- Canada

- /

- Metals and Mining

- /

- TSXV:MMA

TSX Penny Stocks To Watch In September 2025

Reviewed by Simply Wall St

As the Canadian market navigates a period of uncertainty with central banks providing limited guidance, investors are closely watching economic indicators and potential interest rate changes. In such a climate, identifying stocks with strong financial health becomes crucial, especially when considering investment in smaller or newer companies. Despite their outdated label, penny stocks can still present valuable opportunities for those seeking growth potential; this article highlights three examples that combine balance sheet strength with promising prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$3.20 | CA$75.84M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.80 | CA$23.17M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.325 | CA$2.67M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.345 | CA$51.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Zedcor (TSXV:ZDC) | CA$4.71 | CA$495.02M | ✅ 3 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.18 | CA$831.62M | ✅ 3 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.56 | CA$392.42M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.56 | CA$178.15M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.14 | CA$204.1M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.70 | CA$8.71M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 412 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Midnight Sun Mining (TSXV:MMA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Midnight Sun Mining Corp. is engaged in the acquisition and exploration of mineral properties in Africa, with a market cap of CA$263.53 million.

Operations: Midnight Sun Mining Corp. has not reported any revenue segments.

Market Cap: CA$263.53M

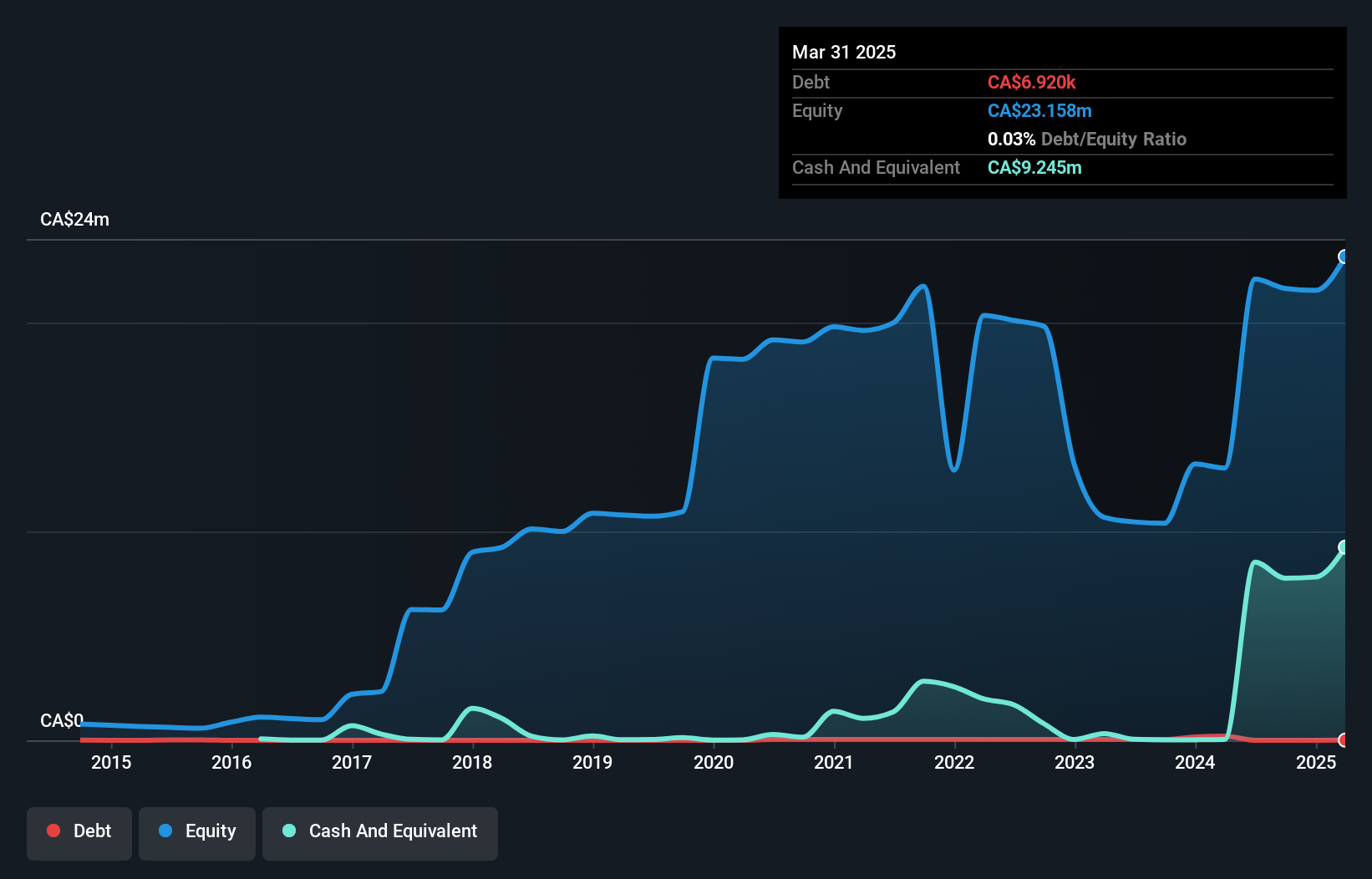

Midnight Sun Mining Corp., with a market cap of CA$263.53 million, is pre-revenue and focused on mineral exploration in Africa. The company has been actively expanding its drilling program at the Solwezi Project in Zambia, particularly targeting the Dumbwa and Kazhiba-Main sites. Recent developments include the commencement of diamond drilling to explore high-grade copper anomalies similar to those found at Barrick's Lumwana Mine. Despite its unprofitability and negative return on equity, Midnight Sun benefits from a seasoned board and management team, stable weekly volatility, adequate cash runway for over a year, and minimal shareholder dilution over the past year.

- Jump into the full analysis health report here for a deeper understanding of Midnight Sun Mining.

- Evaluate Midnight Sun Mining's historical performance by accessing our past performance report.

ROK Resources (TSXV:ROK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ROK Resources Inc. is an independent oil and gas company operating in Canada with a market capitalization of CA$40.44 million.

Operations: The company generates revenue of CA$69.96 million from its oil and gas exploration and production activities.

Market Cap: CA$40.44M

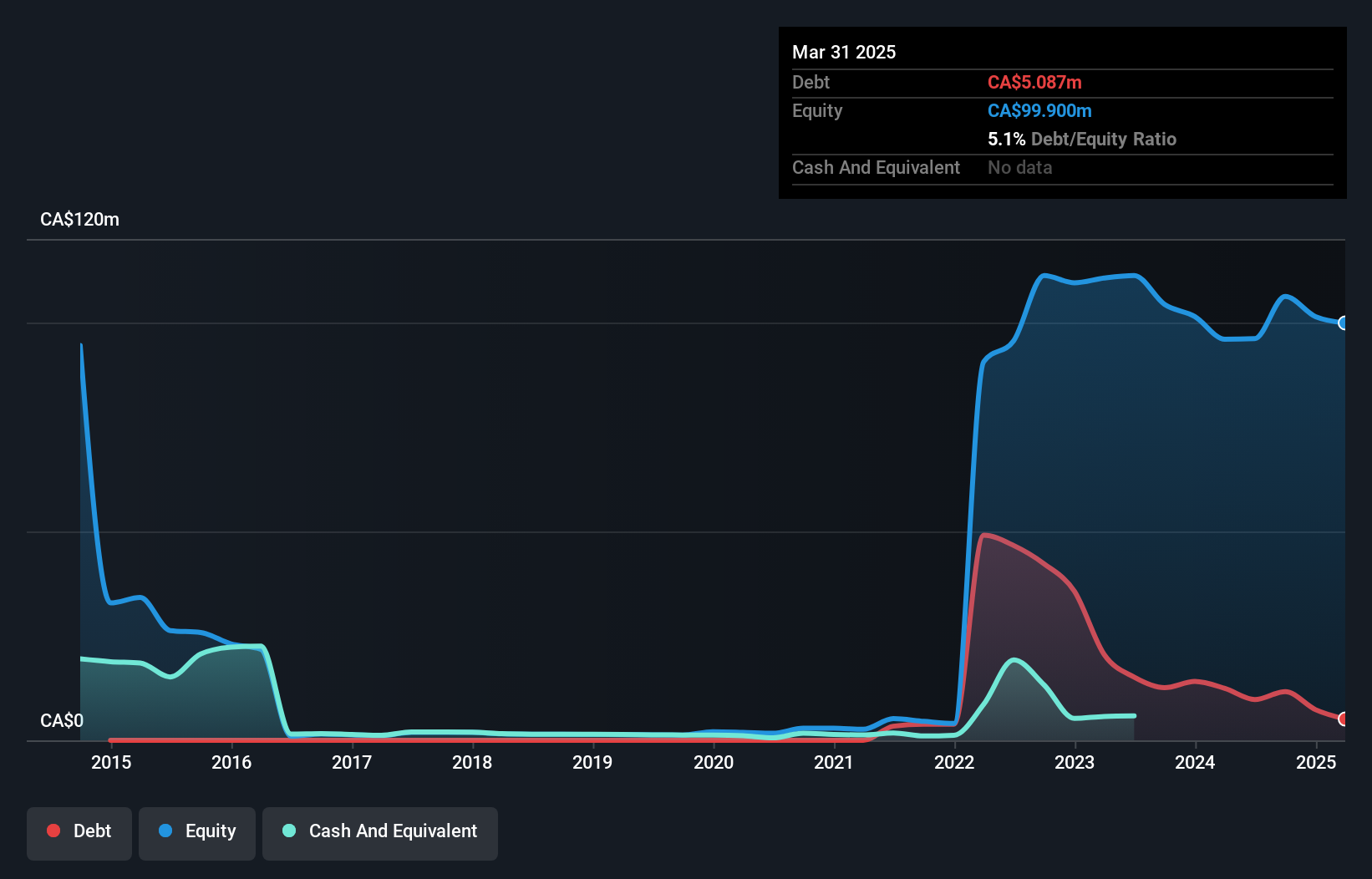

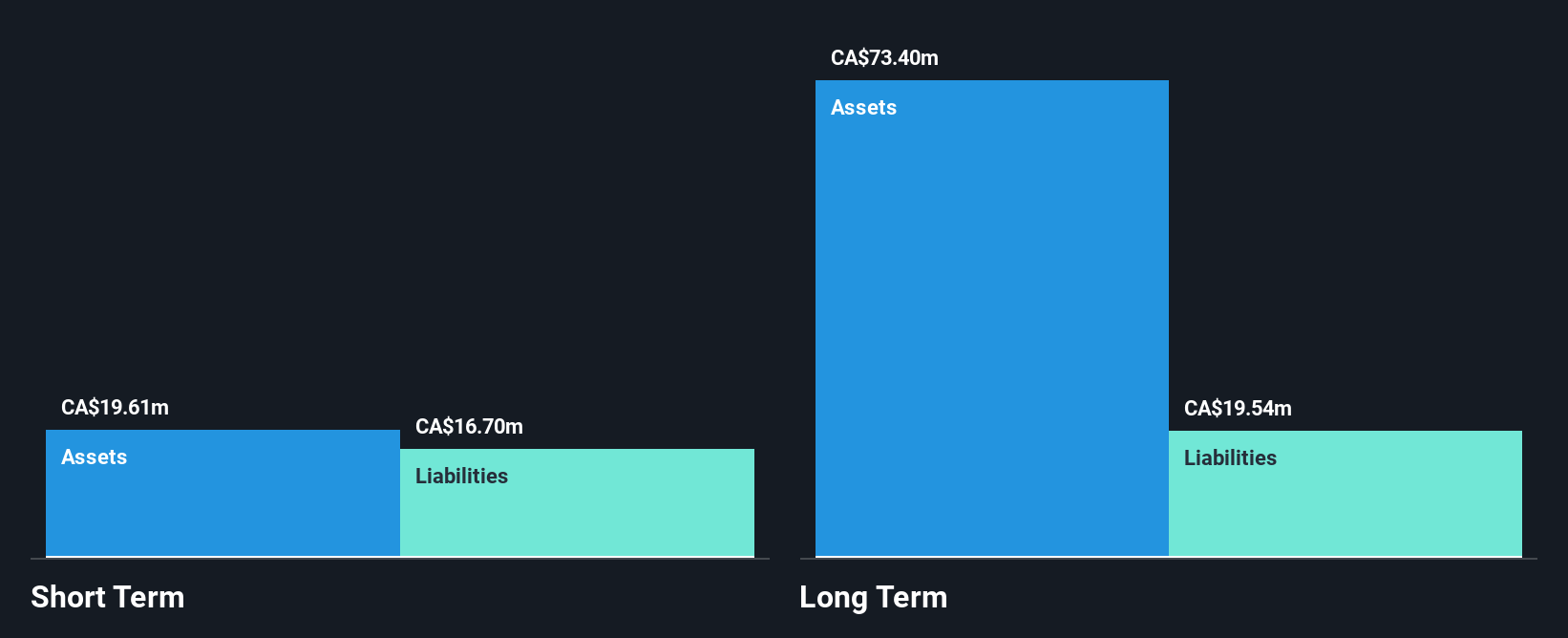

ROK Resources Inc., with a market cap of CA$40.44 million, has recently become profitable, reporting a net income of CA$3.28 million for the second quarter of 2025. The company is debt-free and its Price-To-Earnings ratio (7.6x) is below the Canadian market average, indicating potential value for investors. However, ROK's short-term assets do not cover its long-term liabilities, posing a risk. The firm is set to be acquired by Blue Alaska Oil Trading LLC for CA$52 million in early 2026, pending regulatory and shareholder approvals. ROK has also repurchased shares recently without significant shareholder dilution.

- Click here to discover the nuances of ROK Resources with our detailed analytical financial health report.

- Assess ROK Resources' future earnings estimates with our detailed growth reports.

Zedcor (TSXV:ZDC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zedcor Inc. offers turnkey and customized mobile surveillance and live monitoring solutions in Canada and the United States, with a market cap of CA$495.02 million.

Operations: The company generates revenue from its Security & Surveillance segment, amounting to CA$44.50 million.

Market Cap: CA$495.02M

Zedcor Inc., with a market cap of CA$495.02 million, has shown significant earnings growth, reporting CA$13.54 million in Q2 2025 sales, up from CA$7.37 million the previous year. Despite a low return on equity (3.1%) and interest coverage challenges (EBIT covers interest payments only 2.7 times), the company's debt is well managed with operating cash flow covering 58% of its debt and short-term assets exceeding liabilities by CA$2.9 million. Zedcor's management and board are experienced, though recent insider selling could be a concern for potential investors evaluating stability and confidence in future performance.

- Unlock comprehensive insights into our analysis of Zedcor stock in this financial health report.

- Gain insights into Zedcor's outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Take a closer look at our TSX Penny Stocks list of 412 companies by clicking here.

- Ready For A Different Approach? Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:MMA

Flawless balance sheet with slight risk.

Market Insights

Community Narratives