- Canada

- /

- Electrical

- /

- TSX:ELVA

Why Electrovaya (TSX:ELVA) Is Up 19.6% After Next-Gen ESS Launch and US Manufacturing Expansion

Reviewed by Simply Wall St

- Electrovaya has launched its next-generation Energy Storage Systems (ESS), featuring its Infinity Technology, and commenced manufacturing expansion at its Jamestown, New York facility, with initial deployments planned for 2026 and broader deliveries in 2027.

- The new ESS products are designed for high cycle life, enhanced safety, and lower cost of ownership, and are expected to be eligible for 30-40% U.S. Investment Tax Credits, reflecting benefits from domestic content policies and vertical integration.

- We'll consider how Electrovaya’s U.S.-based ESS manufacturing expansion and domestic content incentives may shape its long-term investment case.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Electrovaya Investment Narrative Recap

To be a shareholder in Electrovaya, you need confidence that the company can turn its proprietary battery technology, manufacturing expansion, and U.S. policy incentives into sustained growth across key verticals like energy storage and material handling. The recent launch of its next-generation ESS and ongoing Jamestown manufacturing ramp are pivotal, but the short-term catalyst, scaling commercial deployments, remains unchanged. The biggest risk continues to be meeting ambitious vertical diversification and large-scale deployment targets in a timely manner; this news does not materially reduce that execution risk.

Among recent announcements, the September 9, 2025 commercial launch of Infinity Technology-powered ESS directly aligns with Electrovaya's stated strategy to address grid, data center, and microgrid markets with long-life, safe, cost-effective products. This move is central to unlocking future recurring revenues and capitalizing on domestic content incentives, supporting both top-line growth and margin resilience if deployments ramp as expected.

But unlike potential upside, the complexity and timing of commercial scaling in new verticals is something investors need to watch closely...

Read the full narrative on Electrovaya (it's free!)

Electrovaya's narrative projects $177.9 million revenue and $28.9 million earnings by 2028. This requires 48.0% yearly revenue growth and a $27.7 million earnings increase from $1.2 million today.

Uncover how Electrovaya's forecasts yield a CA$6.01 fair value, a 38% downside to its current price.

Exploring Other Perspectives

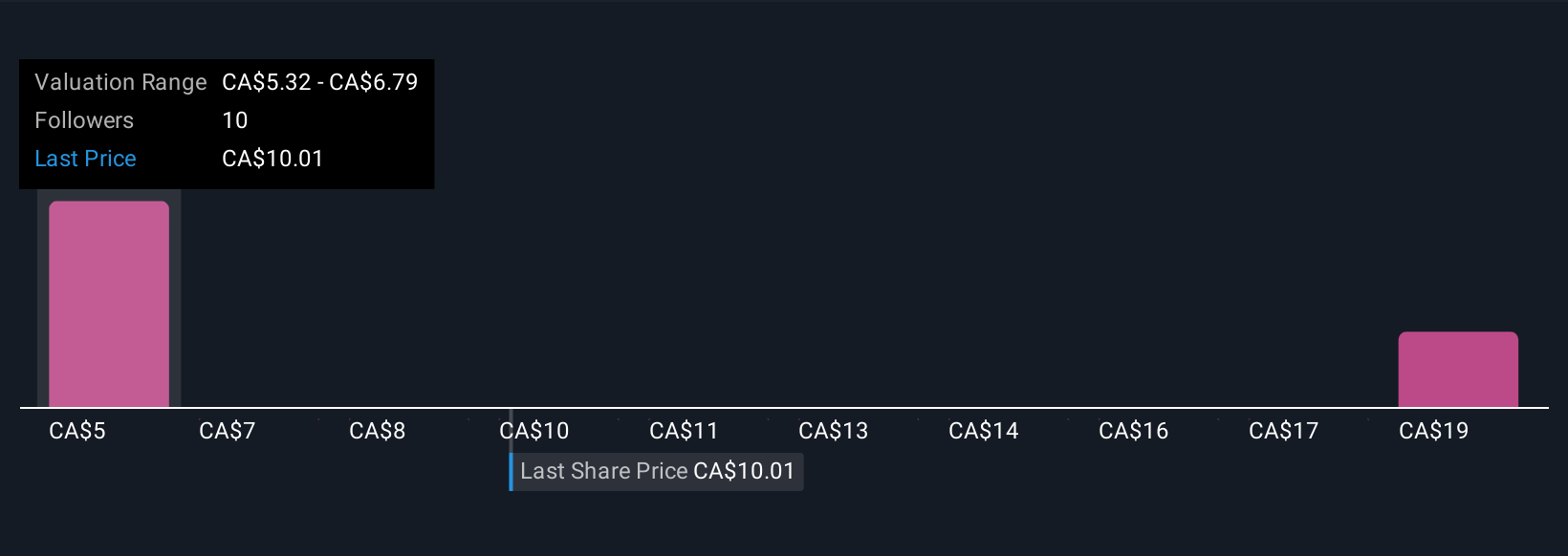

Simply Wall St Community members provide three diverse fair value estimates for Electrovaya, ranging from CA$5.32 to CA$20.01 per share. Opinions differ widely, especially as many are watching whether real gains from new verticals materialize, given the company’s expanding order backlog and ambitious sector targets.

Explore 3 other fair value estimates on Electrovaya - why the stock might be worth 45% less than the current price!

Build Your Own Electrovaya Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Electrovaya research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Electrovaya research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Electrovaya's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electrovaya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ELVA

Electrovaya

Engages in the design, development, manufacture, and sale of lithium-ion batteries, battery management systems, and battery-related products for energy storage, clean electric transportation, and other specialized applications in North America.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives