Does H2O Innovation's (CVE:HEO) CEO Salary Compare Well With The Performance Of The Company?

This article will reflect on the compensation paid to Frédéric Dugré who has served as CEO of H2O Innovation Inc. (CVE:HEO) since 2008. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for H2O Innovation.

Check out our latest analysis for H2O Innovation

How Does Total Compensation For Frédéric Dugré Compare With Other Companies In The Industry?

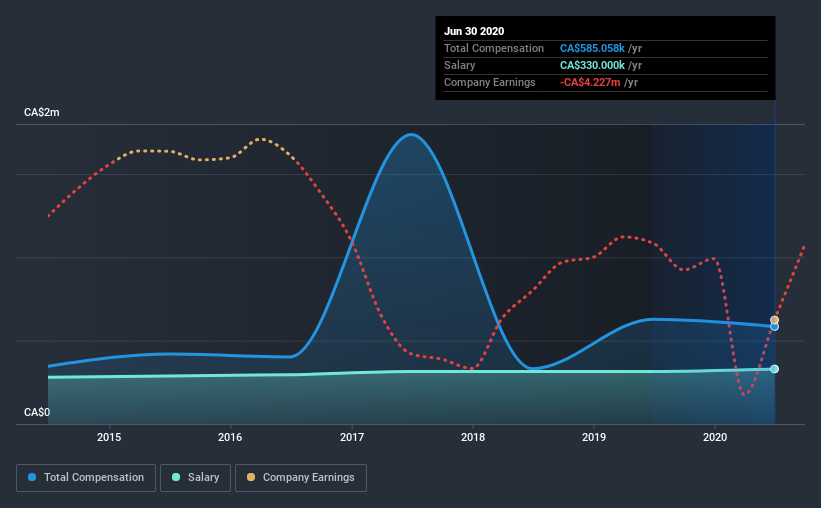

Our data indicates that H2O Innovation Inc. has a market capitalization of CA$145m, and total annual CEO compensation was reported as CA$585k for the year to June 2020. That's a slight decrease of 7.0% on the prior year. In particular, the salary of CA$330.0k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below CA$260m, we found that the median total CEO compensation was CA$321k. Hence, we can conclude that Frédéric Dugré is remunerated higher than the industry median. Moreover, Frédéric Dugré also holds CA$1.6m worth of H2O Innovation stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$330k | CA$315k | 56% |

| Other | CA$255k | CA$314k | 44% |

| Total Compensation | CA$585k | CA$629k | 100% |

Talking in terms of the industry, salary represented approximately 60% of total compensation out of all the companies we analyzed, while other remuneration made up 40% of the pie. H2O Innovation is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

H2O Innovation Inc.'s Growth

Over the past three years, H2O Innovation Inc. has seen its earnings per share (EPS) grow by 33% per year. It achieved revenue growth of 15% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has H2O Innovation Inc. Been A Good Investment?

Boasting a total shareholder return of 52% over three years, H2O Innovation Inc. has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

As we noted earlier, H2O Innovation pays its CEO higher than the norm for similar-sized companies belonging to the same industry. However, H2O Innovation has produced strong EPS growth and shareholder returns over the last three years. So, in acknowledgment of the overall excellent performance, we believe CEO compensation is appropriate. And given most shareholders are probably very happy with recent returns, they might even think that Frédéric deserves a raise!

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 1 warning sign for H2O Innovation that investors should be aware of in a dynamic business environment.

Important note: H2O Innovation is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade H2O Innovation, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if H2O Innovation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:HEO

H2O Innovation

H2O Innovation Inc. designs and provides integrated water treatment solutions based on membrane filtration technology.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)