- Canada

- /

- Food and Staples Retail

- /

- TSX:EMP.A

Empire (TSX:EMP.A) Q2 2026: Stable 2.2% Margin Reinforces Tight-Spread Profit Narrative

Reviewed by Simply Wall St

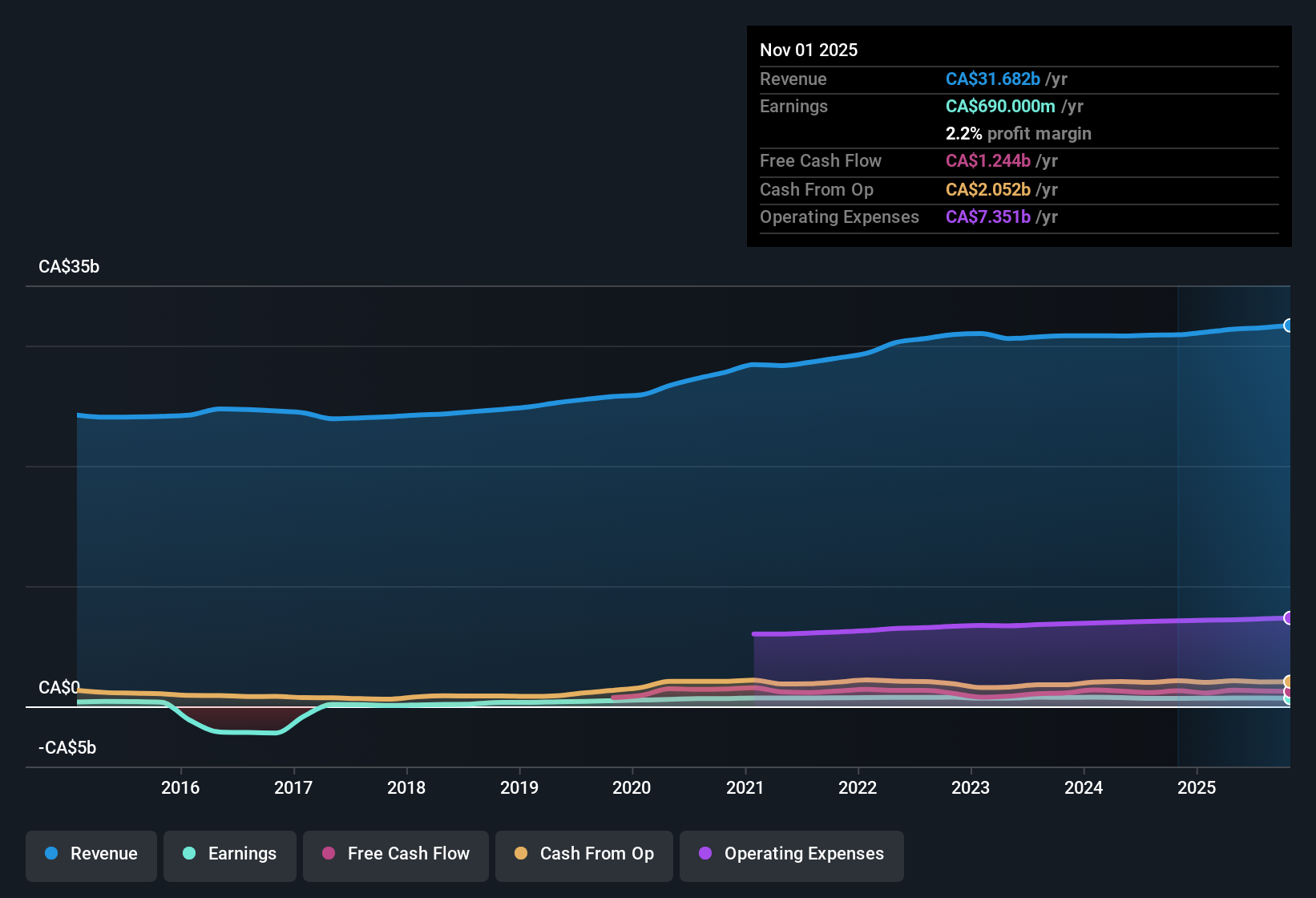

Empire (TSX:EMP.A) has posted Q2 2026 results with revenue of about $8.0 billion and basic EPS of 0.69 CAD, setting a solid backdrop for investors weighing the latest quarter against the broader story. The company has seen revenue move from roughly $7.8 billion and EPS of 0.73 CAD in Q2 2025 to $8.0 billion and 0.69 CAD in Q2 2026, while trailing twelve month EPS sits at 2.95 CAD, giving investors a clearer read on how profitability is tracking through the cycle and what that might mean for margins from here.

See our full analysis for Empire.With the headline numbers on the table, the next step is to see how this earnings print lines up against the prevailing narratives around Empire, and where the data either supports or challenges what investors think they know.

Curious how numbers become stories that shape markets? Explore Community Narratives

TTM earnings at 3.0 CAD per share

- Over the last twelve months, Basic EPS totaled about 2.95 CAD while net income reached roughly 689.6 million CAD on 31.7 billion CAD of revenue.

- For investors with a bullish view, a key point is that trailing EPS has stayed near 3 CAD even as quarterly EPS moves around between roughly 0.62 and 0.91 CAD. This supports the idea of a relatively steady underlying earnings base.

- From Q2 2025 to Q2 2026, individual quarters ranged from 0.62 CAD to 0.91 CAD of EPS, yet the latest trailing figure is still 2.95 CAD. This indicates that softer quarters have been offset by stronger ones over the year.

- Alongside this, trailing net income of 689.6 million CAD is a bit higher than the 665.3 million CAD level seen a year earlier, giving bulls concrete numbers to reference when they argue earnings have been inching forward.

Margins stay slim at 2.2 percent

- Empire is generating about 689.6 million CAD of net income on 31.7 billion CAD of trailing revenue, which equates to a net profit margin of roughly 2.2 percent.

- From a more cautious, bearish angle, critics highlight that this 2.2 percent margin is described as essentially unchanged from last year. This suggests that even with revenue growing from about 30.9 billion CAD to 31.7 billion CAD, profitability per dollar of sales has not moved meaningfully.

- One year ago, trailing revenue was about 30.9 billion CAD with net income of 665.3 million CAD, very close to today’s 31.7 billion CAD and 689.6 million CAD. This underlines how tightly margins are holding around the same level.

- Bears also point to five year earnings having slipped at about 0.3 percent per year while the most recent year grew 3.6 percent, arguing that the longer term record still looks softer than the latest twelve month snapshot.

Slow 2.8 percent revenue growth but discounted P E

- Looking ahead, revenue is forecast to grow around 2.8 percent per year while earnings are expected to rise about 8.75 percent, and the stock trades at roughly 15.5 times earnings versus a 21.7 times industry average.

- From a bullish perspective, investors who focus on valuation argue that this below industry P E, together with forecast earnings growth that comfortably outpaces the expected top line, makes the current 46.52 CAD share price look more appealing than the modest revenue outlook might suggest.

- At 15.5 times earnings, Empire trades below both the 20 times peer average and the 16 times Canadian market, even though analysts still see scope for earnings to compound at about 8.75 percent per year.

- Analysts’ average price target of 57.63 CAD also sits above both the current 46.52 CAD share price and the 40.28 CAD DCF fair value, which indicates that despite slower 2.8 percent revenue growth expectations, many forecasts still lean toward upside from here.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Empire's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Empire’s thin, largely unchanged profit margins and modest revenue trajectory suggest only incremental progress, which leaves long term growth and earnings compounding looking relatively constrained.

If that limited momentum feels underwhelming, shift your focus to stable growth stocks screener (2095 results) to quickly find companies already delivering consistent, dependable expansion instead of waiting years for Empire’s story to improve.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Empire might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EMP.A

Empire

Engages in the food retail and related real estate businesses in Canada.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion