As the Canadian market navigates a landscape of evolving economic trends and strategic portfolio adjustments, investors are increasingly looking for opportunities that align with their long-term financial goals. Penny stocks, though often considered a niche area, represent smaller or newer companies that can offer significant growth potential when supported by strong financial health. In this context, we explore three penny stocks that may combine balance sheet strength with promising upside potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.24 | CA$115M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.54 | CA$13.61M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.59 | CA$528.97M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.25 | CA$221.48M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.32 | CA$948.57M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.20 | CA$33.04M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$182.38M | ★★★★★☆ |

| Orezone Gold (TSX:ORE) | CA$0.64 | CA$302.67M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.92 | CA$108.95M | ★★★★☆☆ |

Click here to see the full list of 939 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

EnWave (TSXV:ENW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EnWave Corporation designs, constructs, markets, and sells vacuum-microwave dehydration machinery for the food, cannabis, and biomaterial industries in Canada, the United States, and internationally with a market cap of CA$21.06 million.

Operations: EnWave Corporation does not report specific revenue segments.

Market Cap: CA$21.06M

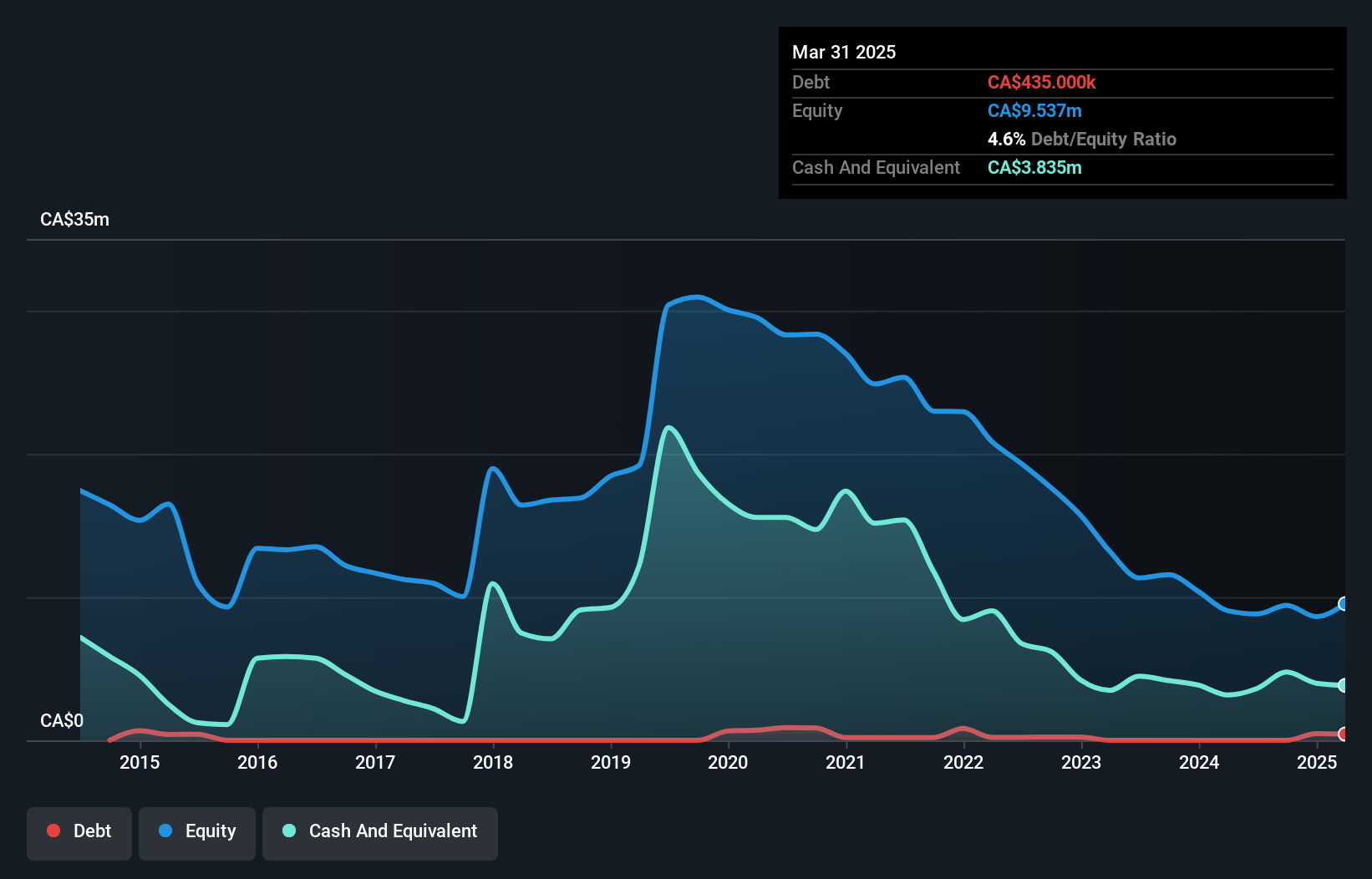

EnWave Corporation, with a market cap of CA$21.06 million, has shown resilience despite its unprofitable status, reporting sales of CA$8.18 million for the year ending September 30, 2024. The company benefits from a stable cash runway exceeding three years due to positive free cash flow and no debt burden. Recent strategic moves include partnerships with ELEA Technology GmbH and CNTA to expand its Radiant Energy Vacuum technology's applications in Europe. The board's recent appointment of experienced CPA Louise Lalonde as Audit Committee Chair enhances governance amid ongoing efforts to strengthen international sales presence through non-dilutive financing initiatives.

- Click here and access our complete financial health analysis report to understand the dynamics of EnWave.

- Review our historical performance report to gain insights into EnWave's track record.

Morien Resources (TSXV:MOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Morien Resources Corp. is a mining development company focused on identifying and acquiring mineral interests and projects in Canada, with a market cap of CA$11.54 million.

Operations: The company's revenue segment includes the identification, purchase, exploration, and development of mineral properties, amounting to CA$0.11 million.

Market Cap: CA$11.54M

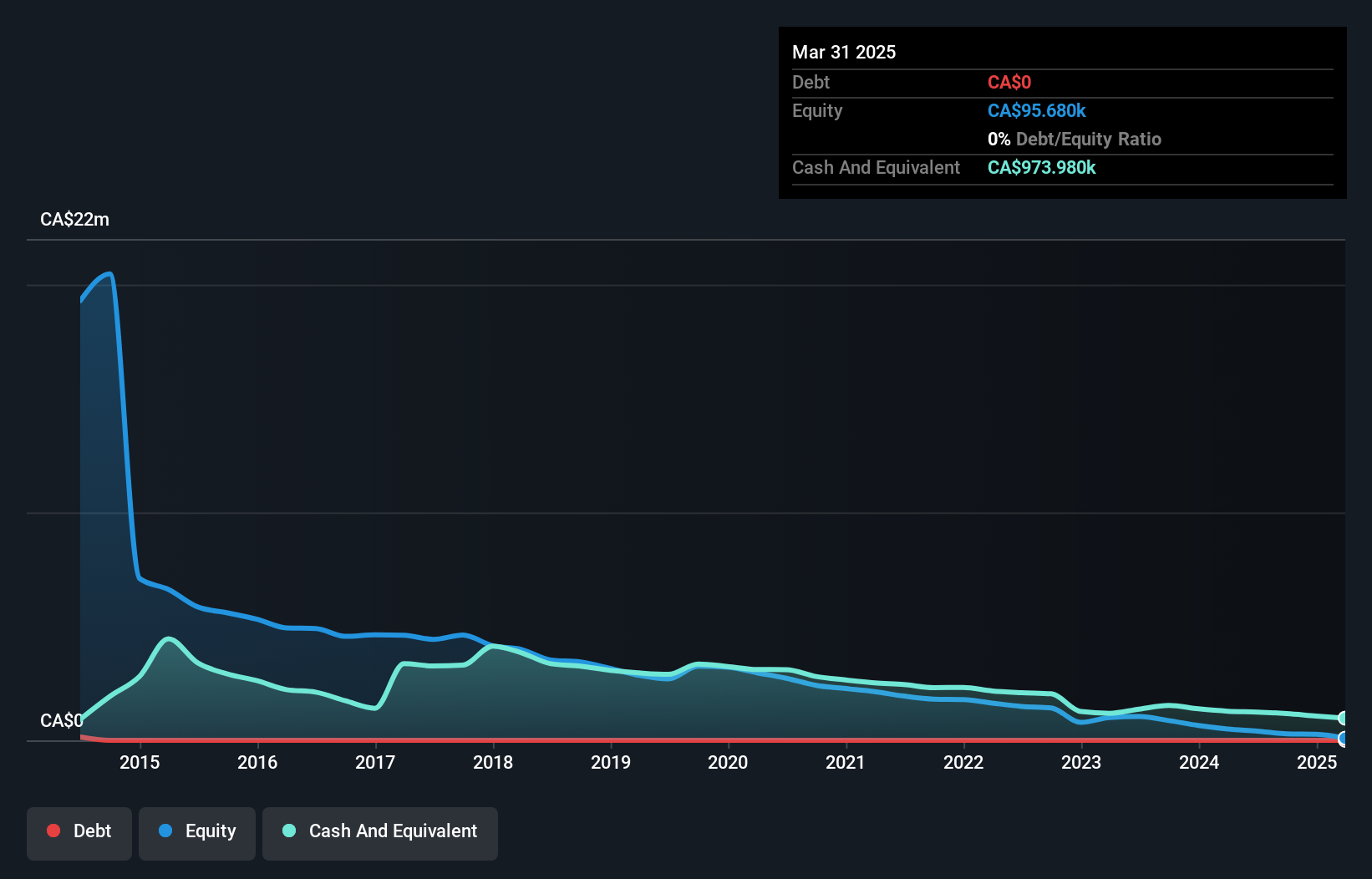

Morien Resources, with a market cap of CA$11.54 million, operates as a pre-revenue mining development company. Despite being unprofitable and experiencing increased losses over the past five years at an annual rate of 47.4%, it maintains a debt-free status and sufficient cash runway for more than two years based on current free cash flow trends. The company's board and management team are experienced, with average tenures of 4.6 and 6.6 years respectively, providing stability amidst its volatile share price and high weekly volatility compared to most Canadian stocks. Recent earnings reports highlight ongoing financial challenges with net losses widening year-over-year.

- Navigate through the intricacies of Morien Resources with our comprehensive balance sheet health report here.

- Gain insights into Morien Resources' historical outcomes by reviewing our past performance report.

WestBond Enterprises (TSXV:WBE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: WestBond Enterprises Corporation, through its subsidiary WestBond Industries Inc., manufactures and sells disposable paper products for medical, hygienic, and industrial uses in Canada and the United States with a market cap of CA$5.70 million.

Operations: The company's revenue is derived entirely from its Disposable Paper Products segment, totaling CA$8.98 million.

Market Cap: CA$5.7M

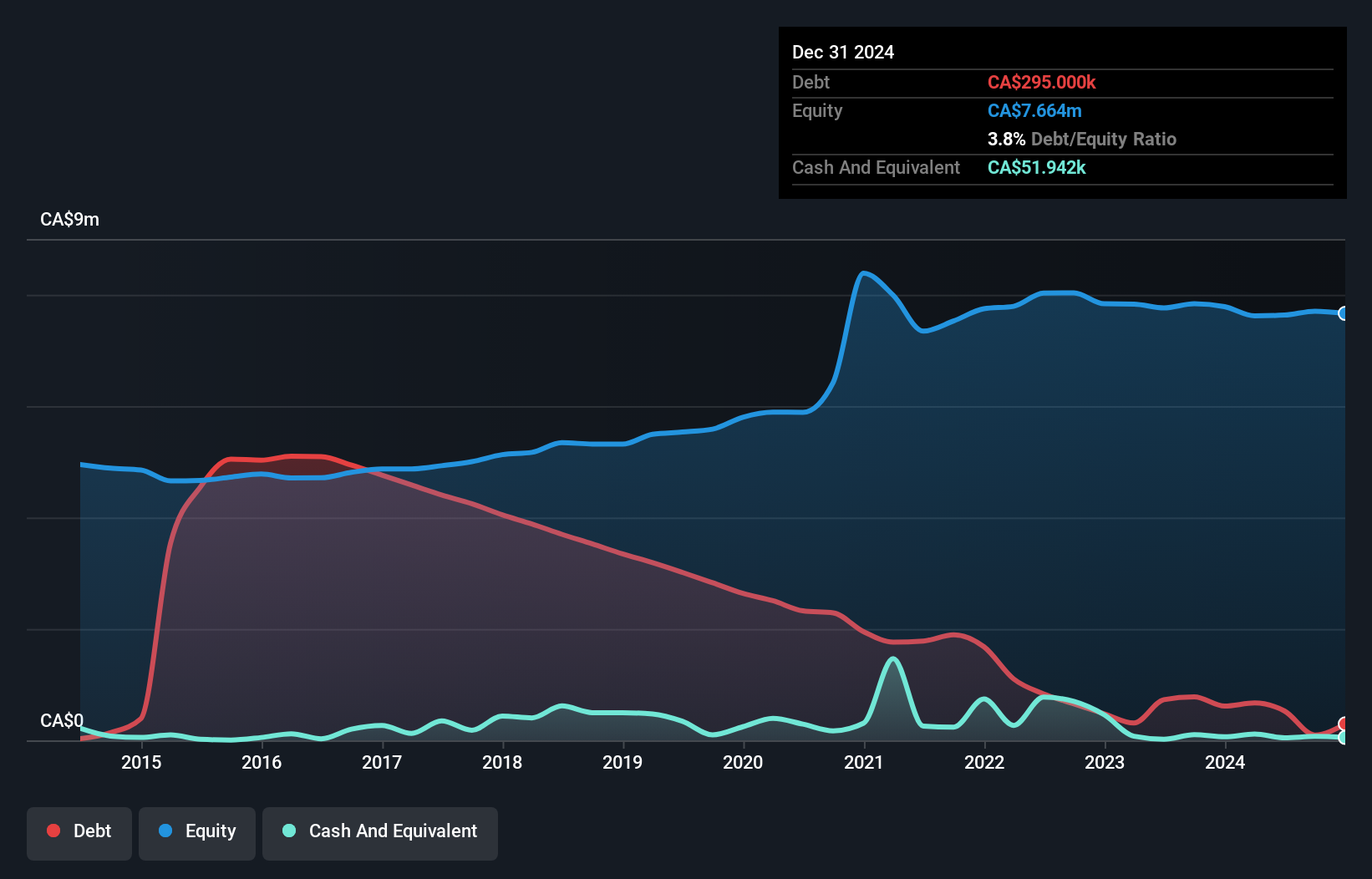

WestBond Enterprises, with a market cap of CA$5.70 million, operates in the disposable paper products sector and faces challenges with profitability as it remains unprofitable. The company's revenue for the recent quarter was CA$2.58 million, slightly down from the previous year. Despite this, WestBond maintains a satisfactory net debt to equity ratio of 0.3% and its short-term assets exceed both short- and long-term liabilities, indicating reasonable financial management. However, high share price volatility persists alongside stable weekly volatility over the past year compared to most Canadian stocks. The board's extensive experience provides governance stability amidst these challenges.

- Dive into the specifics of WestBond Enterprises here with our thorough balance sheet health report.

- Explore historical data to track WestBond Enterprises' performance over time in our past results report.

Next Steps

- Investigate our full lineup of 939 TSX Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EnWave might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ENW

EnWave

Designs, constructs, markets, and sells vacuum-microwave dehydration machinery for the food, cannabis, and biomaterial industries in Canada, the United States, and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion