Amidst a backdrop of modest growth, the Canadian market has seen a 1.6% increase over the past week, while its performance over the last year has remained relatively steady. With expectations for annual earnings growth to be around 12% in the coming years, investors may find particular value in dividend stocks that not only offer attractive yields but also demonstrate stability and potential for long-term appreciation in various market conditions.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| IGM Financial (TSX:IGM) | 6.41% | ★★★★★★ |

| Canadian Western Bank (TSX:CWB) | 4.80% | ★★★★★☆ |

| Richards Packaging Income Fund (TSX:RPI.UN) | 3.82% | ★★★★★☆ |

| Manulife Financial (TSX:MFC) | 4.80% | ★★★★★☆ |

| First National Financial (TSX:FN) | 5.99% | ★★★★★☆ |

| North West (TSX:NWC) | 3.91% | ★★★★★☆ |

| iA Financial (TSX:IAG) | 3.30% | ★★★★★☆ |

| Savaria (TSX:SIS) | 3.11% | ★★★★★☆ |

| Imperial Oil (TSX:IMO) | 2.97% | ★★★★★☆ |

| Secure Energy Services (TSX:SES) | 3.74% | ★★★★★☆ |

Click here to see the full list of 20 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

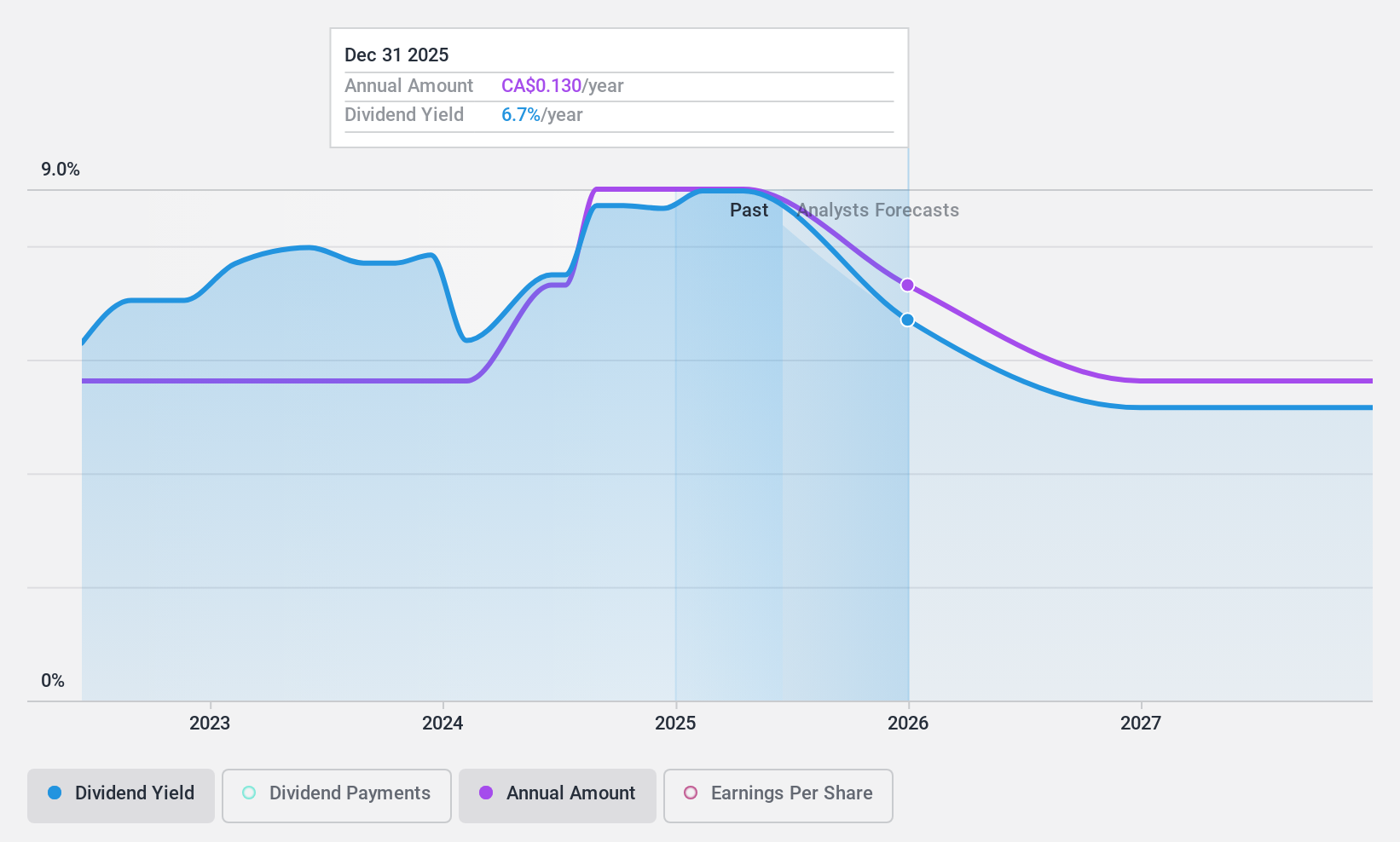

Hemisphere Energy (TSXV:HME)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hemisphere Energy Corporation is a Canadian company engaged in the acquisition, exploration, development, and production of petroleum and natural gas interests, with a market capitalization of approximately CA$137 million.

Operations: Hemisphere Energy Corporation generates its revenue primarily from the sale of petroleum and natural gas, totaling CA$64.813 million.

Dividend Yield: 7.2%

Hemisphere Energy, operating debt-free, presents an intriguing case for dividend investors. Over the past five years, HME has transitioned into profitability with a notable increase in earnings and an improvement in net profit margins. While its dividends are well-covered by both earnings and cash flows, indicating sustainability, there's a cautionary note: the company has not increased its dividend payments since initiation two years ago and faces forecasts of declining revenue and profits. Despite these challenges, HME offers a dividend yield that stands above many Canadian peers—a factor that may appeal to income-focused investors.

- Delve into the full analysis dividend report here for a deeper understanding of Hemisphere Energy.

- Recognizing undervalued stocks is just the first step. To effectively track your investment's performance and make informed decisions, consider utilizing Simply Wall St's portfolio tool.

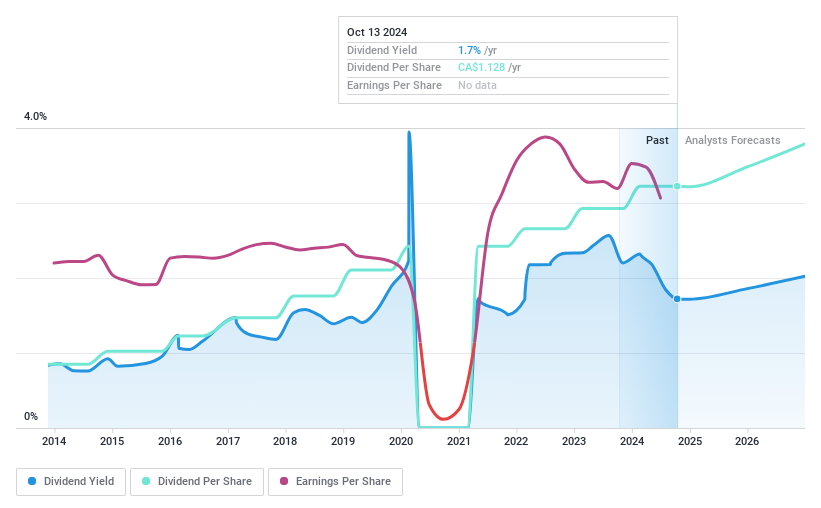

Gildan Activewear (TSX:GIL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gildan Activewear Inc. is a multinational clothing company that specializes in the manufacturing and sales of apparel products across regions including the United States, North America, Europe, Asia-Pacific, and Latin America, with a market capitalization of approximately CA$7.88 billion.

Operations: Gildan Activewear Inc.'s revenue is primarily generated from its apparel segment, which amounted to $3.13 billion.

Dividend Yield: 2.2%

Gildan Activewear, a player in the apparel industry, offers a mixed bag for dividend seekers. The company's debt has crept up over five years, and profit margins have dipped recently. However, Gildan has demonstrated earnings growth historically and maintains dividends that are comfortably supported by both earnings and cash flow, suggesting sustainability. Dividend growth is part of its history but comes with volatility. While its yield isn't top-tier in Canada's market, Gildan's ability to cover interest payments robustly indicates financial prudence.

- Navigate through the intricacies of Gildan Activewear with our comprehensive dividend report here.

- After identifying this stock as a potential bargain, streamline your investment strategy and monitor its progress with the comprehensive analytics provided by Simply Wall St's portfolio tool.

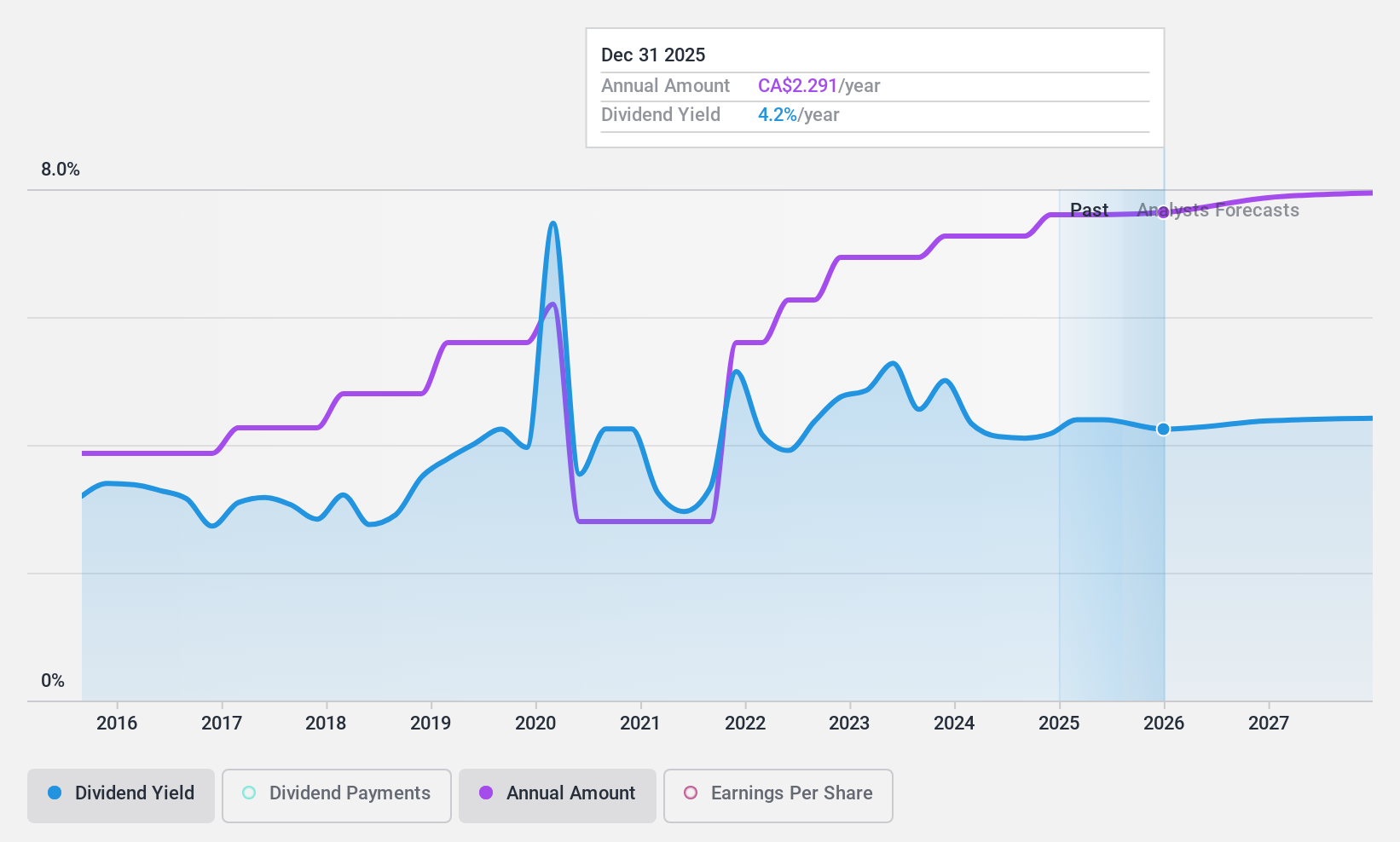

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company with operations spanning across Canada and international markets, currently holding a market capitalization of approximately CA$57.43 billion.

Operations: Suncor Energy Inc. generates its revenue primarily through three segments: Oil Sands, which brought in CA$23.07 billion; Refining and Marketing, with revenues of CA$32.03 billion; and Exploration and Production, contributing CA$2.75 billion.

Dividend Yield: 4.9%

Suncor Energy stands out for its solid financial health, with a declining debt to equity ratio and earnings that have grown notably over the past five years. The company's dividends benefit from this strength, evidenced by a sustainable payout ratio and consistent coverage by both earnings and cash flow. Despite dividends experiencing some volatility over the last decade, recent improvements in profit margins indicate a positive trend. However, investors should note that Suncor's dividend yield isn't among the highest in Canada, and forecasts suggest potential declines in both revenue and profits in the coming years.

- Click here to discover the nuances of Suncor Energy with our detailed analytical dividend report.

- Discovering a possibly undervalued opportunity can be exciting, but ensuring it fits well within your investment goals is essential. Do so seamlessly using the analytical power of Simply Wall St's portfolio tool.

Taking Advantage

Harness the power of the Simply Wall St screener to navigate the landscape of Canadian dividend stocks with ease. Access the full spectrum of 20 Top Dividend Stocks by clicking on this link.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GIL

Gildan Activewear

Manufactures and sells various apparel products in the United States, North America, Europe, Asia-Pacific, and Latin America.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives