- Canada

- /

- Electrical

- /

- TSXV:NBM

East Africa Metals Leads These 3 Promising TSX Penny Stocks

Reviewed by Simply Wall St

The Canadian market is currently navigating a landscape of uncertainty, with looming tariffs and political unpredictability influencing investor sentiment. Amidst this cautious backdrop, investors may find opportunities in penny stocks—an area that continues to hold potential despite its somewhat antiquated label. These smaller or newer companies can offer growth prospects at lower price points, especially when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.58 | CA$168.53M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.73 | CA$450.76M | ★★★★★★ |

| NTG Clarity Networks (TSXV:NCI) | CA$1.89 | CA$78.83M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.66 | CA$595.66M | ★★★★★★ |

| BluMetric Environmental (TSXV:BLM) | CA$1.06 | CA$36.92M | ★★★★★★ |

| McCoy Global (TSX:MCB) | CA$2.93 | CA$79.09M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.12 | CA$30.09M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$4.43 | CA$3.43B | ★★★★★☆ |

| Orezone Gold (TSX:ORE) | CA$0.83 | CA$379.19M | ★★★★★☆ |

Click here to see the full list of 936 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

East Africa Metals (TSXV:EAM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: East Africa Metals Inc. is a mineral exploration company engaged in the identification, acquisition, exploration, development, and sale of base and precious mineral resource properties in Ethiopia and Tanzania with a market cap of CA$26.25 million.

Operations: East Africa Metals Inc. currently does not report any revenue segments.

Market Cap: CA$26.25M

East Africa Metals Inc., with a market cap of CA$26.25 million, is pre-revenue and remains unprofitable, reporting a net loss for the third quarter of CA$0.64 million. Despite high volatility and short-term liabilities exceeding assets, the company recently secured CA$503,586 through a private placement from a strategic investor, indicating some confidence in its African ventures. The board of directors is experienced with an average tenure of 11.4 years, though management tenure data is insufficient. The company's cash runway was limited to one month but has been bolstered by recent capital raising activities.

- Navigate through the intricacies of East Africa Metals with our comprehensive balance sheet health report here.

- Gain insights into East Africa Metals' past trends and performance with our report on the company's historical track record.

Hemisphere Energy (TSXV:HME)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hemisphere Energy Corporation is engaged in the acquisition, exploration, development, and production of petroleum and natural gas interests in Canada, with a market cap of CA$168 million.

Operations: The company's revenue is derived entirely from its petroleum and natural gas interests, amounting to CA$78.57 million.

Market Cap: CA$168M

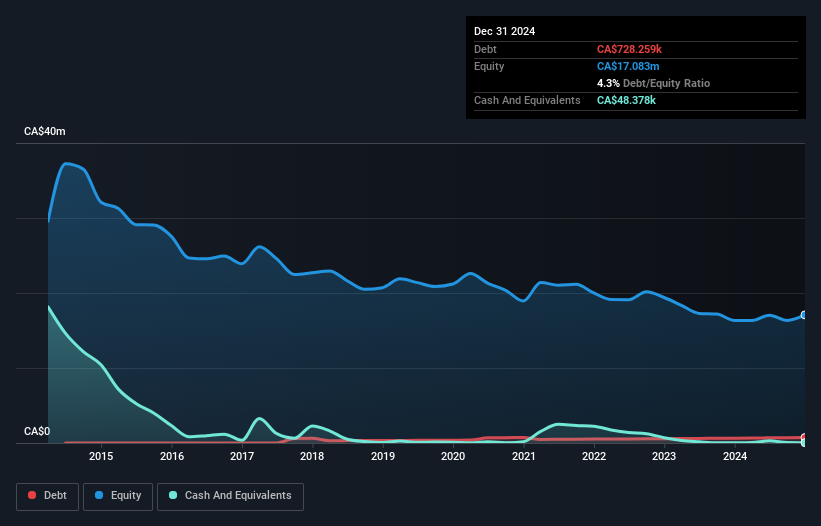

Hemisphere Energy, with a market cap of CA$168 million, demonstrates strong financial health by being debt-free and maintaining high-quality earnings. The company has achieved significant profit growth over the past five years at an annual rate of 54.3%, although recent growth has slowed to 26.7%. Its return on equity stands out at 40.3%, considered outstanding, while trading at a favorable price-to-earnings ratio of 5.9x compared to the Canadian market average of 14.6x. Hemisphere plans to allocate its free funds flow towards dividends and potential acquisitions or development projects, supported by stable cash flows and an experienced management team.

- Unlock comprehensive insights into our analysis of Hemisphere Energy stock in this financial health report.

- Assess Hemisphere Energy's future earnings estimates with our detailed growth reports.

NEO Battery Materials (TSXV:NBM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NEO Battery Materials Ltd. is a Canadian company specializing in the production of silicon anode materials for lithium-ion batteries used in electric vehicles, electronics, and energy storage systems, with a market cap of CA$85.74 million.

Operations: NEO Battery Materials Ltd. currently does not report any revenue segments.

Market Cap: CA$85.74M

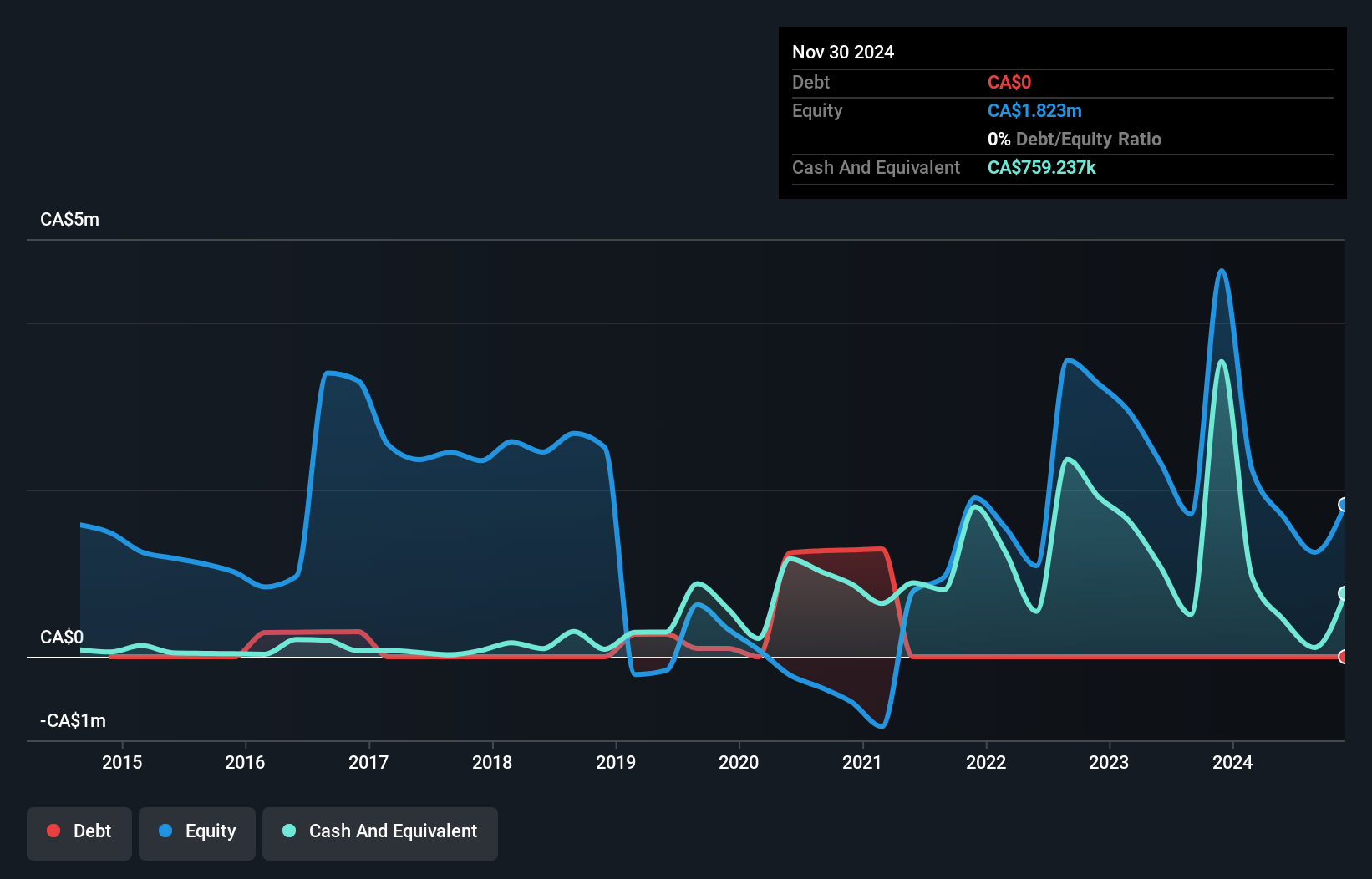

NEO Battery Materials Ltd., with a market cap of CA$85.74 million, is pre-revenue and currently unprofitable, facing increased losses over the past five years. Despite these challenges, the company remains debt-free and has recently expanded production capabilities to 20 tons per year for its high-performance silicon anode products. NEO's strategic initiatives include developing Canada's first advanced silicon anode manufacturing facility and collaborating with a North American battery cell manufacturer to enhance product performance. However, the company has less than one year of cash runway, indicating potential financial constraints ahead.

- Click here and access our complete financial health analysis report to understand the dynamics of NEO Battery Materials.

- Gain insights into NEO Battery Materials' historical outcomes by reviewing our past performance report.

Key Takeaways

- Jump into our full catalog of 936 TSX Penny Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade NEO Battery Materials, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NEO Battery Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NBM

NEO Battery Materials

NEO Battery Materials Ltd. focus on manufacturing of silicon anode materials for lithium-ion batteries in electric vehicles, electronics, and energy storage systems in Canada.

Moderate with adequate balance sheet.

Market Insights

Community Narratives