- Canada

- /

- Electrical

- /

- TSX:ELVA

Electrovaya Inc. (TSE:ELVA) Shares Fly 38% But Investors Aren't Buying For Growth

Electrovaya Inc. (TSE:ELVA) shares have continued their recent momentum with a 38% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 78%.

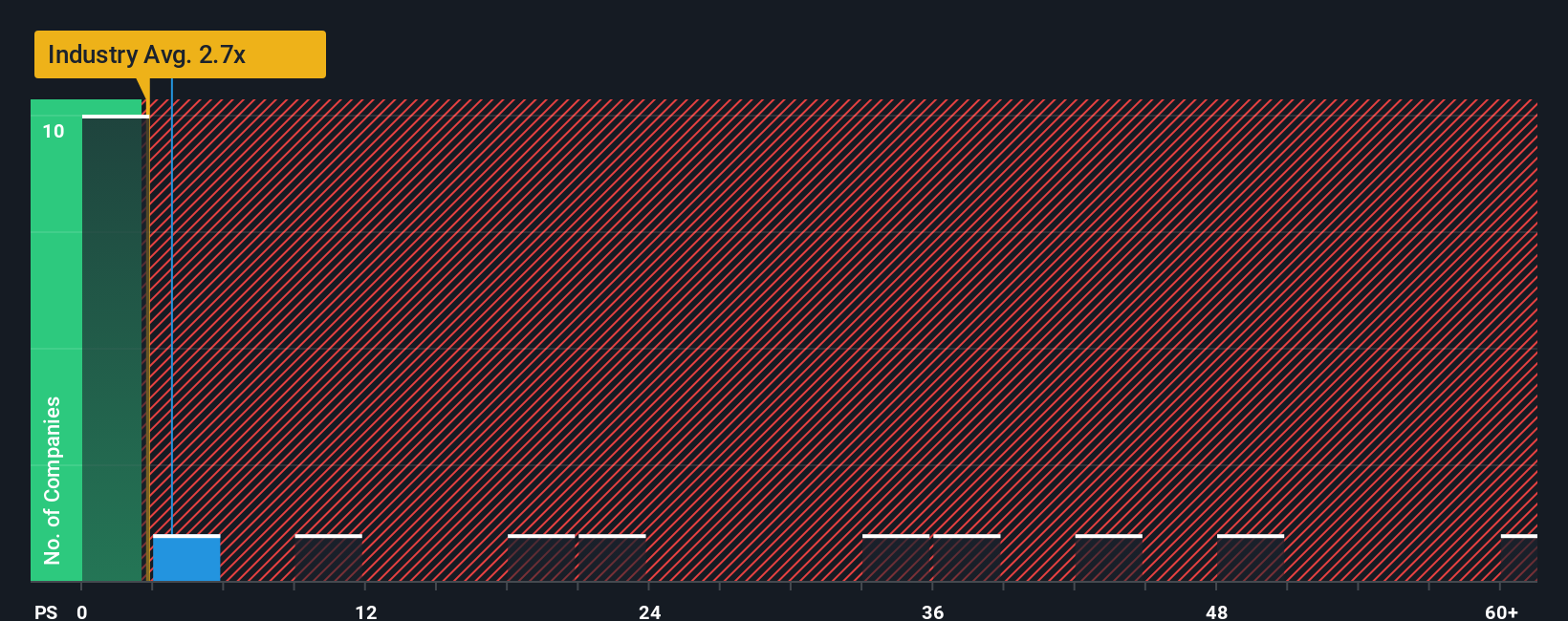

In spite of the firm bounce in price, Electrovaya may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 3.8x, considering almost half of all companies in the Electrical industry in Canada have P/S ratios greater than 14.4x and even P/S higher than 43x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Electrovaya

How Electrovaya Has Been Performing

Electrovaya could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Electrovaya.Is There Any Revenue Growth Forecasted For Electrovaya?

The only time you'd be truly comfortable seeing a P/S as depressed as Electrovaya's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 3.6% decrease to the company's top line. In spite of this, the company still managed to deliver immense revenue growth over the last three years. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 51% per annum over the next three years. With the industry predicted to deliver 109% growth per annum, the company is positioned for a weaker revenue result.

With this information, we can see why Electrovaya is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Electrovaya's P/S

Electrovaya's recent share price jump still sees fails to bring its P/S alongside the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of Electrovaya's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for Electrovaya that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Electrovaya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ELVA

Electrovaya

Engages in the design, development, manufacture, and sale of lithium-ion batteries, battery management systems, and battery-related products for energy storage, clean electric transportation, and other specialized applications in North America.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives