- Canada

- /

- Metals and Mining

- /

- TSXV:GMV

3 TSX Penny Stocks With Market Caps Over CA$10M To Consider

Reviewed by Simply Wall St

As the Canadian market navigates a period of sideways consolidation, investors are exploring ways to fortify their portfolios against potential volatility. Penny stocks, often representing smaller or newer companies, continue to intrigue investors with their potential for growth and value. Despite the term's outdated feel, these stocks can offer compelling opportunities when backed by strong financial foundations and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.73 | CA$172.56M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.53 | CA$14.32M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.82 | CA$449.82M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.66 | CA$632.31M | ★★★★★★ |

| BluMetric Environmental (TSXV:BLM) | CA$1.00 | CA$35.81M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$3.89 | CA$3.11B | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.12 | CA$30.89M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.81 | CA$298.08M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$1.90 | CA$200.35M | ★★★★★☆ |

| Orezone Gold (TSX:ORE) | CA$0.83 | CA$379.19M | ★★★★★☆ |

Click here to see the full list of 934 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Full Circle Lithium (TSXV:FCLI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Full Circle Lithium Corp. is a specialty chemical recycling and processing company operating in the United States and Canada, with a market cap of CA$29.84 million.

Operations: No revenue segments have been reported.

Market Cap: CA$29.84M

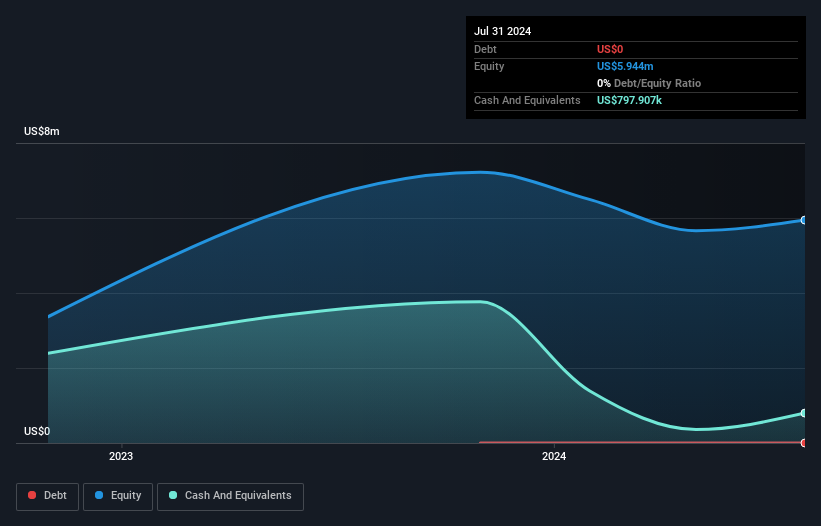

Full Circle Lithium Corp., with a market cap of CA$29.84 million, is pre-revenue and currently unprofitable, reporting a net loss of US$3.77 million for the year ended October 31, 2024. Despite its financial challenges, the company has made strategic moves by signing a global distribution agreement with US Fire Pump Company for its FCL-X lithium-ion battery fire extinguishing agent. The recent successful deployment of FCL-X in combating one of the largest battery fires in U.S. history highlights its potential market impact. However, Full Circle faces volatility in share price and limited cash runway under one year.

- Click here and access our complete financial health analysis report to understand the dynamics of Full Circle Lithium.

- Review our growth performance report to gain insights into Full Circle Lithium's future.

FPX Nickel (TSXV:FPX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FPX Nickel Corp., a junior mining company with a market cap of CA$73.99 million, focuses on acquiring, exploring, and developing nickel mineral resource properties in Canada.

Operations: FPX Nickel Corp. currently does not report any revenue segments.

Market Cap: CA$74M

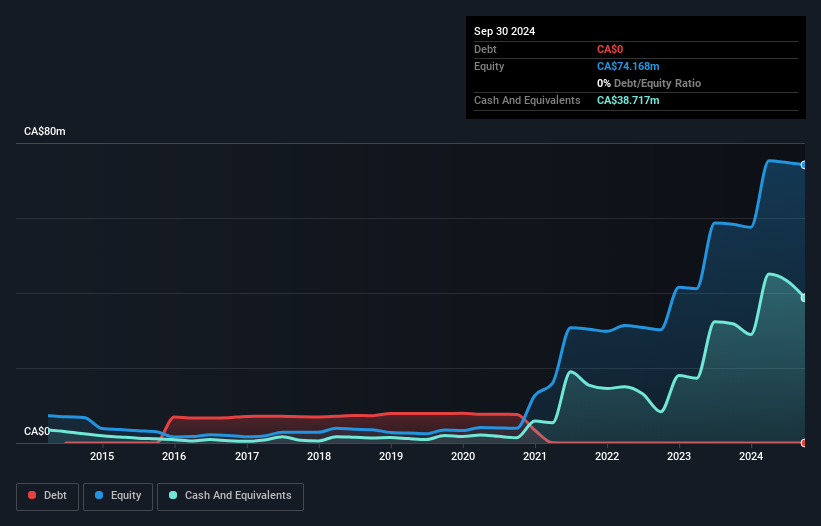

FPX Nickel Corp., with a market cap of CA$73.99 million, is a pre-revenue company focusing on nickel resource development in Canada. Despite being debt-free and having stable weekly volatility, FPX faces financial constraints with less than a year of cash runway if free cash flow continues to decline at historical rates. Recent announcements highlight the potential for significant contributions to North American nickel sulphate production through its proposed Awaruite Refinery, which could enhance its strategic position in the EV industry. However, challenges remain as it advances environmental assessments and engineering studies for the Baptiste Nickel Project.

- Click here to discover the nuances of FPX Nickel with our detailed analytical financial health report.

- Gain insights into FPX Nickel's outlook and expected performance with our report on the company's earnings estimates.

GMV Minerals (TSXV:GMV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GMV Minerals Inc. is an exploration stage company focused on sourcing and exploring mineral properties in the United States, with a market cap of CA$10.07 million.

Operations: Currently, there are no reported revenue segments for this exploration stage company.

Market Cap: CA$10.07M

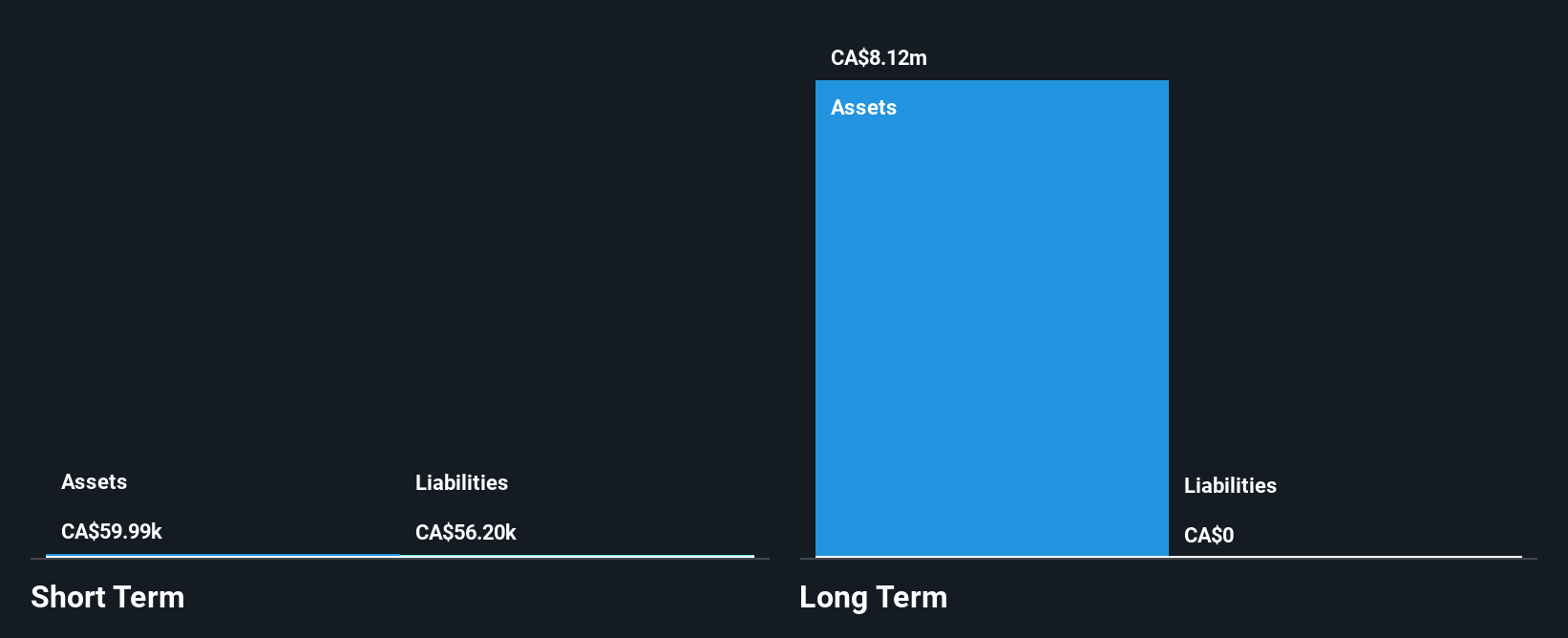

GMV Minerals Inc., with a market cap of CA$10.07 million, is a pre-revenue exploration company focused on mineral properties in the U.S. Despite being debt-free and having no long-term liabilities, GMV faces challenges with less than one year of cash runway based on current free cash flow. The company's share price has been highly volatile recently but hasn't experienced meaningful shareholder dilution over the past year. Management and board members are seasoned, averaging 16 and 12.2 years respectively in tenure. Recent earnings reports show reduced net losses compared to the previous year, reflecting slight financial improvements amidst ongoing volatility.

- Click to explore a detailed breakdown of our findings in GMV Minerals' financial health report.

- Evaluate GMV Minerals' historical performance by accessing our past performance report.

Make It Happen

- Explore the 934 names from our TSX Penny Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GMV

GMV Minerals

An exploration stage company, engages in the sourcing and exploration of mineral properties in the United States.

Adequate balance sheet slight.

Market Insights

Community Narratives