- Canada

- /

- Professional Services

- /

- TSX:CWL

Should You Be Adding Caldwell Partners International (TSE:CWL) To Your Watchlist Today?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Caldwell Partners International (TSE:CWL). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Caldwell Partners International

Caldwell Partners International's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Who among us would not applaud Caldwell Partners International's stratospheric annual EPS growth of 55%, compound, over the last three years? Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

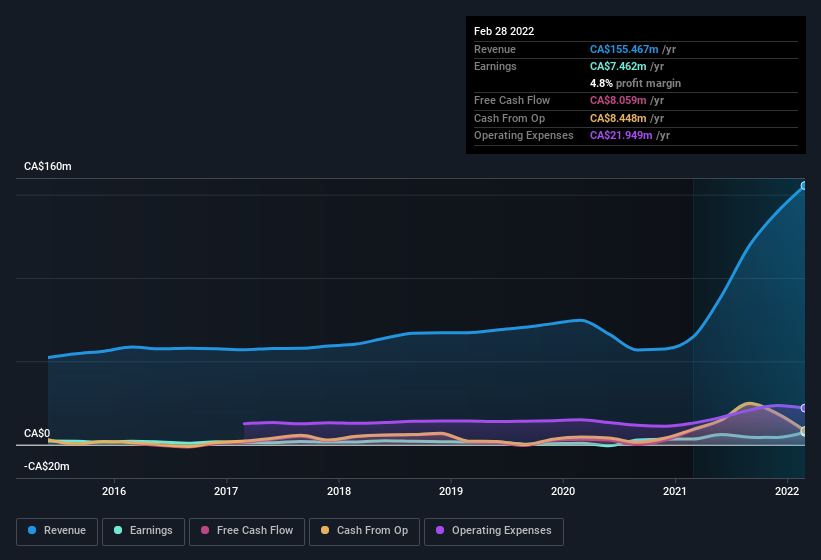

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Caldwell Partners International shareholders can take confidence from the fact that EBIT margins are up from 3.5% to 8.8%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Caldwell Partners International isn't a huge company, given its market capitalization of CA$58m. That makes it extra important to check on its balance sheet strength.

Are Caldwell Partners International Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Caldwell Partners International insiders spent CA$166k on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic. It is also worth noting that it was VP of Finance & Corporate Secretary Michael R. Falagario who made the biggest single purchase, worth CA$30k, paying CA$2.40 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Caldwell Partners International insiders own more than a third of the company. In fact, they own 36% of the shares, making insiders a very influential shareholder group. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. In terms of absolute value, insiders have CA$21m invested in the business, using the current share price. That's nothing to sneeze at!

Does Caldwell Partners International Deserve A Spot On Your Watchlist?

Caldwell Partners International's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. What's more insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Caldwell Partners International deserves timely attention. We should say that we've discovered 2 warning signs for Caldwell Partners International that you should be aware of before investing here.

As a growth investor I do like to see insider buying. But Caldwell Partners International isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CWL

Caldwell Partners International

Provides candidate research and sourcing services in Canada, the United States, and Europe.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026