- Canada

- /

- Metals and Mining

- /

- TSXV:LME

3 TSX Penny Stocks With Market Caps Over CA$30M

Reviewed by Simply Wall St

As the Canadian market navigates potential rate cuts and economic stabilization, investors are keeping a close eye on opportunities that align with these shifting conditions. Penny stocks, though an older term, remain relevant as they often represent smaller or newer companies with untapped potential. In this article, we explore three penny stocks that demonstrate strong financials and offer compelling growth prospects amidst current market dynamics.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.65 | CA$61.7M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.79 | CA$20.72M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.33 | CA$2.76M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.325 | CA$47.31M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.11 | CA$711.87M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.99 | CA$19.82M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.35 | CA$382.73M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.52 | CA$176.63M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.99 | CA$189.86M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.67 | CA$8.34M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 409 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

D-BOX Technologies (TSX:DBO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: D-BOX Technologies Inc. designs, manufactures, and commercializes haptic motion systems for theatrical entertainment, sim racing and simulation, and training across multiple continents with a market cap of CA$95.68 million.

Operations: The company's revenue is primarily derived from its Theatrical segment, which generated CA$24.91 million, followed by Sim Racing at CA$9.73 million and Simulation and Training at CA$8.69 million.

Market Cap: CA$95.68M

D-BOX Technologies has demonstrated significant financial improvement, with recent earnings growth of 4255.9% and revenue increasing to CA$13.04 million from CA$8.76 million year-over-year. The company maintains a strong balance sheet, with short-term assets covering both short and long-term liabilities, and its debt is well-covered by operating cash flow. Despite stable weekly volatility at 11%, the stock's value remains significantly below fair estimates, suggesting potential undervaluation. Recent leadership changes aim to streamline operations and accelerate growth across segments, indicating strategic efforts towards enhanced execution and commercial clarity under new CEO Naveen Prasad's direction.

- Navigate through the intricacies of D-BOX Technologies with our comprehensive balance sheet health report here.

- Gain insights into D-BOX Technologies' past trends and performance with our report on the company's historical track record.

Greenlane Renewables (TSX:GRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Greenlane Renewables Inc. offers biogas desulfurization and upgrading systems and services globally, with a market cap of CA$37.13 million.

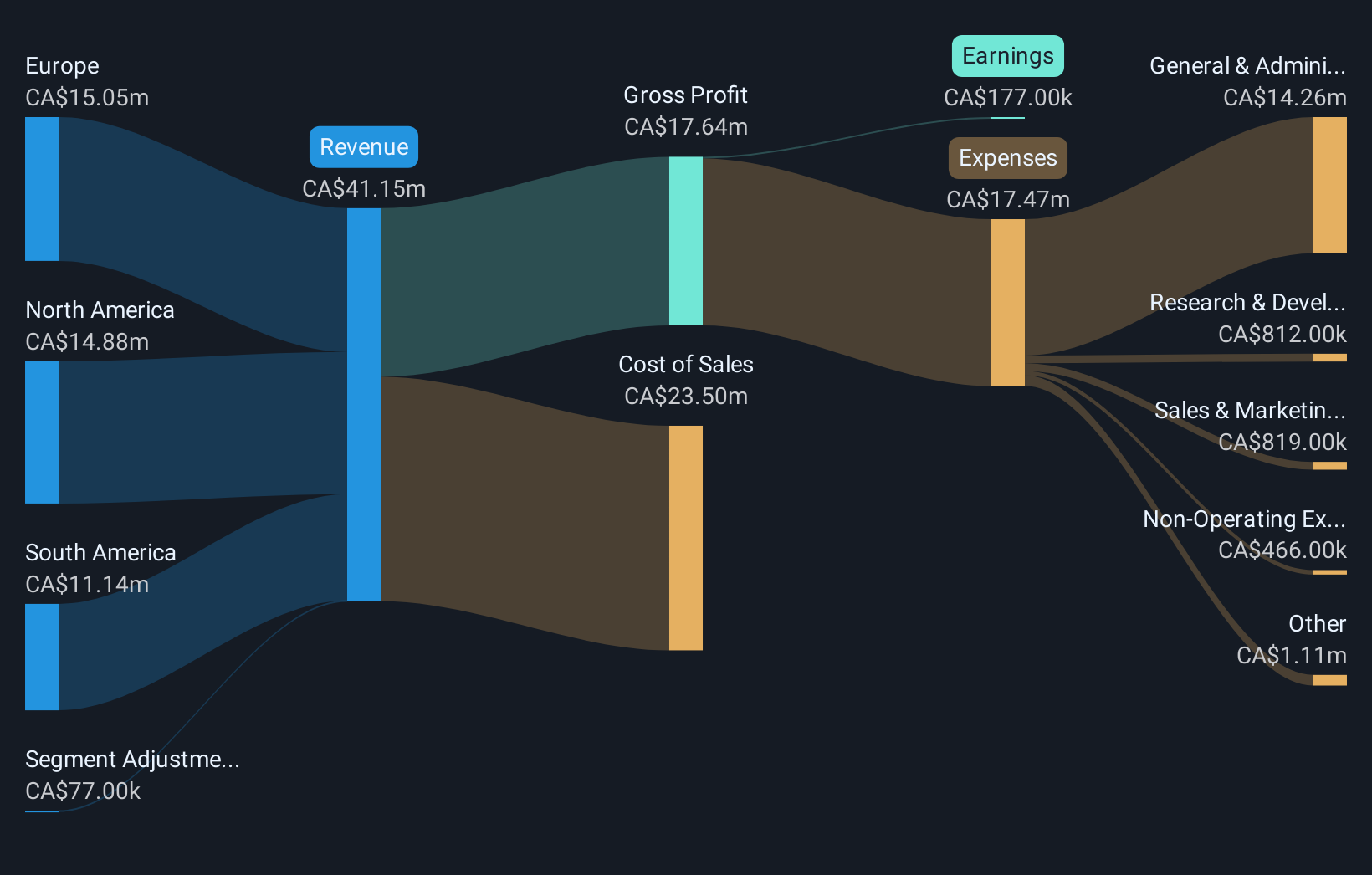

Operations: The company's revenue is primarily generated from its Machinery & Industrial Equipment segment, totaling CA$41.15 million.

Market Cap: CA$37.13M

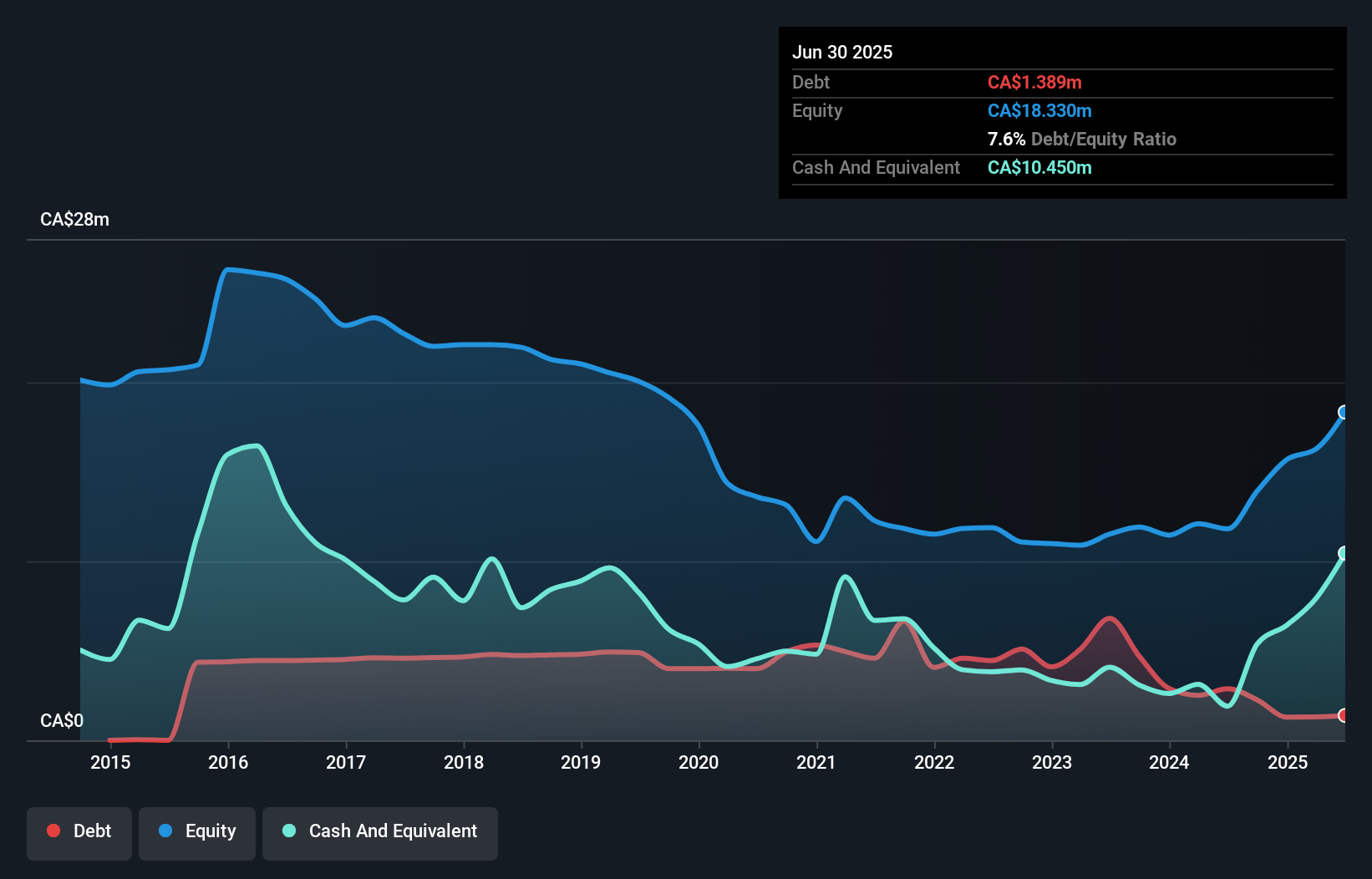

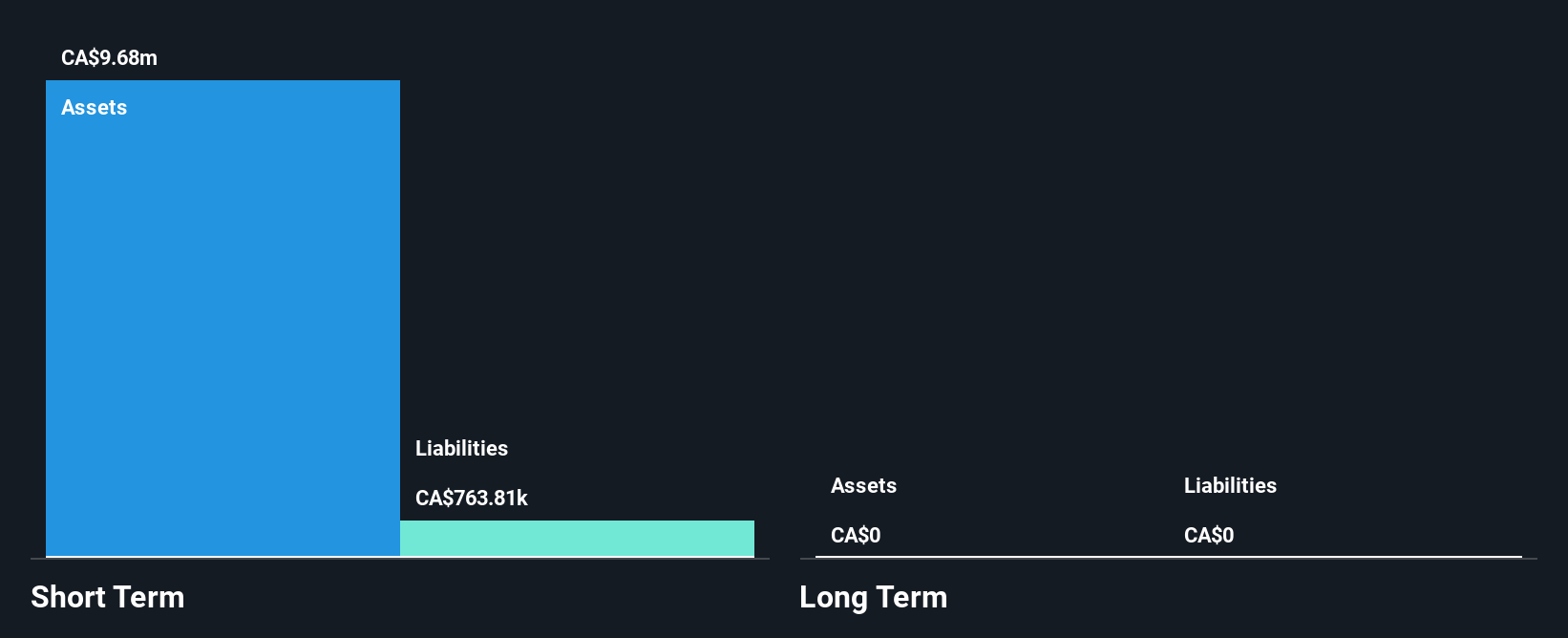

Greenlane Renewables Inc. has shown financial resilience by becoming profitable this year, with net income reaching CA$1.28 million in Q2 2025, a turnaround from the previous year's loss. The company remains debt-free, with short-term assets of CA$34.7 million exceeding liabilities and no significant shareholder dilution over the past year. Recent client announcements highlight five new service agreements for renewable natural gas projects, emphasizing strong demand and trust in Greenlane's technology globally. However, despite these positive developments, the stock price remains highly volatile and trades significantly below its estimated fair value.

- Click here to discover the nuances of Greenlane Renewables with our detailed analytical financial health report.

- Evaluate Greenlane Renewables' historical performance by accessing our past performance report.

Laurion Mineral Exploration (TSXV:LME)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Laurion Mineral Exploration Inc. focuses on acquiring, exploring, and developing mineral properties in Canada, with a market cap of CA$93.19 million.

Operations: Laurion Mineral Exploration Inc. does not report any revenue segments.

Market Cap: CA$93.19M

Laurion Mineral Exploration Inc. is a pre-revenue company actively advancing its Ishkoday Project, with recent drilling results revealing promising gold grades at the Sturgeon River Mine area. The company remains debt-free and has reduced its losses over the past five years by 3.6% annually, though it continues to operate at a net loss of CA$0.675 million in Q2 2025. Recent board changes introduce Vikram Jayaraman, bringing technical and strategic expertise to support Laurion's exploration and shareholder value objectives. With sufficient cash runway for over a year, Laurion is strategically positioned for continued exploration progress and potential growth opportunities.

- Unlock comprehensive insights into our analysis of Laurion Mineral Exploration stock in this financial health report.

- Review our historical performance report to gain insights into Laurion Mineral Exploration's track record.

Taking Advantage

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 406 more companies for you to explore.Click here to unveil our expertly curated list of 409 TSX Penny Stocks.

- Interested In Other Possibilities? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LME

Laurion Mineral Exploration

Engages in the acquisition, exploration, and development of mineral properties in Canada.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives