- Canada

- /

- Professional Services

- /

- TSX:TRI

A Fresh Look at Thomson Reuters (TSX:TRI) Valuation After New AI Partnership and $1 Billion Buyback

Reviewed by Simply Wall St

Thomson Reuters (TSX:TRI) just announced two significant moves that have investors taking a closer look. First, the company is partnering with Clockwork.ai to embed powerful AI-driven financial planning tools into its platform. This partnership aims to offer accounting firms faster and deeper insights for client advisory work. In addition, management has launched a $1 billion share repurchase program, putting real capital behind their confidence in the company’s future and its current valuation. For investors, these initiatives signal a strategy focused on both accelerating product innovation and rewarding shareholders.

These developments arrive after a year of steady gains for Thomson Reuters, with the stock climbing 11% and outperforming much of the broader market. While shares dipped in the past month, momentum picked up again following the partnership and buyback announcements. This activity suggests that institutional investors may be reassessing growth prospects. The company’s ongoing rollout of AI solutions in Legal and Tax & Accounting, along with robust earnings growth, continues to reinforce a narrative of resilience and adaptability as business needs evolve.

With shares now trading near all-time highs, investors have a key decision to make: is Thomson Reuters trading at a discount to its true worth, or has the market already factored in all of its future upside?

Most Popular Narrative: 9.9% Undervalued

According to community narrative, Thomson Reuters is currently trading below its estimated fair value, driven by strong expectations around earnings growth, margin expansion, and the transformative impact of its AI-powered product strategy.

Thomson Reuters' ongoing rollout of agentic AI solutions across Legal and Tax & Accounting, such as Westlaw Advantage, CoCounsel Legal, and Ready to Advise/Ready to Review, is enabling automation of increasingly complex professional workflows. As customer adoption accelerates, these differentiated premium offerings are expected to drive both higher subscription revenue and further price increases.

Curious how analysts justify a premium usually reserved for tech disruptors? The narrative points to ambitious forecasts for both growth and profitability, all relying on game-changing products and rapid customer adoption. Want the real story behind the numbers? Explore further to see which assumptions could make TRI a rare value opportunity.

Result: Fair Value of $274.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent competition from new AI entrants and slow customer adoption could challenge Thomson Reuters’ pricing power and put its long-term growth at risk.

Find out about the key risks to this Thomson Reuters narrative.Another View: What Do Other Models Say?

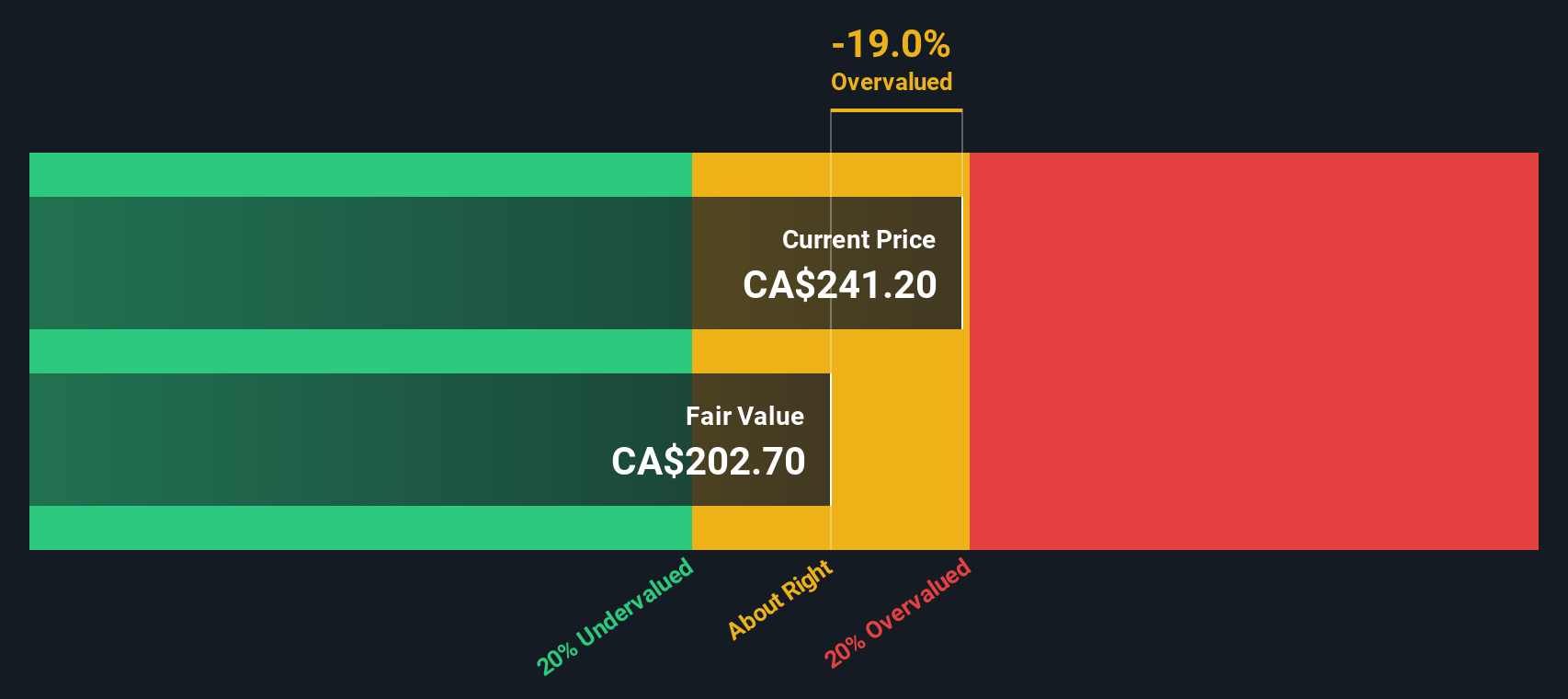

While the community narrative sees Thomson Reuters as undervalued, our DCF model paints a more cautious picture. The model suggests the shares could be overvalued based on long-term cash flow forecasts. Are investors overly optimistic, or is there hidden value being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Thomson Reuters Narrative

If you see things differently or want a firsthand look at the underlying numbers, it takes just a few minutes to craft and test your own perspective. do it your way.

A great starting point for your Thomson Reuters research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make sure you are not limiting your portfolio to just one opportunity. Savvy investors broaden their horizons and find stocks that match their ambitions. Use these powerful screens to pinpoint companies with features that set them apart, before the rest of the market catches on.

- Uncover fresh potential by evaluating penny stocks with strong financials using the penny stocks with strong financials and spot companies quietly building solid foundations.

- Capture steady income streams by checking out dividend stocks with yields over 3 percent. dividend stocks with yields > 3% makes it easy to find reliable payers that can boost your returns.

- Seize opportunities at the intersection of technology and biology by exploring healthcare AI leaders, all accessible with the healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thomson Reuters might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TRI

Thomson Reuters

Operates as a content and technology company in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives