge, now’s an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

Given Loblaw’s strategic changes, resilient returns, and a current share price trading below analyst targets, investors may wonder if this is a hidden value play or if the market has already priced in Loblaw’s future growth.

Most Popular Narrative: 8.6% Undervalued

With the latest close at CA$54.35, the consensus narrative points to a fair value nearly 9% above this price. The narrative’s outlook sets an intriguing context as Loblaw continues to evolve in a shifting retail and healthcare environment.

The push towards ESG initiatives, local sourcing, and the Buy Canadian trend is strengthening brand loyalty and supporting premium pricing and private label sales. This approach anchors gross margins and lowers competitive churn risk.

What’s really powering this valuation? There is a web of underlying catalysts, such as retail innovation, brand strategy, and surprising numbers driving margins, that you won’t want to miss. See which key assumptions analysts are banking on for Loblaw’s next big leap.

Result: Fair Value of $59.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid digital disruption and mounting margin pressures could challenge Loblaw’s growth thesis, particularly if online competitors or cost inflation accelerate unexpectedly.

Find out about the key risks to this Loblaw Companies narrative.

Another View: Price-to-Earnings Ratio Shows a Steeper Price

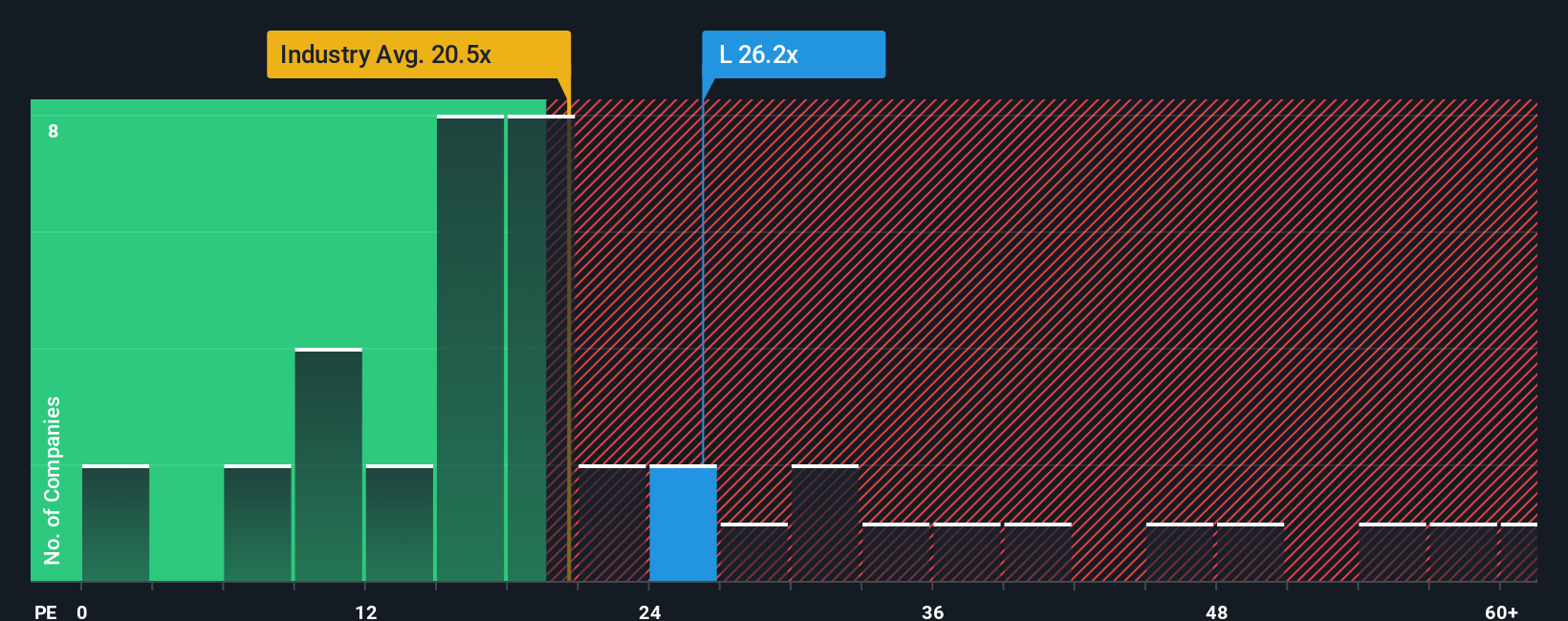

While the first approach suggested Loblaw could be undervalued, our analysis of its price-to-earnings ratio presents a less optimistic picture. Loblaw’s P/E ratio of 26.2x is noticeably higher than both its peers (20.6x) and the Consumer Retailing industry average (20.5x). Even the fair ratio estimate is lower at 23x, highlighting a potential premium investors are paying today. Is this pricing justified by future growth, or does it point to heightened valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Loblaw Companies Narrative

If you have a different perspective or want to dive into the numbers yourself, it’s quick and easy to create your own story in just a few minutes. Do it your way

A great starting point for your Loblaw Companies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors constantly seek new opportunities before they hit the spotlight. Don't miss your chance to find tomorrow's winners with these powerful tools:

- Uncover unique market gems by scanning these 897 undervalued stocks based on cash flows that could be trading beneath their true potential.

- Boost your income strategy and spot future payout leaders by evaluating these 19 dividend stocks with yields > 3% with impressive yields above 3%.

- Stay ahead of the curve and unlock potential in next-generation technology with these 25 AI penny stocks rapidly reimagining entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:L

Loblaw Companies

A food and pharmacy company, provides grocery, pharmacy and healthcare services, health and beauty products, apparel, general merchandise, financial services, and wireless mobile products and services in Canada and the United States.

Outstanding track record average dividend payer.

Similar Companies

Market Insights

Community Narratives