Slammed 34% GreenPower Motor Company Inc. (CVE:GPV) Screens Well Here But There Might Be A Catch

GreenPower Motor Company Inc. (CVE:GPV) shareholders that were waiting for something to happen have been dealt a blow with a 34% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 76% loss during that time.

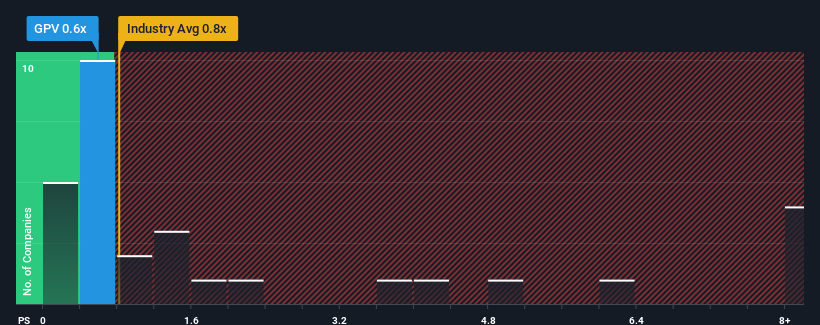

Although its price has dipped substantially, it's still not a stretch to say that GreenPower Motor's price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Machinery industry in Canada, where the median P/S ratio is around 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for GreenPower Motor

How Has GreenPower Motor Performed Recently?

GreenPower Motor could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on GreenPower Motor.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like GreenPower Motor's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.1%. Even so, admirably revenue has lifted 196% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 27% as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 7.8%, which is noticeably less attractive.

In light of this, it's curious that GreenPower Motor's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Following GreenPower Motor's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at GreenPower Motor's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You always need to take note of risks, for example - GreenPower Motor has 3 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:GPV

GreenPower Motor

Designs, manufactures, and distributes electric vehicles for commercial markets in the United States and Canada.

Excellent balance sheet slight.