- Canada

- /

- Food and Staples Retail

- /

- TSX:CRRX

Trade Alert: The Chairman Emeritus Of CareRx Corporation (TSE:CRRX), Jack Shevel, Has Just Spent CA$850k Buying 9.4% More Shares

Those following along with CareRx Corporation (TSE:CRRX) will no doubt be intrigued by the recent purchase of shares by Jack Shevel, Chairman Emeritus of the company, who spent a stonking CA$850k on stock at an average price of CA$4.25. While that only increased their holding size by 9.4%, it is still a big swing by our standards.

View our latest analysis for CareRx

The Last 12 Months Of Insider Transactions At CareRx

Notably, that recent purchase by Jack Shevel is the biggest insider purchase of CareRx shares that we've seen in the last year. That implies that an insider found the current price of CA$4.75 per share to be enticing. That means they have been optimistic about the company in the past, though they may have changed their mind. While we always like to see insider buying, it's less meaningful if the purchases were made at much lower prices, as the opportunity they saw may have passed. Happily, the CareRx insiders decided to buy shares at close to current prices.

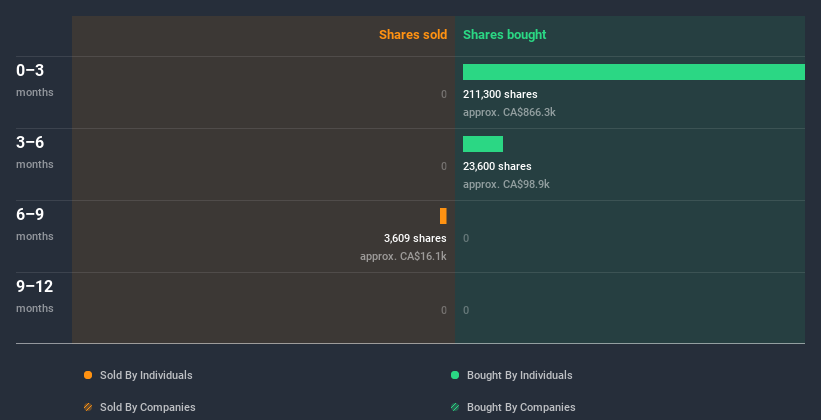

In the last twelve months insiders purchased 234.90k shares for CA$997k. But they sold 3.61k shares for CA$16k. Overall, CareRx insiders were net buyers during the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

CareRx is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Does CareRx Boast High Insider Ownership?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. We usually like to see fairly high levels of insider ownership. CareRx insiders own about CA$21m worth of shares. That equates to 17% of the company. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

What Might The Insider Transactions At CareRx Tell Us?

The recent insider purchases are heartening. And an analysis of the transactions over the last year also gives us confidence. However, we note that the company didn't make a profit over the last twelve months, which makes us cautious. When combined with notable insider ownership, these factors suggest CareRx insiders are well aligned, and that they may think the share price is too low. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing CareRx. When we did our research, we found 4 warning signs for CareRx (1 shouldn't be ignored!) that we believe deserve your full attention.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade CareRx, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade CareRx, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:CRRX

CareRx

Provides pharmacy services to seniors homes and other congregate care settings in Canada.

Mediocre balance sheet and overvalued.