The Canadian market has experienced some pullback recently, driven by political uncertainty and profit-taking after a strong year of growth. Despite this volatility, the underlying economic fundamentals remain robust, providing a landscape where smaller companies can thrive. Penny stocks, though often overlooked due to their historical connotations, continue to offer intriguing opportunities for investors seeking value and growth potential in financially sound enterprises.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.19 | CA$393.48M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$116.42M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.36 | CA$948.57M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.54 | CA$492.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.31 | CA$227.38M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$33.58M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.13 | CA$101.79M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$178.48M | ★★★★★☆ |

Click here to see the full list of 958 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

InnoCan Pharma (CNSX:INNO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: InnoCan Pharma Corporation is a pharmaceutical technology company that develops drug delivery platforms combining cannabidiol (CBD) with other pharmaceutical ingredients across the United States, Canada, Europe, and internationally, with a market cap of CA$60.26 million.

Operations: The company generates revenue primarily from online sales, amounting to $28.86 million, with additional income from other operations totaling $0.07 million.

Market Cap: CA$60.26M

InnoCan Pharma, with a market cap of CA$60.26 million, has shown promising developments despite being unprofitable. Recent earnings indicate a significant reduction in net losses and an increase in sales to US$24.04 million for the first nine months of 2024. The company remains debt-free, which is advantageous for financial stability, although shareholders have experienced dilution over the past year. Positive results from safety assessments and compassionate therapy studies highlight potential future applications for its liposomal-CBD products. A recent private placement aims to raise CAD 700,000, potentially supporting further research and development efforts.

- Click here and access our complete financial health analysis report to understand the dynamics of InnoCan Pharma.

- Understand InnoCan Pharma's track record by examining our performance history report.

Nano One Materials (TSX:NANO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nano One Materials Corp. focuses on producing and selling cathode active materials for lithium-ion batteries used in electric vehicles, energy storage systems, and consumer electronics, with a market cap of CA$102.44 million.

Operations: Nano One Materials Corp. has not reported any specific revenue segments.

Market Cap: CA$102.44M

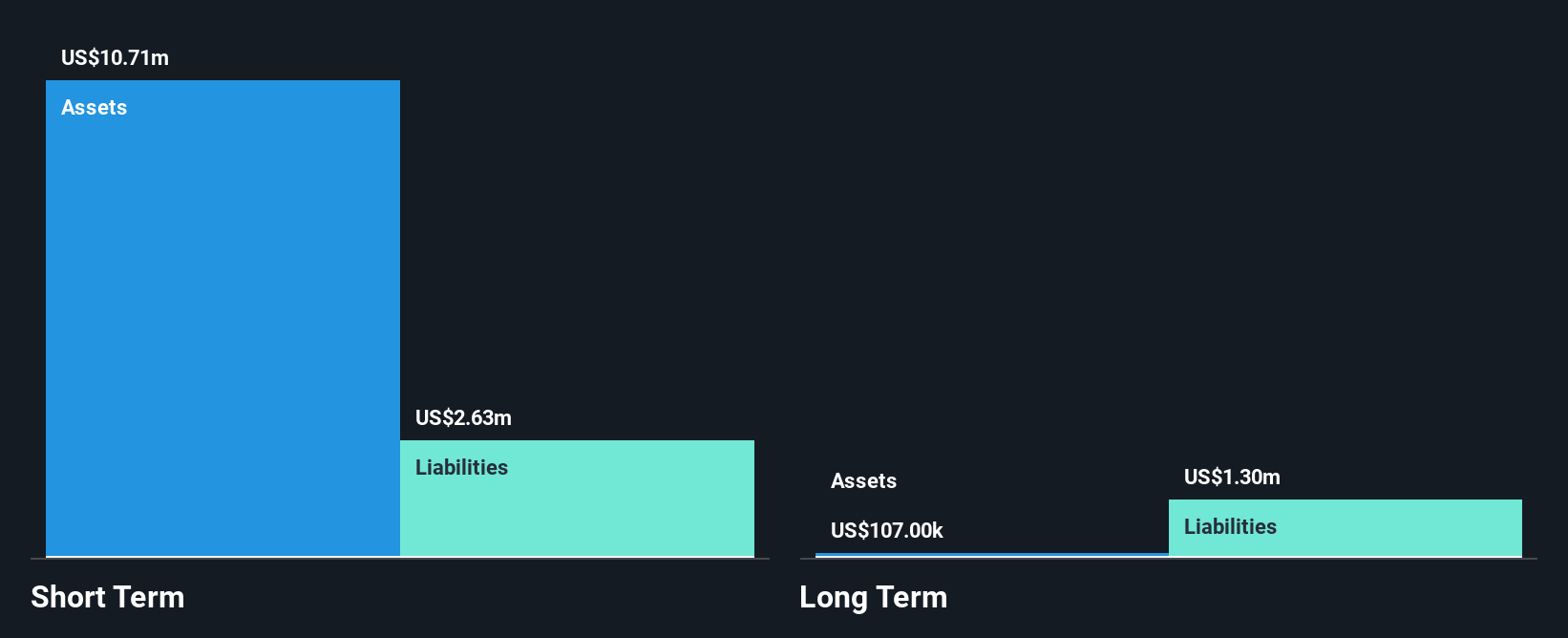

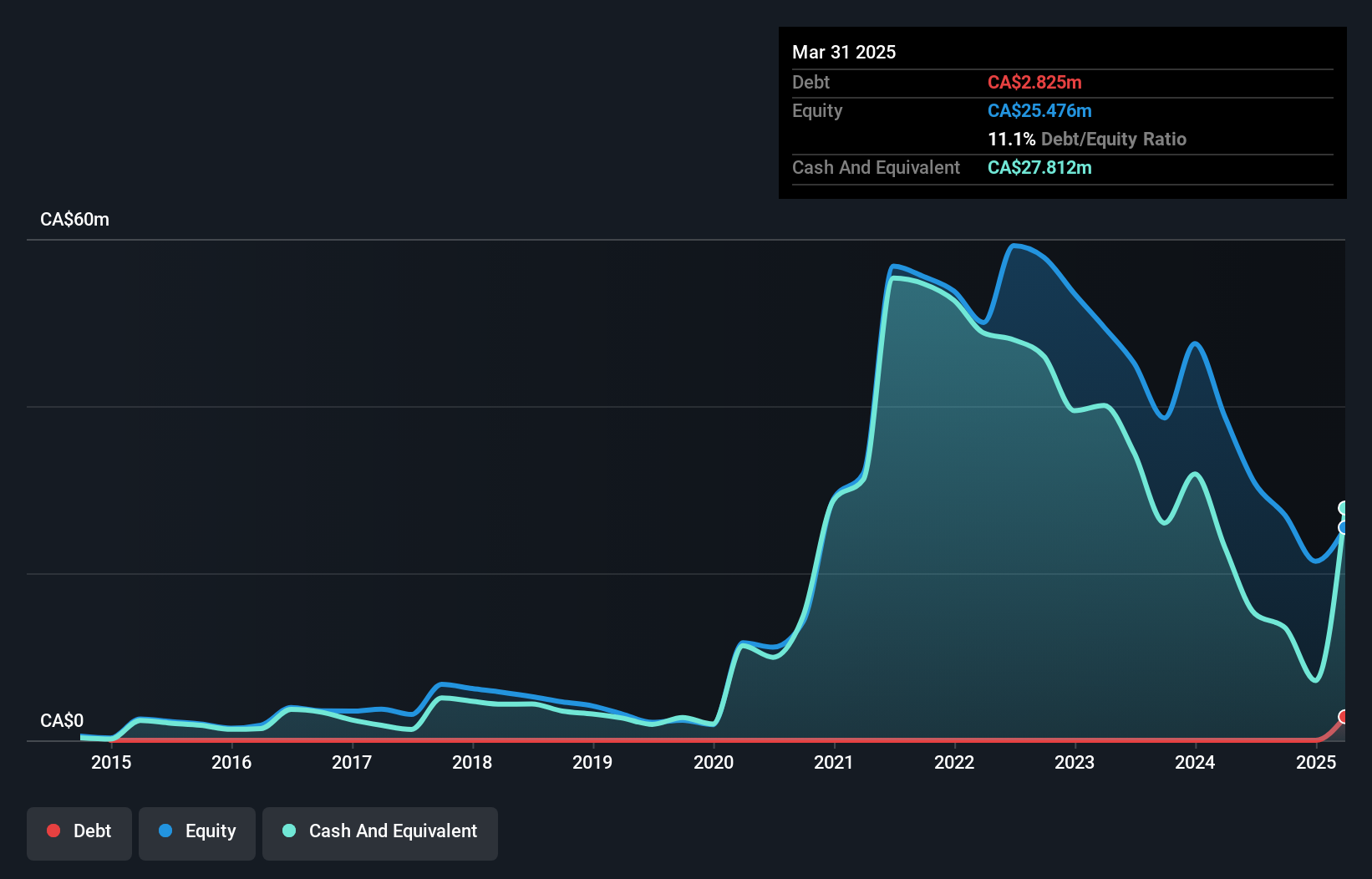

Nano One Materials Corp., with a market cap of CA$102.44 million, is pre-revenue and currently unprofitable but has garnered significant governmental support. Recent financing from the Government of Québec, including a CA$15 million loan and a CA$3 million grant, aids its innovative One-Pot™ process aimed at reducing costs and environmental impact in lithium iron phosphate production. Despite having less than a year of cash runway, Nano One remains debt-free with short-term assets exceeding liabilities. Strategic alliances further bolster its position in the North American battery supply chain for electric vehicles and energy storage systems.

- Unlock comprehensive insights into our analysis of Nano One Materials stock in this financial health report.

- Gain insights into Nano One Materials' future direction by reviewing our growth report.

NEO Battery Materials (TSXV:NBM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NEO Battery Materials Ltd. is a Canadian company specializing in the production of silicon anode materials for lithium-ion batteries used in electric vehicles, electronics, and energy storage systems, with a market cap of CA$90.75 million.

Operations: NEO Battery Materials Ltd. currently does not report any revenue segments.

Market Cap: CA$90.75M

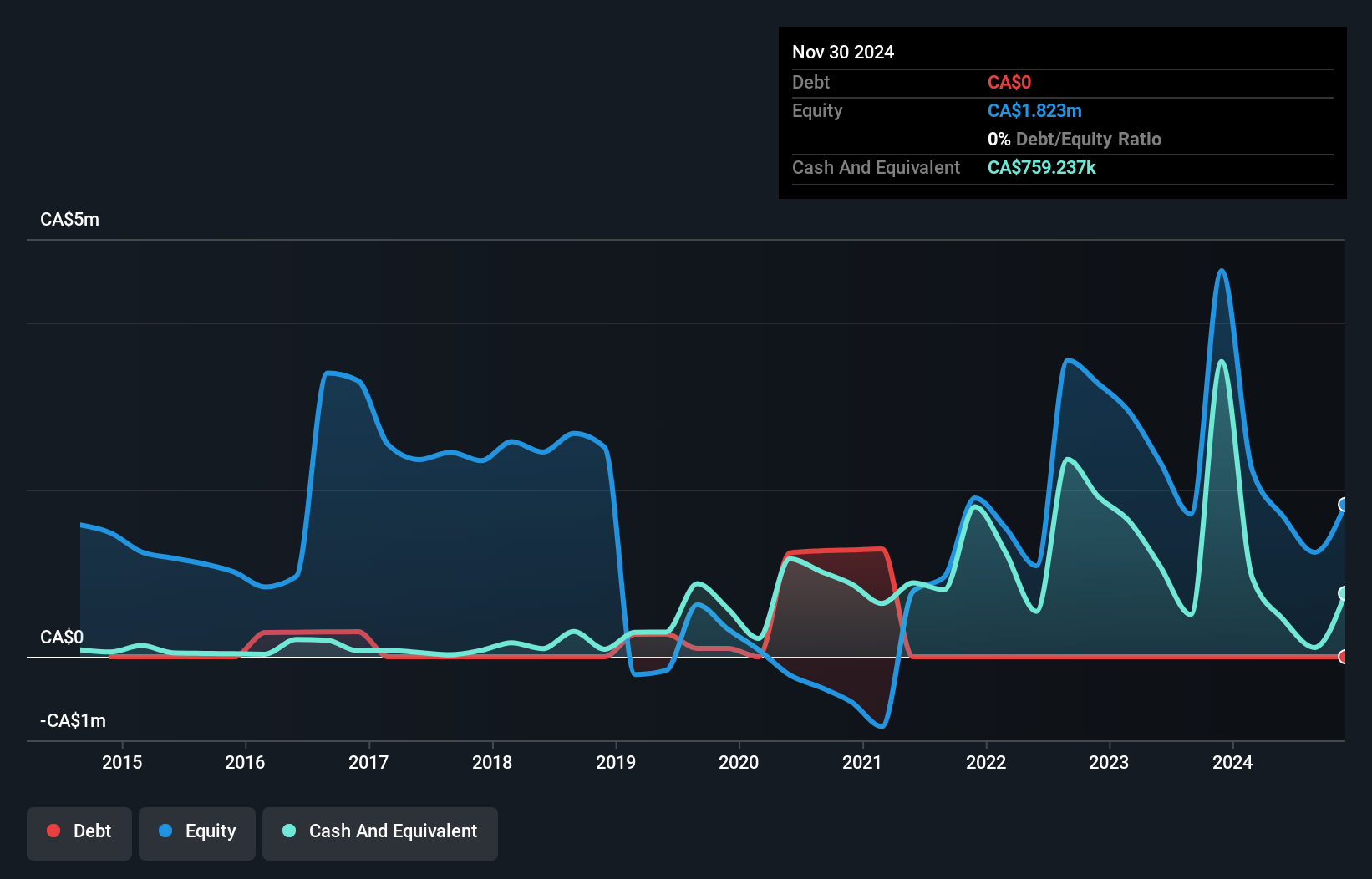

NEO Battery Materials Ltd., with a market cap of CA$90.75 million, is pre-revenue and unprofitable, experiencing increased losses over the past five years. Despite this, NEO has formed strategic alliances to enhance its silicon anode materials for electric vehicles and electronics. Recent partnerships include agreements with a North American battery cell manufacturer and OCSiAl LLC for advanced carbon nanotube integration. While highly volatile, NEO's initiatives such as a planned commercial facility in Canada and involvement in a recycled silicon battery project indicate potential growth avenues within the lithium-ion battery industry despite current financial challenges.

- Take a closer look at NEO Battery Materials' potential here in our financial health report.

- Review our historical performance report to gain insights into NEO Battery Materials' track record.

Taking Advantage

- Access the full spectrum of 958 TSX Penny Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nano One Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NANO

Nano One Materials

Engages in the production and sale of cathode active materials for lithium-ion battery applications in electric vehicles, energy storage systems, and consumer electronics.

Excellent balance sheet slight.

Market Insights

Community Narratives