Last Update 16 Aug 25

Fair value Increased 34%Warehouse Automation And Robotics Will Fuel Uncertain Yet Promising Trends

Driven by significant increases in both Electrovaya's future P/E ratio and net profit margin, analysts have notably raised the consensus price target from CA$4.50 to CA$6.01.

What's in the News

- Launched battery systems for airport ground support equipment in partnership with a major OEM; first commercial shipment set for August and products to be showcased at the International GSE Expo.

- Introduced multiple battery system products for robotic vehicle platforms through collaborations with three major OEMs in the US and Japan; initial deliveries to begin this quarter with commercial ramp-up in fiscal 2026.

- Received approximately $4.5 million in new purchase orders from a leading Fortune 100 e-commerce company, bringing total demand from this customer to over $20 million in fiscal 2025 for Infinity battery systems.

- Successfully completed UL2580 certification for 448 models of next-gen 24V, 36V, and 48V lithium-ion battery systems, offering industry-leading energy density; new models available to customers this year.

- Signed commercial supply agreement with Janus Electric Holdings to provide advanced high voltage Infinity batteries for electric truck conversions, supporting Janus’s zero-emission swappable battery platform.

Valuation Changes

Summary of Valuation Changes for Electrovaya

- The Consensus Analyst Price Target has significantly risen from CA$4.50 to CA$6.01.

- The Future P/E for Electrovaya has significantly risen from 8.11x to 12.54x.

- The Net Profit Margin for Electrovaya has significantly risen from 14.70% to 16.42%.

Key Takeaways

- Sustained demand and expansion into new sectors are expected to reduce risk and boost margins, but setbacks or slower market growth could hurt earnings stability.

- Confidence in premium battery technology, supply chain strength, and new product rollouts may be challenged if competition, cost pressures, or slower adoption arise.

- Diversification, technical innovation, manufacturing expansion, and growing recurring revenues position Electrovaya for reduced risk, higher margins, and sustained long-term growth.

Catalysts

About Electrovaya- Engages in the design, development, manufacture, and sale of lithium-ion batteries, battery management systems, and battery-related products for energy storage, clean electric transportation, and other specialized applications in North America.

- Investors may be pricing in strong, continued revenue growth and improved profitability driven by expectations that warehouse automation, robotics, and e-commerce sectors will sustain elevated demand for Electrovaya's batteries as automation adoption accelerates; this could lead to revenue and margin estimates that are difficult to maintain if industry growth slows or competitors catch up technologically.

- There may be an assumption that sizable expansion into new verticals-such as robotics, airport ground equipment, defense, and grid energy storage-will rapidly diversify revenue streams and meaningfully decrease customer concentration risk, resulting in more stable and rising future earnings; any delays or disappointments in these verticals would negatively impact projected revenue growth.

- The stock may be reflecting expectations that Electrovaya's long-life, high-safety battery technology will command premium pricing and margin stability, especially given increased ESG focus and the need for ultra-safe batteries in data centers and mission-critical environments; should battery commoditization or new regulatory compliance pressures emerge, this advantage may erode quicker than anticipated, compressing margins.

- There appears to be optimism that ongoing domestic supply chain investments (e.g., North American sourcing, Jamestown manufacturing expansion) will fully insulate Electrovaya from geopolitical risks and material cost increases, thus supporting net margin expansion; unforeseen supply disruptions or cost pressures could limit these net margin benefits.

- Investors likely anticipate the successful commercialization of new technologies (ceramic separator, solid-state batteries) and recurring revenue models (energy services, software) to drive step-changes in long-term growth and margin profile; if market adoption is slower than expected or R&D expenses outpace revenue contribution, this could weigh on future earnings and margin forecasts.

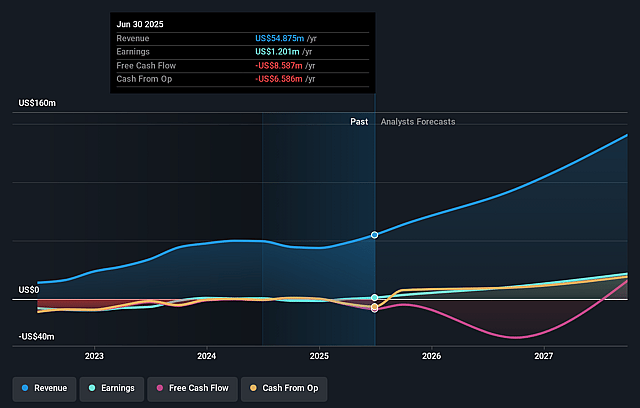

Electrovaya Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Electrovaya's revenue will grow by 48.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.2% today to 16.2% in 3 years time.

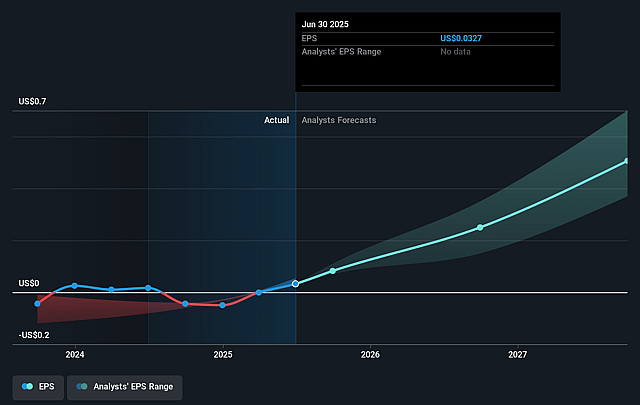

- Analysts expect earnings to reach $28.9 million (and earnings per share of $0.62) by about September 2028, up from $1.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.3x on those 2028 earnings, down from 211.5x today. This future PE is lower than the current PE for the CA Electrical industry at 17.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.85%, as per the Simply Wall St company report.

Electrovaya Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued high revenue growth (67% year-over-year for Q3 and 31% year-to-date) with expanding order backlogs ($65M in orders over 9 months) and strong customer momentum among Fortune 100 and 500 companies indicate sustained, broad-based demand and increasing revenue visibility, potentially supporting further share price appreciation.

- Ongoing diversification into multiple fast-growing verticals-such as robotics, airport ground equipment, construction, defense, Class 8 trucks, and energy storage-reduces reliance on single markets, expands the addressable market, and could drive significant incremental revenues and reduce revenue volatility over the long term.

- Strategic investments in North American manufacturing (Jamestown facility and Mississauga expansion), alongside successfully establishing local supply chains and eligibility for U.S. production tax credits (45X), position Electrovaya to benefit from geo-political realignments, government incentives, and Buy American/de-risking trends, supporting both top-line growth and margin resilience.

- The company's proprietary technical advantages-including industry-leading safety, high cycle life, evolving ceramic separator innovations, and progress on solid-state battery R&D-strengthen its position to capture premium markets (data centers, mission-critical/firesafe applications) and support higher margins and competitive differentiation, reducing margin compression risks.

- Expansion of recurring-revenue offerings (AI-driven demand response, battery-as-a-service, and data analytics) is on track to contribute in fiscal 2026 and beyond, offering the potential for more predictable, higher-quality revenue streams and improved net margins, which can positively impact long-term earnings and valuation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$6.006 for Electrovaya based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $177.9 million, earnings will come to $28.9 million, and it would be trading on a PE ratio of 9.3x, assuming you use a discount rate of 7.9%.

- Given the current share price of CA$8.74, the analyst price target of CA$6.01 is 45.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.