- Canada

- /

- Electrical

- /

- TSX:ELVA

Electrovaya (TSX:ELVA): Assessing Valuation After Expansion Updates and EXIM Debt Facility Drawdown News

Reviewed by Kshitija Bhandaru

If you have been following Electrovaya (TSX:ELVA), you know the stock is back in the spotlight thanks to a couple of events catching the attention of investors. The company has been busy, sharing expansion plans through high-profile conference presentations while announcing fresh updates on its substantial EXIM debt facility drawdowns. These announcements support its manufacturing buildout in Jamestown, New York. For investors weighing whether to get involved, these moves signal momentum as Electrovaya leans into growth initiatives, all while keeping communication channels open with the market.

In the wider context, Electrovaya’s share price has been through significant swings, surging nearly 89% over the past three months and climbing 167% in the past year. The year-to-date return sits at 133%, putting it squarely on the radar for those tracking momentum-driven names. While short-term numbers also reflect some volatility, the flood of recent news around financing and industry engagement has refocused attention on what might come next for the company’s valuation and future trajectory.

With all eyes on the company’s growth plans and a stock that has posted big gains in a short time, the question is whether Electrovaya is an undervalued opportunity or if the market is already pricing in next year’s growth story?

Most Popular Narrative: 41% Overvalued

According to the most widely followed narrative, Electrovaya is currently considered overvalued by about 41% compared to analysts’ estimate of its fair value, using a 7.85% discount rate and projections of much higher future earnings and profit margins.

Ongoing diversification into multiple fast-growing verticals, such as robotics, airport ground equipment, construction, defense, Class 8 trucks, and energy storage, reduces reliance on single markets. This expansion of the addressable market could drive significant incremental revenues and reduce revenue volatility over the long term.

Is Electrovaya’s future already priced in, or are there fundamentals that could rewire what investors expect? The narrative points to ambitious growth, rapid margin expansion, and a multi-sector strategy as key drivers shaping that eye-catching valuation. Want to find out the exact growth figures, margin expectations, and what could make or break this outlook? The full story dives deep into the bold financial projections setting this target.

Result: Fair Value of $6.01 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, setbacks in key vertical expansions or slower than expected customer adoption could quickly dampen the upbeat outlook and challenge optimistic forecasts.

Find out about the key risks to this Electrovaya narrative.Another View: Discounted Cash Flow Perspective Raises Questions

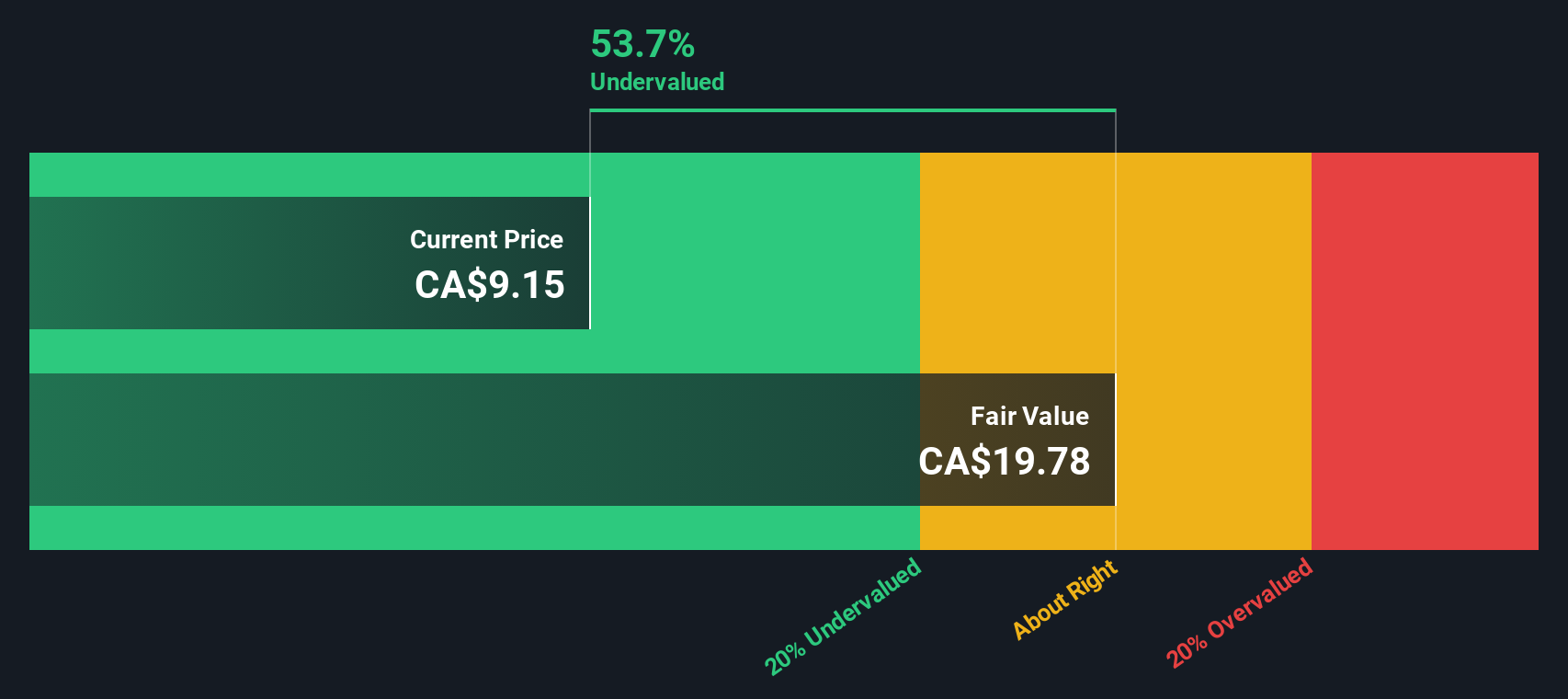

Looking at the numbers from a different angle, our SWS DCF model comes to a very different conclusion. This approach suggests Electrovaya might be notably undervalued, painting a much more bullish scenario. Could this calculation be closer to the mark, or does it overlook key risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Electrovaya Narrative

If you see things differently or want to dig into the numbers yourself, you can put together your own take in just a few minutes. Do it your way.

A great starting point for your Electrovaya research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t wait for the next big move to pass you by. Take action now and uncover companies you might not have considered for your watchlist.

- Tap into emerging tech with AI-driven innovators by using our AI penny stocks to get ahead of industry trends before the crowd.

- Secure steady income streams by finding businesses paying generous yields with the dividend stocks with yields > 3% and strengthen your portfolio for the long haul.

- Catch growth stories trading at a bargain when you use our undervalued stocks based on cash flows for compelling value prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electrovaya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ELVA

Electrovaya

Engages in the design, development, manufacture, and sale of lithium-ion batteries, battery management systems, and battery-related products for energy storage, clean electric transportation, and other specialized applications in North America.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives