- Canada

- /

- Oil and Gas

- /

- TSX:PEY

Top TSX Dividend Stocks To Consider In October 2024

Reviewed by Simply Wall St

As the TSX reaches new all-time highs, buoyed by optimism from recent U.S. Fed rate cuts and a robust economic outlook, investors are increasingly looking at dividend stocks as a reliable source of income amid market uncertainties. In this favorable environment, selecting well-established companies with strong earnings growth and consistent dividend payouts becomes crucial for building a resilient investment portfolio.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 7.00% | ★★★★★★ |

| Secure Energy Services (TSX:SES) | 3.31% | ★★★★★☆ |

| Labrador Iron Ore Royalty (TSX:LIF) | 7.81% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.29% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.11% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.57% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.14% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.13% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.40% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.48% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top TSX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

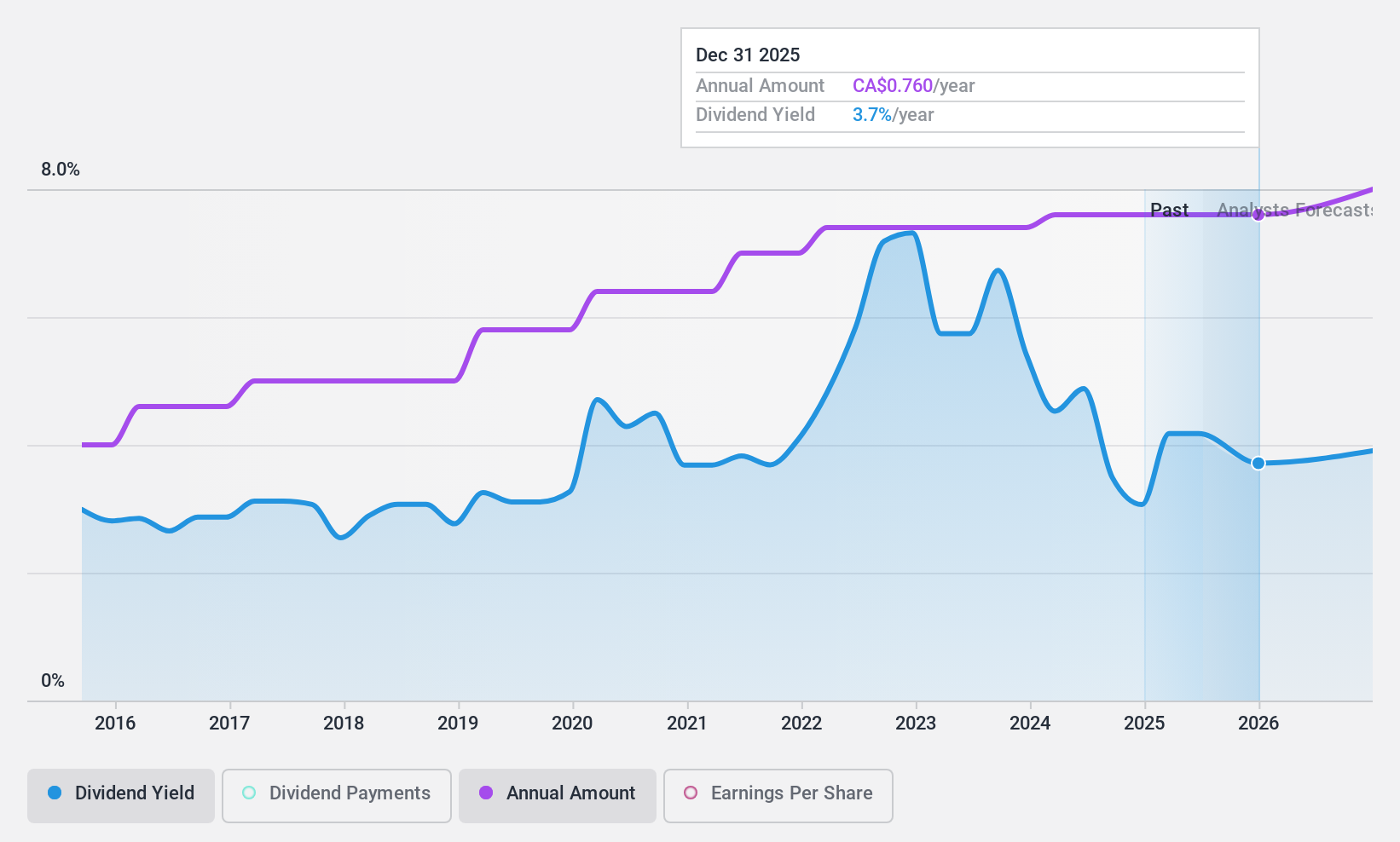

Aecon Group (TSX:ARE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aecon Group Inc., with a market cap of CA$1.31 billion, provides construction and infrastructure development services to private and public sector clients in Canada, the United States, and internationally.

Operations: Aecon Group Inc. generates revenue primarily from its Construction segment, which accounts for CA$4.04 billion, and its Concessions segment, contributing CA$34.47 million.

Dividend Yield: 3.6%

Aecon Group's recent financial performance shows a net loss, with earnings not covering its dividend payments. Despite this, dividends have been stable and growing over the past decade. The company’s share repurchase program and significant contract wins, such as the $928 million Surrey Langley SkyTrain project and a $700 million Bruce Power contract, bolster its construction segment backlog. However, with a high payout ratio of 355.1%, dividend sustainability remains questionable despite low cash payout ratios suggesting coverage by cash flows.

- Take a closer look at Aecon Group's potential here in our dividend report.

- Our valuation report here indicates Aecon Group may be undervalued.

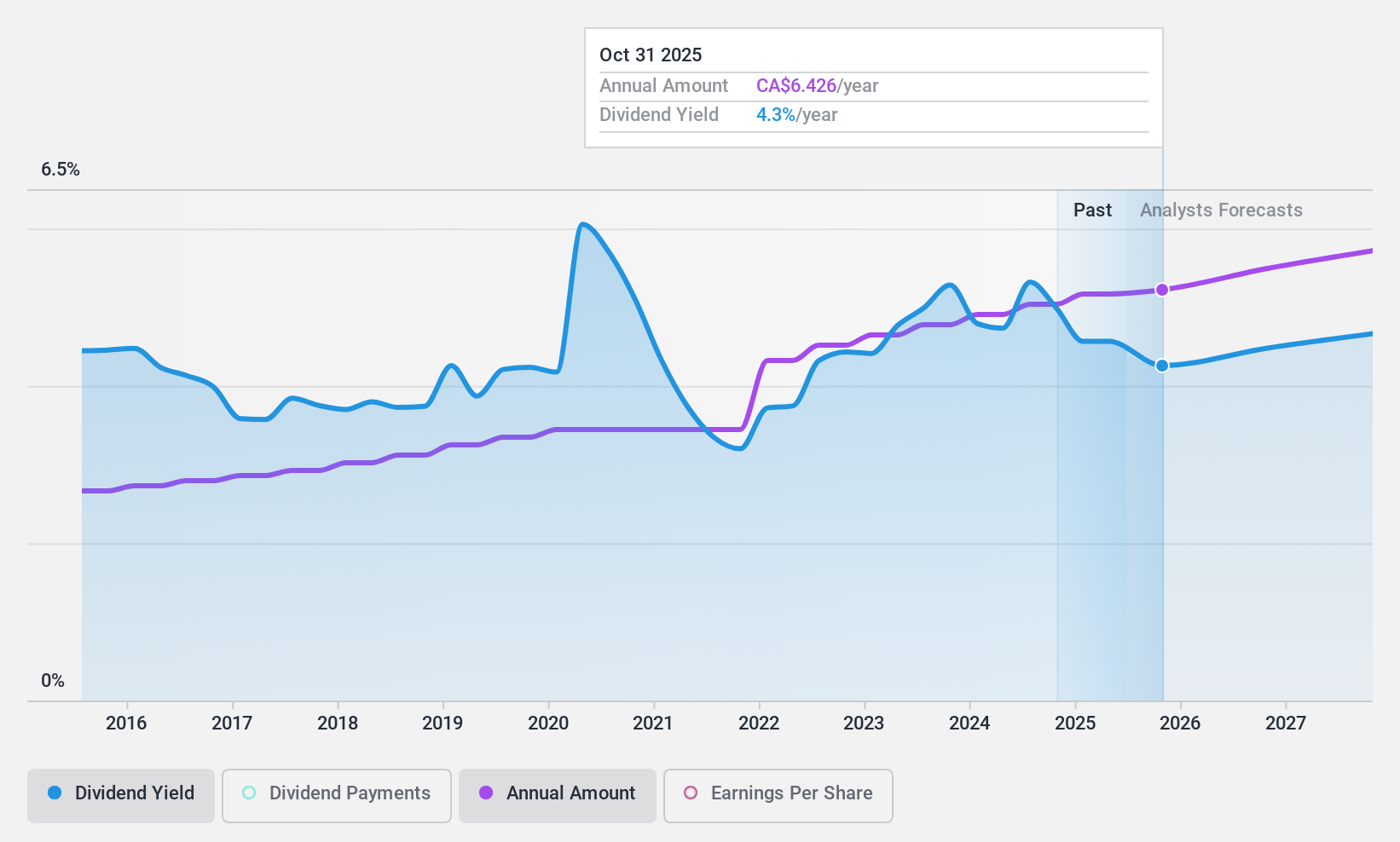

Bank of Montreal (TSX:BMO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Montreal provides diversified financial services primarily in North America and has a market cap of CA$89.02 billion.

Operations: Bank of Montreal's revenue segments include Canadian Personal and Commercial Banking (CA$10.20 billion), U.S. Personal and Commercial Banking (CA$8.89 billion), BMO Wealth Management (CA$7.61 billion), and BMO Capital Markets (CA$6.47 billion).

Dividend Yield: 5%

Bank of Montreal offers a reliable dividend yield of 5.04%, though it falls short compared to the top 25% of Canadian dividend payers. Dividends have been stable and growing over the past decade, supported by a reasonable payout ratio currently at 69.5%, forecasted to improve to 53.2% in three years. Despite trading below fair value, recent fixed-income offerings indicate robust financial management, enhancing its ability to sustain dividends amidst market fluctuations.

- Click to explore a detailed breakdown of our findings in Bank of Montreal's dividend report.

- The valuation report we've compiled suggests that Bank of Montreal's current price could be quite moderate.

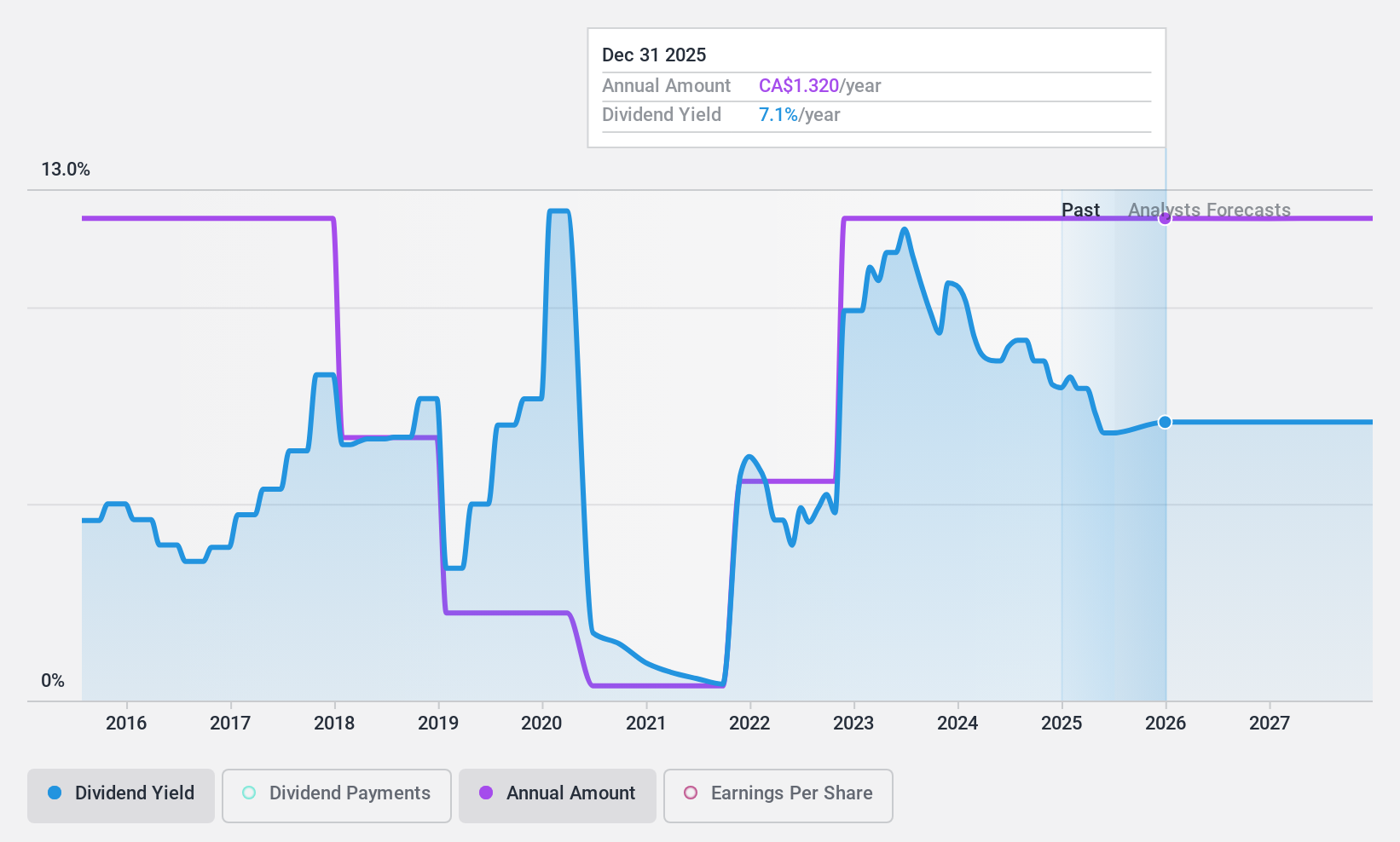

Peyto Exploration & Development (TSX:PEY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Peyto Exploration & Development Corp. is an energy company focused on the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta's Deep Basin with a market cap of CA$3.02 billion.

Operations: Peyto Exploration & Development Corp. generates CA$901.99 million in revenue from its oil and gas exploration and production activities.

Dividend Yield: 8.4%

Peyto Exploration & Development Corp. offers a high dividend yield of 8.41%, placing it in the top 25% of Canadian dividend payers. However, the dividends are not well covered by free cash flows, with a cash payout ratio at 113.6%. Despite recent affirmations of monthly dividends at $0.11 per share, the company's dividend history has been volatile and unreliable over the past decade, with significant annual drops exceeding 20%.

- Click here and access our complete dividend analysis report to understand the dynamics of Peyto Exploration & Development.

- Our valuation report unveils the possibility Peyto Exploration & Development's shares may be trading at a discount.

Key Takeaways

- Click this link to deep-dive into the 31 companies within our Top TSX Dividend Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PEY

Peyto Exploration & Development

An energy company, engages in the exploration, development, and production of natural gas, oil, and natural gas liquids in Deep Basin of Alberta.

Undervalued with reasonable growth potential and pays a dividend.