3 Intriguing Stocks That May Be Trading At An Estimated 13.8% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets continue to react positively to recent political developments and economic indicators, major indices like the S&P 500 have reached new record highs, driven by optimism around trade policies and AI investments. Amidst this buoyant market environment, identifying stocks that are potentially undervalued can be a strategic move for investors looking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$526.72 | 49.8% |

| Berkshire Hills Bancorp (NYSE:BHLB) | US$28.32 | US$56.60 | 50% |

| Shenzhen Yinghe Technology (SZSE:300457) | CN¥18.80 | CN¥37.54 | 49.9% |

| World Fitness Services (TWSE:2762) | NT$92.70 | NT$184.63 | 49.8% |

| Vertiseit (OM:VERT B) | SEK50.20 | SEK99.93 | 49.8% |

| Fudo Tetra (TSE:1813) | ¥2153.00 | ¥4301.30 | 49.9% |

| Greenworks (Jiangsu) (SZSE:301260) | CN¥13.95 | CN¥27.81 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5854.00 | ¥11678.68 | 49.9% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥9.10 | CN¥18.19 | 50% |

| Tenable Holdings (NasdaqGS:TENB) | US$43.39 | US$86.65 | 49.9% |

Let's review some notable picks from our screened stocks.

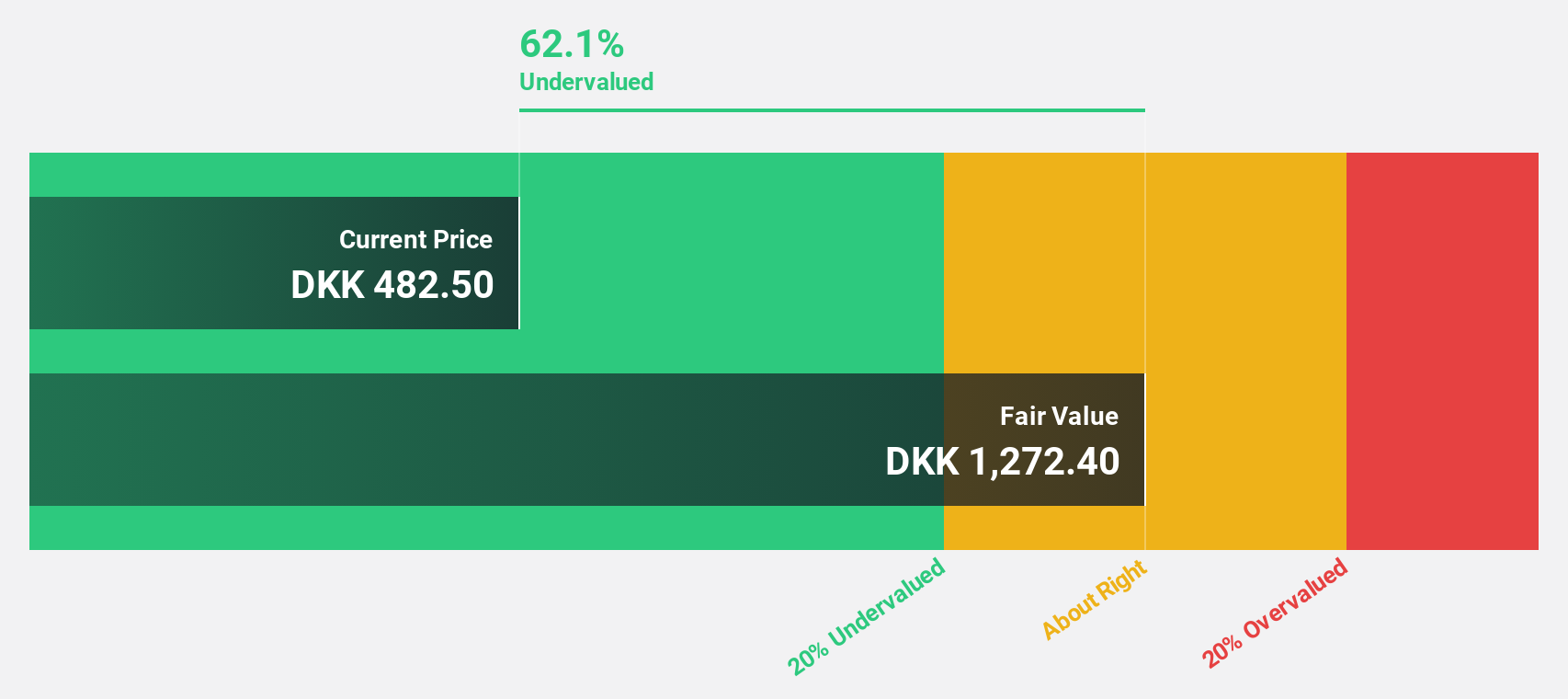

Novo Nordisk (CPSE:NOVO B)

Overview: Novo Nordisk A/S is a pharmaceutical company involved in the research, development, manufacture, and distribution of pharmaceutical products across Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America and other international markets with a market cap of DKK2.76 trillion.

Operations: The company's revenue is primarily derived from Diabetes and Obesity Care, which accounts for DKK253.08 billion, and Rare Disease treatments, contributing DKK17.51 billion.

Estimated Discount To Fair Value: 48.9%

Novo Nordisk appears undervalued based on discounted cash flow analysis, trading at DKK 622.4, significantly below the estimated fair value of DKK 1219.19. Despite recent legal challenges and trial setbacks, the company shows robust financial health with forecasted earnings growth of 13.6% annually, outpacing the Danish market average. However, its share price has been volatile recently and it has an unstable dividend track record which may concern some investors seeking consistent returns.

- The growth report we've compiled suggests that Novo Nordisk's future prospects could be on the up.

- Take a closer look at Novo Nordisk's balance sheet health here in our report.

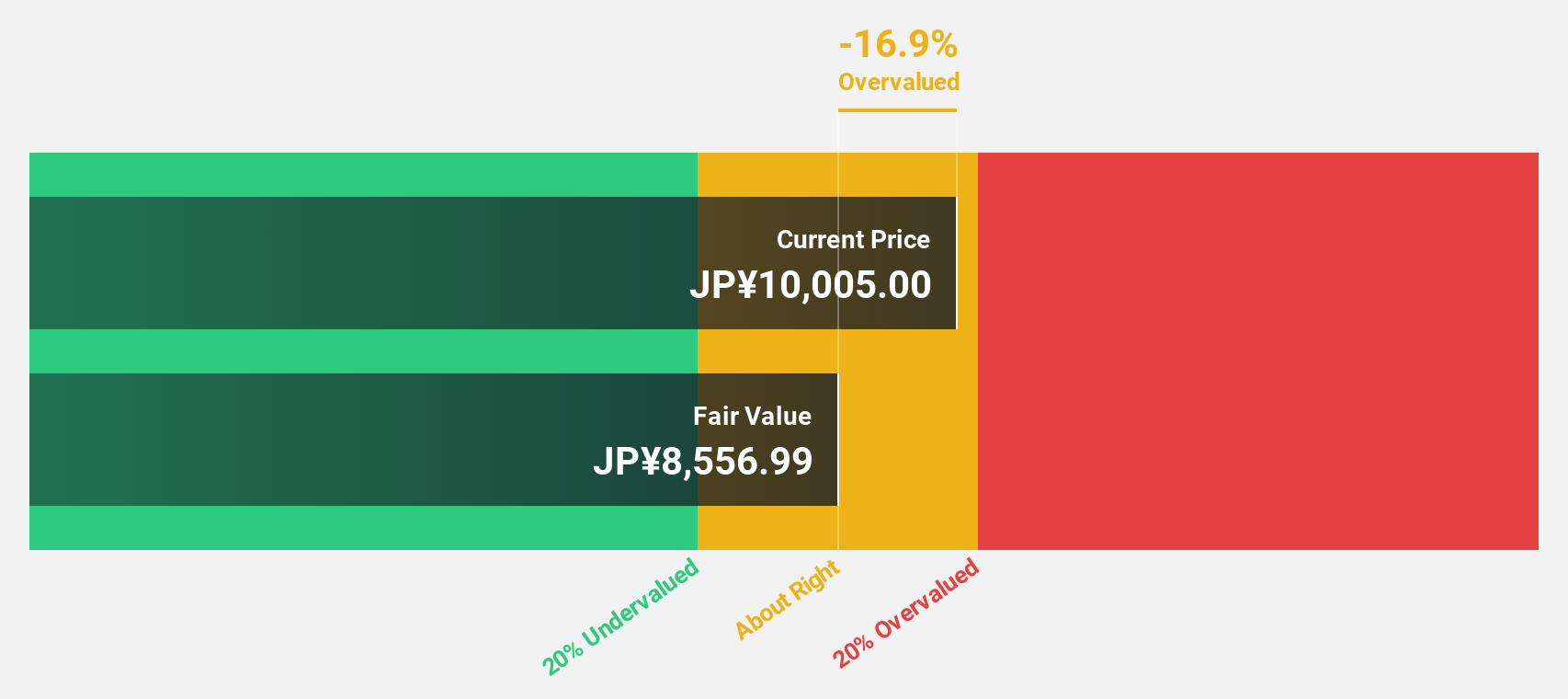

Trend Micro (TSE:4704)

Overview: Trend Micro Incorporated develops and sells security-related software and services for computers both in Japan and internationally, with a market cap of approximately ¥1.16 trillion.

Operations: The company's revenue segments include ¥85.04 billion from Japan, ¥65.17 billion from Europe, ¥70.30 billion from the Americas, and ¥125.59 billion from the Asia Pacific region.

Estimated Discount To Fair Value: 15.9%

Trend Micro, trading at ¥8823, is undervalued relative to its estimated fair value of ¥10489.99 based on discounted cash flow analysis. Recent product launches in AI-driven security tools enhance its market position and operational efficiency. Earnings are projected to grow 17.34% annually, surpassing the Japanese market's average growth rate of 8.1%. While revenue growth is modest at 5.7% per year, it remains above the national average of 4.3%, supporting a positive outlook for future cash flows.

- Our comprehensive growth report raises the possibility that Trend Micro is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Trend Micro.

AtkinsRéalis Group (TSX:ATRL)

Overview: AtkinsRéalis is an integrated professional services and project management company with a global presence, and it has a market cap of CA$14.21 billion.

Operations: The company's revenue segments include Capital at CA$126.66 million, Nuclear at CA$1.30 billion, and LSTK Projects at CA$264.84 million.

Estimated Discount To Fair Value: 13.8%

AtkinsRéalis Group, trading at CA$81.26, is undervalued compared to its fair value estimate of CA$94.23. With a forecasted revenue growth rate of 6.6% annually, it surpasses the Canadian market average of 4.8%. Earnings are expected to grow significantly at 27.4% per year over the next three years, outpacing the broader market's growth rate of 15.5%. Recent contracts in nuclear and infrastructure sectors bolster its cash flow potential and strategic positioning globally.

- Insights from our recent growth report point to a promising forecast for AtkinsRéalis Group's business outlook.

- Click to explore a detailed breakdown of our findings in AtkinsRéalis Group's balance sheet health report.

Summing It All Up

- Explore the 887 names from our Undervalued Stocks Based On Cash Flows screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novo Nordisk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NOVO B

Novo Nordisk

Engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives