In the last week, the Canadian market has been flat, but over the past 12 months, it has risen by 22%, with earnings forecasted to grow by 17% annually. Penny stocks, though a somewhat outdated term, remain relevant as they often represent smaller or newer companies that can offer both value and growth opportunities. In this context of rising markets and potential earnings growth, we will explore several penny stocks that stand out for their financial strength and potential for long-term success.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.63 | CA$593.2M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.69 | CA$273.57M | ★★★★★☆ |

| Alvopetro Energy (TSXV:ALV) | CA$4.825 | CA$176.46M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.26 | CA$116.54M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.44 | CA$12.46M | ★★★★★☆ |

| Mandalay Resources (TSX:MND) | CA$3.30 | CA$308.29M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.20 | CA$5.34M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.21 | CA$219.69M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$30.36M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

Click here to see the full list of 964 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Fintech Select (TSXV:FTEC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fintech Select Ltd. offers financial payment services in Canada and has a market cap of CA$2.80 million.

Operations: Fintech Select Ltd. has not reported any revenue segments.

Market Cap: CA$2.8M

Fintech Select Ltd., with a market cap of CA$2.80 million, has recently become profitable, reporting net income growth and sales of CA$1.31 million for the second quarter of 2024. Despite its profitability and outstanding return on equity (1162%), the company remains highly volatile and trades significantly below its estimated fair value. It has no debt but faces liquidity challenges as short-term assets do not cover liabilities. Recent changes in auditors may affect investor confidence, though these were due to external factors unrelated to financial performance. The board's average tenure suggests experienced governance amidst these developments.

- Click here to discover the nuances of Fintech Select with our detailed analytical financial health report.

- Explore historical data to track Fintech Select's performance over time in our past results report.

Gatekeeper Systems (TSXV:GSI)

Simply Wall St Financial Health Rating: ★★★★★★

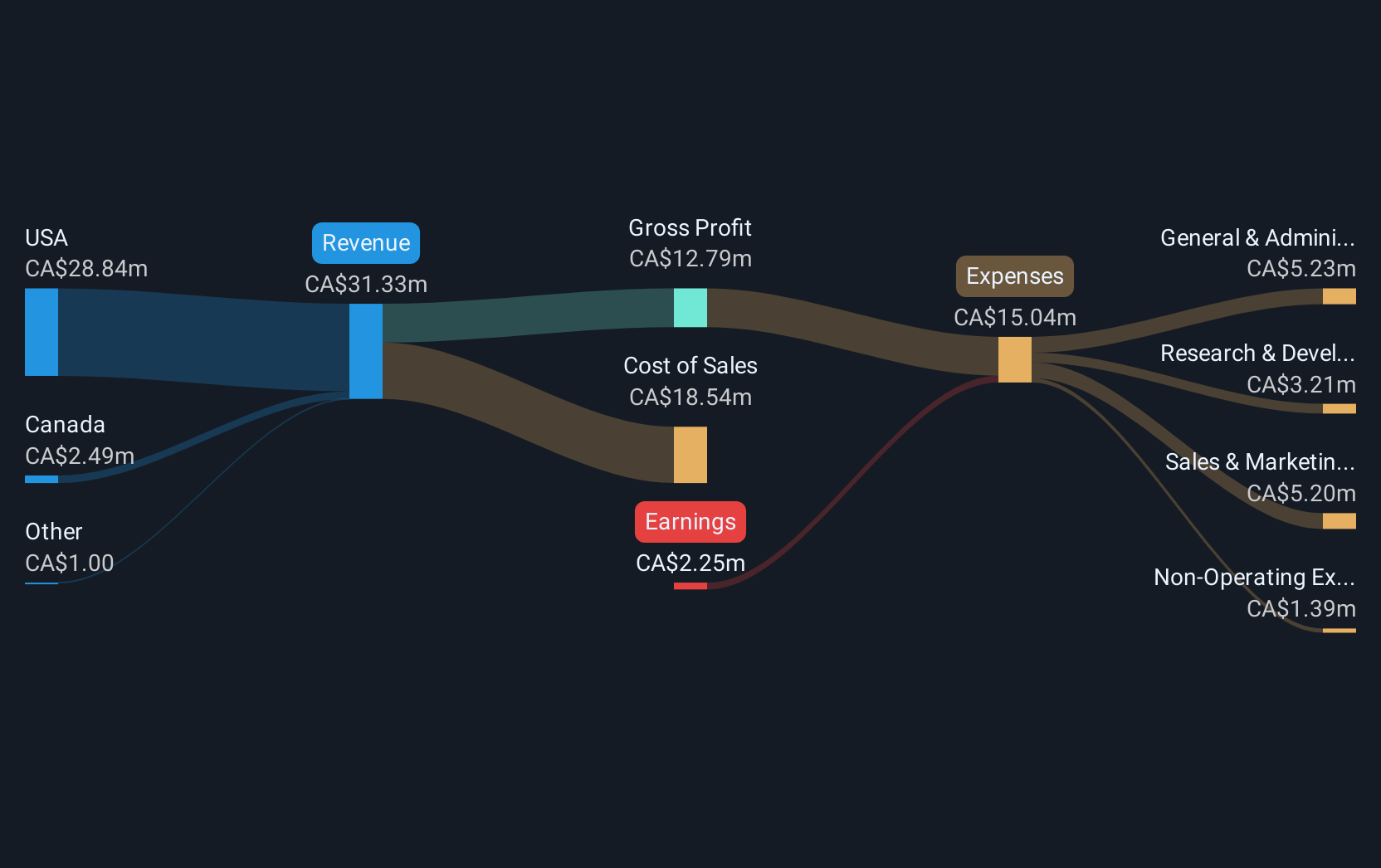

Overview: Gatekeeper Systems Inc. designs, manufactures, markets, and sells video security solutions for mobile and transportation environments focused on children, passengers, and public safety in Canada and the United States with a market cap of CA$54.35 million.

Operations: The company's revenue segment is primarily derived from Electronic Security Devices, totaling CA$33.49 million.

Market Cap: CA$54.35M

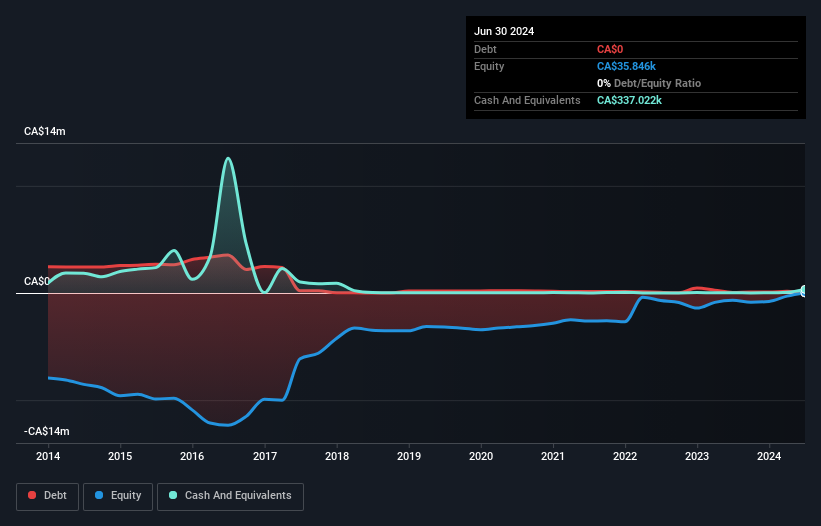

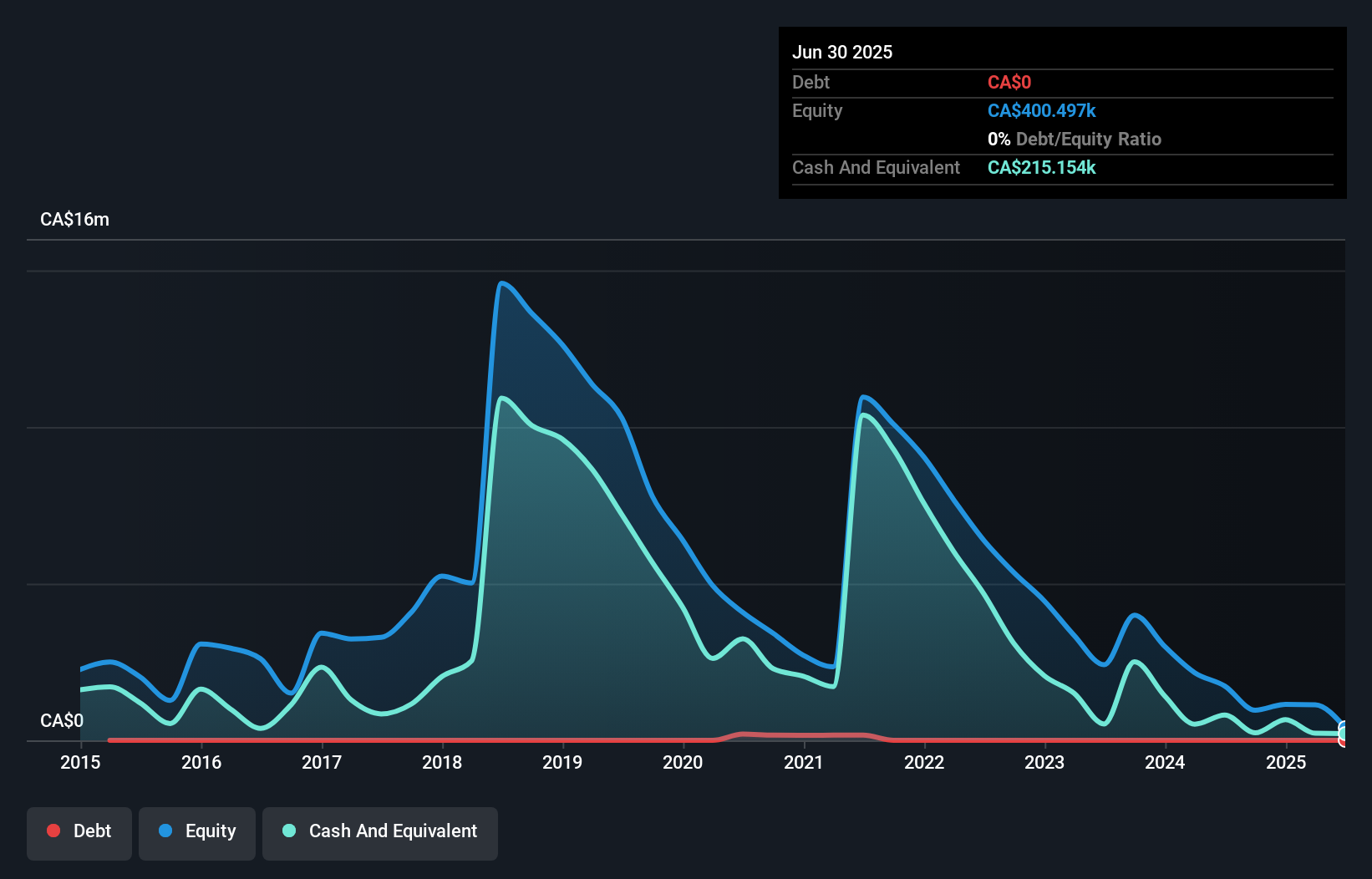

Gatekeeper Systems, with a market cap of CA$54.35 million, exhibits stable weekly volatility and trades significantly below its estimated fair value. The company is debt-free, and its short-term assets comfortably exceed both long-term and short-term liabilities. Despite experiencing negative earnings growth over the past year, Gatekeeper has achieved profitability over the last five years with an average annual earnings growth of 31.9%. Recent corporate guidance indicates record revenue for fiscal 2024 at approximately CA$37.6 million, marking a substantial increase from the previous year and highlighting potential growth momentum in its operations.

- Navigate through the intricacies of Gatekeeper Systems with our comprehensive balance sheet health report here.

- Examine Gatekeeper Systems' past performance report to understand how it has performed in prior years.

Legend Power Systems (TSXV:LPS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Legend Power Systems Inc. is an electrical energy conservation company operating in Canada and the United States, with a market cap of CA$27.74 million.

Operations: The company's revenue comes from the sale or installation of The Smartgate, amounting to CA$1.33 million.

Market Cap: CA$27.74M

Legend Power Systems, with a market cap of CA$27.74 million, is currently unprofitable but has managed to reduce its losses by 7.3% annually over the past five years. The company operates debt-free and has short-term assets of CA$2.8 million exceeding both its short-term liabilities (CA$1.2 million) and long-term liabilities (CA$269.4K). Recent earnings reports show improved sales for Q3 at CA$1.04 million compared to the previous year's CA$0.47 million, though it remains pre-revenue by broader industry standards with less than US$1m in revenue annually from The Smartgate sales or installations.

- Click here and access our complete financial health analysis report to understand the dynamics of Legend Power Systems.

- Learn about Legend Power Systems' historical performance here.

Seize The Opportunity

- Get an in-depth perspective on all 964 TSX Penny Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GSI

Gatekeeper Systems

Designs, manufactures, markets, and sells video security solutions for mobile and transportation environment for children, passengers, and public safety in Canada and the United States.

Flawless balance sheet and slightly overvalued.