- Canada

- /

- Commercial Services

- /

- TSX:GFL

TSX Stocks That May Be Trading Below Fair Value Estimates For September 2024

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has risen 2.7%, driven by gains in the Materials and Financials sectors of 6.9% and 2.5%, respectively. With the market up 16% over the last 12 months and earnings forecasted to grow by 15% annually, identifying stocks that may be trading below fair value becomes crucial for investors looking to capitalize on potential growth opportunities in this robust environment.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$181.00 | CA$361.01 | 49.9% |

| Computer Modelling Group (TSX:CMG) | CA$11.84 | CA$22.17 | 46.6% |

| Savaria (TSX:SIS) | CA$21.12 | CA$41.29 | 48.8% |

| Kinaxis (TSX:KXS) | CA$153.25 | CA$282.71 | 45.8% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Endeavour Mining (TSX:EDV) | CA$33.04 | CA$56.11 | 41.1% |

| NanoXplore (TSX:GRA) | CA$2.32 | CA$4.55 | 49% |

| Blackline Safety (TSX:BLN) | CA$5.44 | CA$10.21 | 46.7% |

| Boyd Group Services (TSX:BYD) | CA$212.19 | CA$340.34 | 37.7% |

| Opsens (TSX:OPS) | CA$2.90 | CA$4.64 | 37.5% |

Let's dive into some prime choices out of the screener.

GFL Environmental (TSX:GFL)

Overview: GFL Environmental Inc. provides non-hazardous solid waste management and environmental services in Canada and the United States, with a market cap of CA$21.43 billion.

Operations: The company's revenue segments include CA$4.79 billion from Solid Waste in the USA, CA$2.16 billion from Solid Waste in Canada, and CA$1.67 billion from Environmental Services.

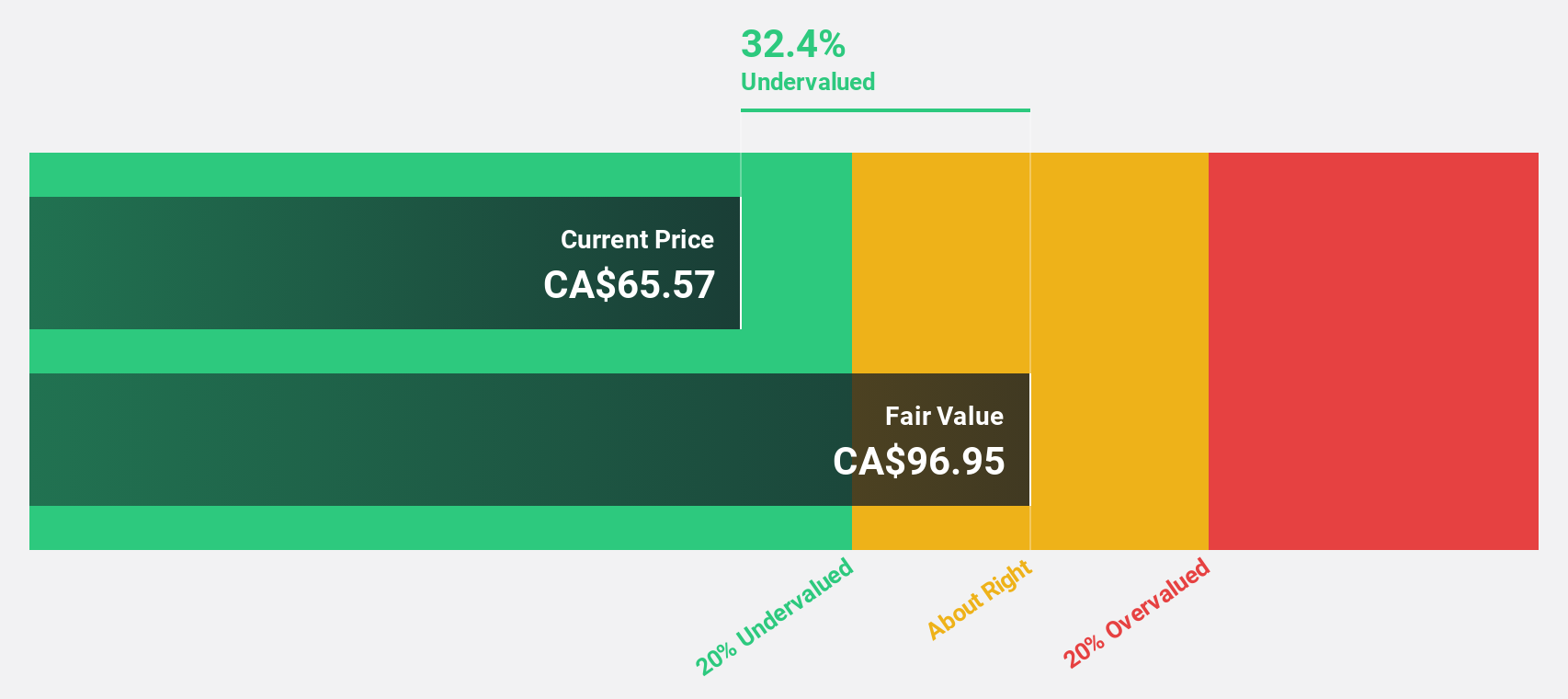

Estimated Discount To Fair Value: 33.7%

GFL Environmental Inc. is trading at CA$53.31, significantly below its estimated fair value of CA$80.37, making it a potentially undervalued stock based on cash flows. Despite recent net losses and shareholder dilution, the company has raised its revenue guidance for 2024 to between $7.90 billion and $7.93 billion and expects profitability within three years with an annual profit growth forecast of 115%. Additionally, GFL's revenue is projected to grow faster than the Canadian market average.

- Our comprehensive growth report raises the possibility that GFL Environmental is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of GFL Environmental.

goeasy (TSX:GSY)

Overview: goeasy Ltd. offers non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands to consumers in Canada, with a market cap of CA$3.01 billion.

Operations: Revenue segments for goeasy Ltd. include CA$154.10 million from Easyhome and CA$1.24 billion from Easyfinancial.

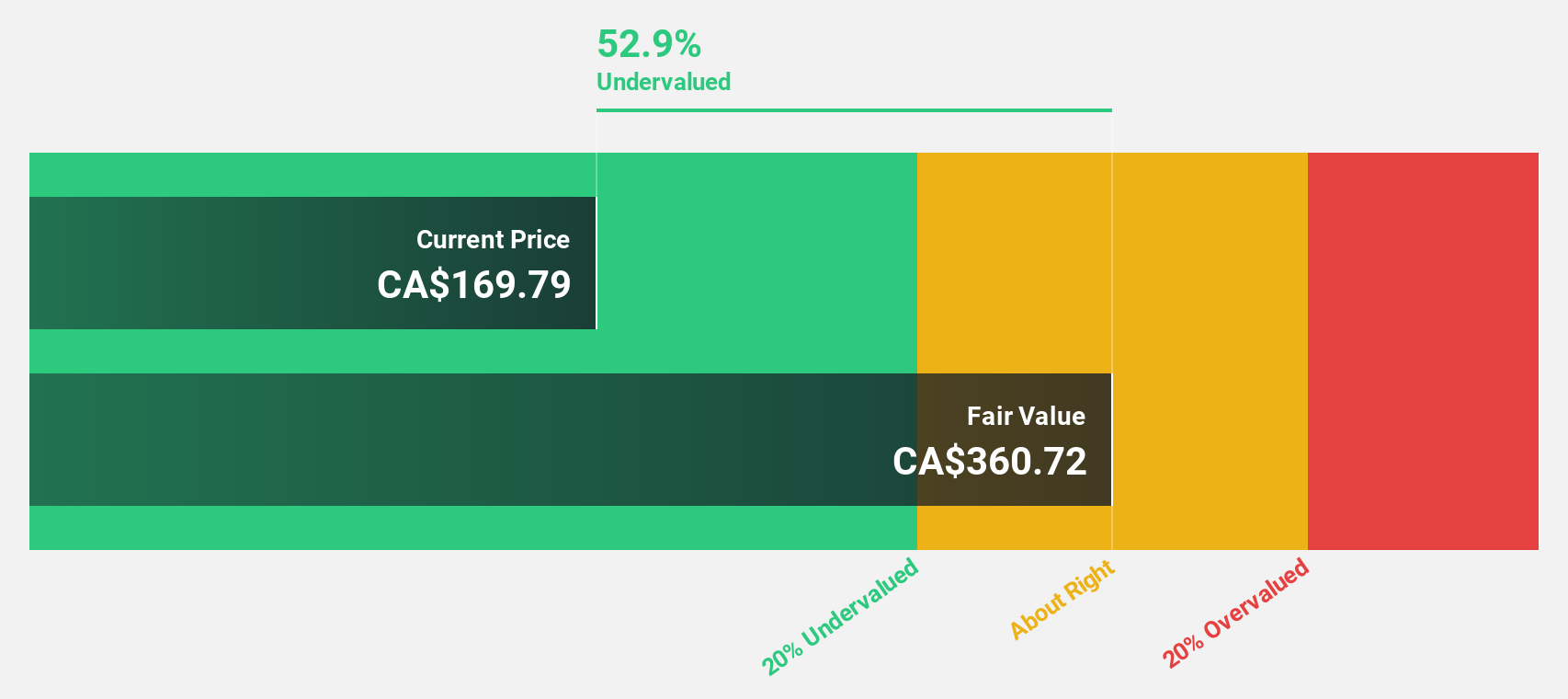

Estimated Discount To Fair Value: 49.9%

goeasy Ltd. appears undervalued based on discounted cash flow analysis, trading at CA$181 compared to an estimated fair value of CA$361.01. The company reported strong earnings growth with net income rising to CAD 65.4 million in Q2 2024 from CAD 55.55 million a year ago and provided robust revenue guidance through 2026, expecting up to $1.95 billion by then. However, its dividend sustainability is questionable due to low coverage by free cash flows and significant debt levels not well covered by operating cash flow.

- Our earnings growth report unveils the potential for significant increases in goeasy's future results.

- Dive into the specifics of goeasy here with our thorough financial health report.

MDA Space (TSX:MDA)

Overview: MDA Space Ltd. designs, manufactures, and services space robotics, satellite systems and components, and intelligence systems across various regions including Canada, the United States, Europe, Asia, the Middle East, and internationally with a market cap of CA$2.00 billion.

Operations: The company's revenue segments include Geointelligence, Robotics & Space Operations, and Satellite Systems, collectively generating CA$860.80 million.

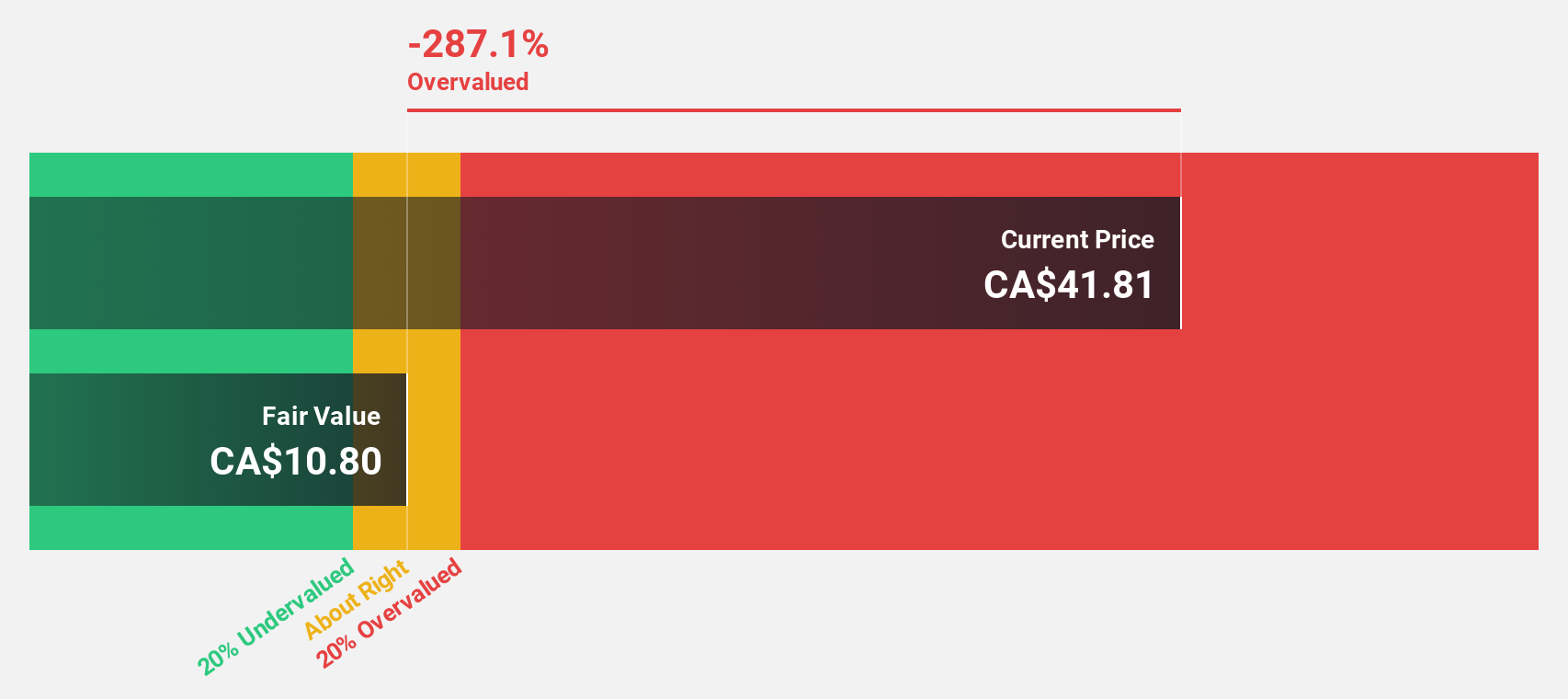

Estimated Discount To Fair Value: 12.9%

MDA Space Ltd. appears undervalued based on discounted cash flow analysis, trading at CA$16.65 compared to an estimated fair value of CA$19.12. Recent business expansions include a new satellite production facility in Quebec and a significant contract with SWISSto12 for antenna systems, both supporting future revenue growth forecasted at 26.3% per year. Despite low projected return on equity (12.9%), MDA's earnings are expected to grow significantly, outpacing the Canadian market's average growth rate.

- Our expertly prepared growth report on MDA Space implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on MDA Space's balance sheet by reading our health report here.

Next Steps

- Delve into our full catalog of 30 Undervalued TSX Stocks Based On Cash Flows here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GFL

GFL Environmental

Offers non-hazardous solid waste management and environmental services in Canada and the United States.

Reasonable growth potential with mediocre balance sheet.