- Canada

- /

- Metals and Mining

- /

- TSXV:UGD

D-BOX Technologies And 2 Other Promising Penny Stocks On The TSX

Reviewed by Simply Wall St

As we move into 2025, the Canadian market continues to benefit from a supportive economic backdrop, with the TSX having gained 18% in the previous year. In this context, investors are increasingly interested in identifying stocks that can offer both stability and potential growth. Penny stocks, though an older term, still represent smaller or less-established companies that might provide significant value when backed by strong financials. This article will explore three such penny stocks on the TSX that stand out for their financial health and potential for long-term success.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.04 | CA$379.39M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.40 | CA$122.01M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.42 | CA$961.62M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.64 | CA$583.7M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.54 | CA$15.47M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.45 | CA$241.16M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$30.89M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.66 | CA$307.33M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$178.48M | ★★★★★☆ |

Click here to see the full list of 945 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

D-BOX Technologies (TSX:DBO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: D-BOX Technologies Inc. designs, manufactures, and commercializes motion systems for the entertainment and simulation and training markets worldwide, with a market cap of CA$35.24 million.

Operations: The company generates revenue from three primary segments: Entertainment (CA$21.92 million), Simulation and Training (CA$8.05 million), and Rights for Use, Rental and Maintenance (CA$9.17 million).

Market Cap: CA$35.24M

D-BOX Technologies Inc., with a market cap of CA$35.24 million, has shown significant earnings growth, achieving profitability over the past five years. The company's revenue streams from Entertainment, Simulation and Training, and Rights for Use indicate diversification. Its financial health is supported by short-term assets exceeding both short- and long-term liabilities. Despite a volatile share price recently, D-BOX's debt is well-covered by operating cash flow and interest payments are manageable with EBIT coverage at 4.5x. Recent earnings reports highlight improved net income and profit margins year-over-year, reflecting robust operational performance amidst industry challenges.

- Dive into the specifics of D-BOX Technologies here with our thorough balance sheet health report.

- Gain insights into D-BOX Technologies' historical outcomes by reviewing our past performance report.

Chesapeake Gold (TSXV:CKG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chesapeake Gold Corp. is a mineral exploration and evaluation company that focuses on acquiring, evaluating, and developing precious metal deposits in North and Central America, with a market cap of CA$62.24 million.

Operations: Chesapeake Gold Corp. does not report any revenue segments.

Market Cap: CA$62.24M

Chesapeake Gold Corp., with a market cap of CA$62.24 million, remains pre-revenue as it focuses on developing its Metates gold-silver project in Mexico. The company is debt-free, with short-term assets exceeding liabilities, providing some financial stability despite ongoing losses. Recent metallurgical updates revealed promising gold recovery rates over 70% using proprietary technology, laying the groundwork for a pre-feasibility study aimed at advancing Metates as one of America's largest deposits. Strategic acquisition of intellectual property rights and patent applications could unlock significant value in the global refractory ores market valued at US$1.5 trillion, although profitability remains elusive.

- Click here and access our complete financial health analysis report to understand the dynamics of Chesapeake Gold.

- Examine Chesapeake Gold's past performance report to understand how it has performed in prior years.

Unigold (TSXV:UGD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Unigold Inc. is a junior natural resource company dedicated to exploring and developing gold projects in the Dominican Republic, with a market cap of CA$21.94 million.

Operations: Unigold Inc. does not report any revenue segments as it is focused on exploring and developing gold projects in the Dominican Republic.

Market Cap: CA$21.94M

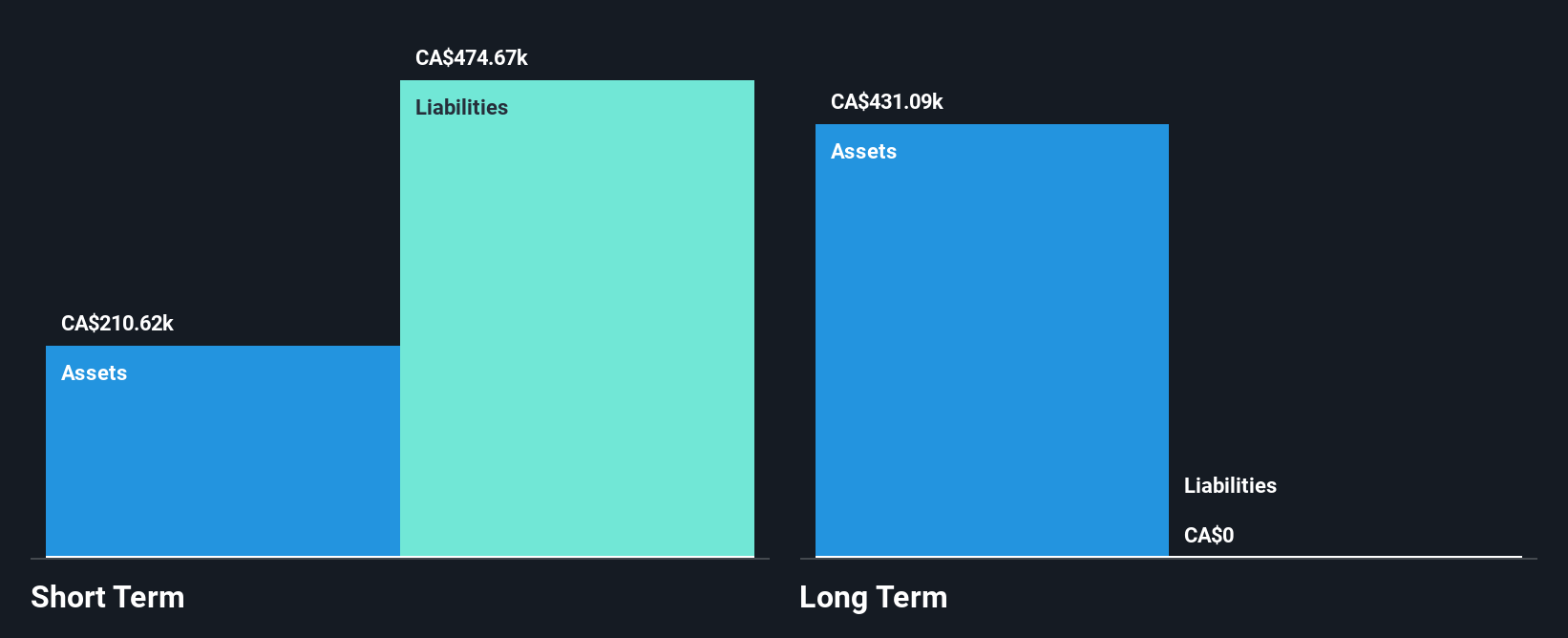

Unigold Inc., with a market cap of CA$21.94 million, is pre-revenue and focused on gold exploration in the Dominican Republic. Despite being debt-free and having short-term assets exceeding liabilities, the company faces financial challenges with less than a year of cash runway and recent shareholder dilution. Unigold's experienced management team has seen losses reduce slightly over five years, though it remains unprofitable with negative return on equity. Recent earnings reports show continued net losses, highlighting volatility in share price as an ongoing concern for investors considering penny stocks like Unigold in their portfolios.

- Navigate through the intricacies of Unigold with our comprehensive balance sheet health report here.

- Understand Unigold's track record by examining our performance history report.

Next Steps

- Discover the full array of 945 TSX Penny Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:UGD

Unigold

A junior natural resource company, focuses on exploring and developing gold projects in the Dominican Republic.

Moderate with adequate balance sheet.