- Canada

- /

- Energy Services

- /

- TSX:TVK

3 TSX Stocks That May Be Trading Up To 49.9% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

In the current economic climate, Canadian stocks have been navigating a complex landscape shaped by new tariff implementations and fiscal policies. While U.S. equities are experiencing shifts in growth dynamics, Canadian investors may find opportunities in TSX stocks that appear undervalued based on intrinsic value estimates. Identifying such stocks involves looking for companies with strong fundamentals that can weather economic fluctuations and potentially benefit from strategic advantages within their sectors.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trisura Group (TSX:TSU) | CA$43.56 | CA$86.25 | 49.5% |

| TerraVest Industries (TSX:TVK) | CA$164.41 | CA$318.23 | 48.3% |

| Propel Holdings (TSX:PRL) | CA$36.45 | CA$67.31 | 45.9% |

| OceanaGold (TSX:OGC) | CA$18.95 | CA$37.65 | 49.7% |

| Magna Mining (TSXV:NICU) | CA$1.73 | CA$3.41 | 49.3% |

| Lithium Royalty (TSX:LIRC) | CA$5.535 | CA$8.77 | 36.9% |

| Ivanhoe Mines (TSX:IVN) | CA$10.93 | CA$18.38 | 40.5% |

| Exchange Income (TSX:EIF) | CA$66.50 | CA$102.44 | 35.1% |

| Blackline Safety (TSX:BLN) | CA$6.65 | CA$9.98 | 33.4% |

| Aecon Group (TSX:ARE) | CA$20.23 | CA$40.35 | 49.9% |

We're going to check out a few of the best picks from our screener tool.

Aecon Group (TSX:ARE)

Overview: Aecon Group Inc. is a company that, along with its subsidiaries, offers construction and infrastructure development services to both private and public sector clients across Canada, the United States, and internationally, with a market cap of CA$1.27 billion.

Operations: Aecon Group Inc.'s revenue is primarily derived from its Construction segment, which accounts for CA$4.43 billion, with an additional contribution from its Concessions segment totaling CA$10.73 million.

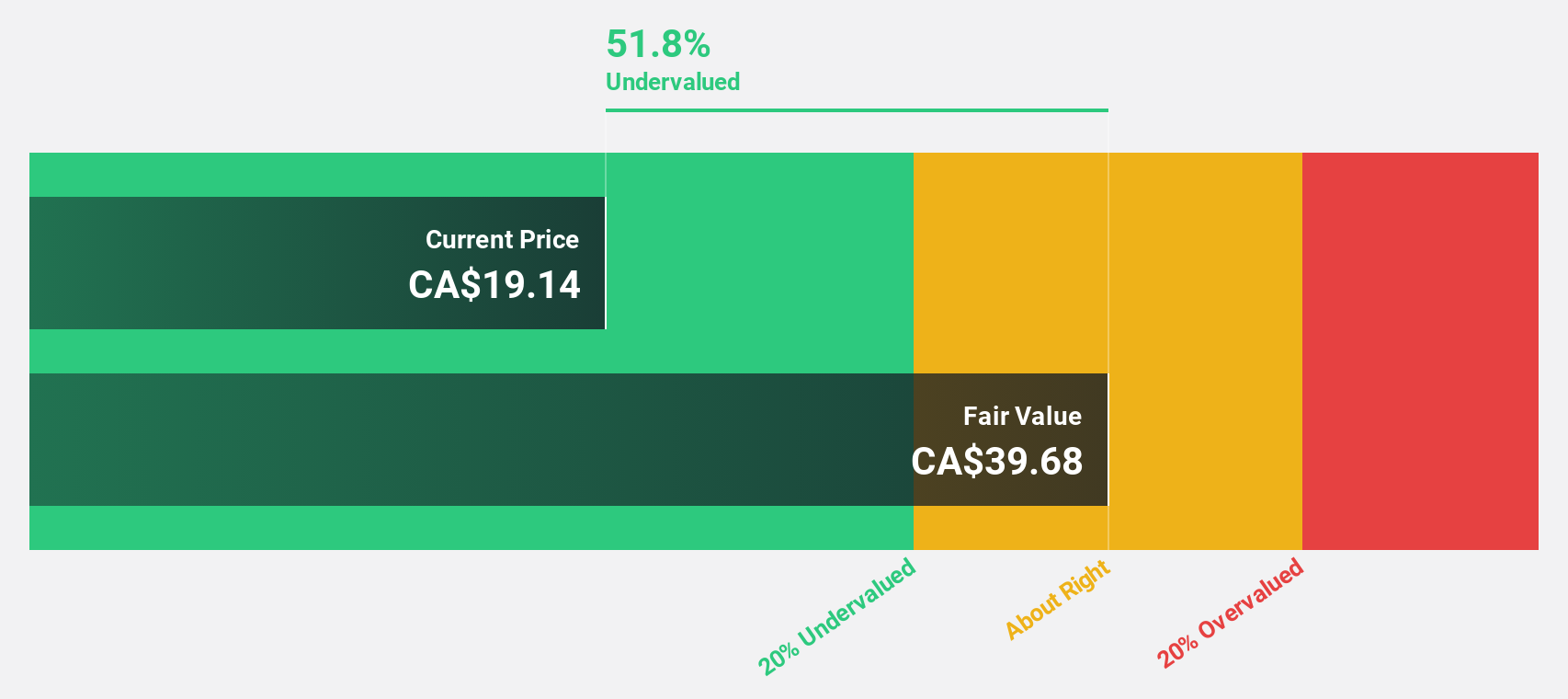

Estimated Discount To Fair Value: 49.9%

Aecon Group is trading at CA$20.23, significantly undervalued compared to its estimated fair value of CA$40.35. Despite a recent net loss, Aecon's revenue is forecast to grow faster than the Canadian market at 7.7% annually, with earnings projected to increase substantially by 139.34% per year as it becomes profitable within three years. The company's strong construction backlog includes a CA$1.3 billion contract for Ontario's Darlington New Nuclear Project, enhancing future cash flow prospects.

- According our earnings growth report, there's an indication that Aecon Group might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Aecon Group.

Skeena Resources (TSX:SKE)

Overview: Skeena Resources Limited is involved in the exploration and development of mineral properties in Canada, with a market cap of CA$2.59 billion.

Operations: Skeena Resources Limited does not currently report any revenue segments.

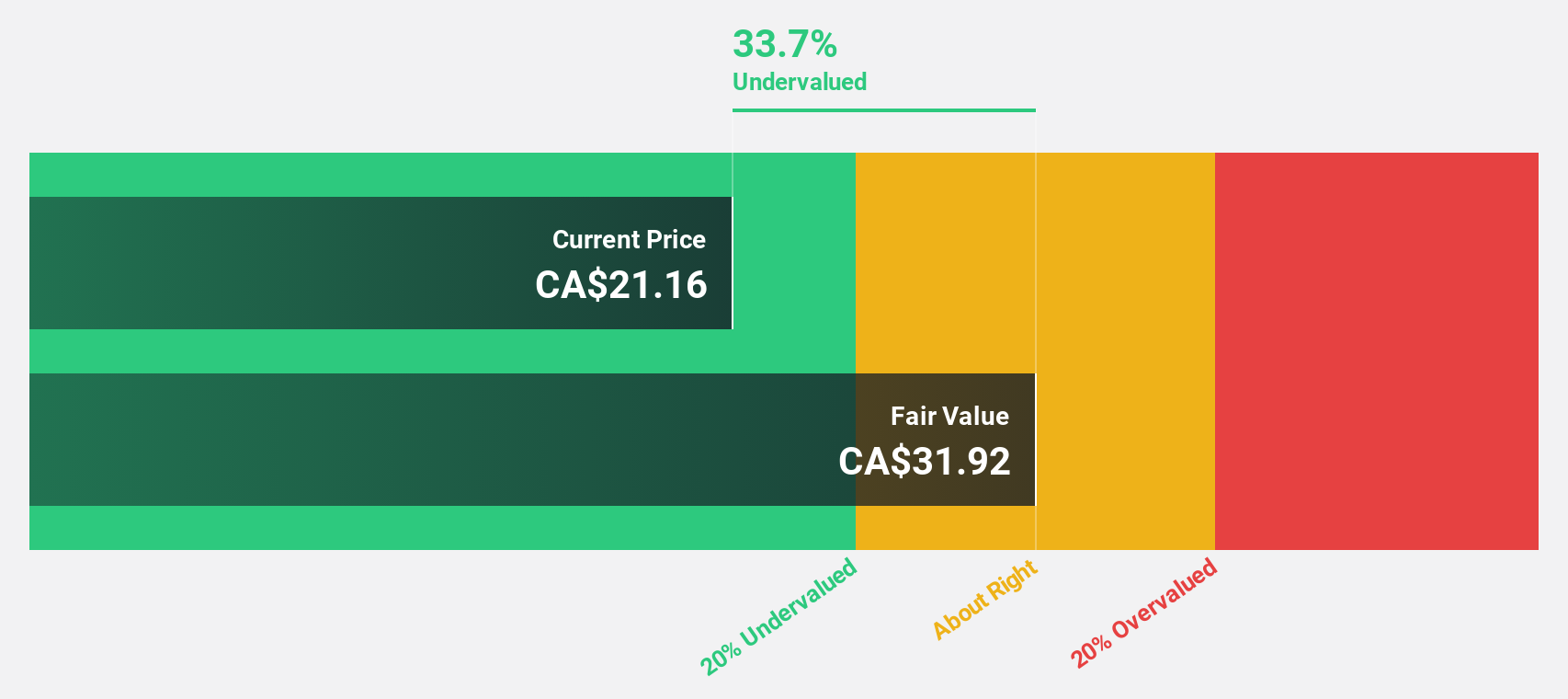

Estimated Discount To Fair Value: 26.2%

Skeena Resources, trading at CA$22.55, is undervalued with an estimated fair value of CA$30.54 and expected revenue growth of 97.4% annually, surpassing market averages. Despite a recent net loss of CA$38.25 million for Q1 2025 and significant insider selling, the company anticipates profitability within three years. Progress in permitting its Eskay Creek project could enhance cash flow prospects as it collaborates with Indigenous groups to advance development responsibly.

- The analysis detailed in our Skeena Resources growth report hints at robust future financial performance.

- Dive into the specifics of Skeena Resources here with our thorough financial health report.

TerraVest Industries (TSX:TVK)

Overview: TerraVest Industries Inc. is a company that manufactures and sells goods and services across various sectors including agriculture, mining, energy, chemicals, utilities, transportation, and construction in Canada, the United States, and internationally with a market cap of CA$3.50 billion.

Operations: The company's revenue is derived from several segments, including Service (CA$216.52 million), Processing Equipment (CA$104.18 million), Compressed Gas Equipment (CA$336.15 million), and HVAC and Containment Equipment (CA$363.00 million).

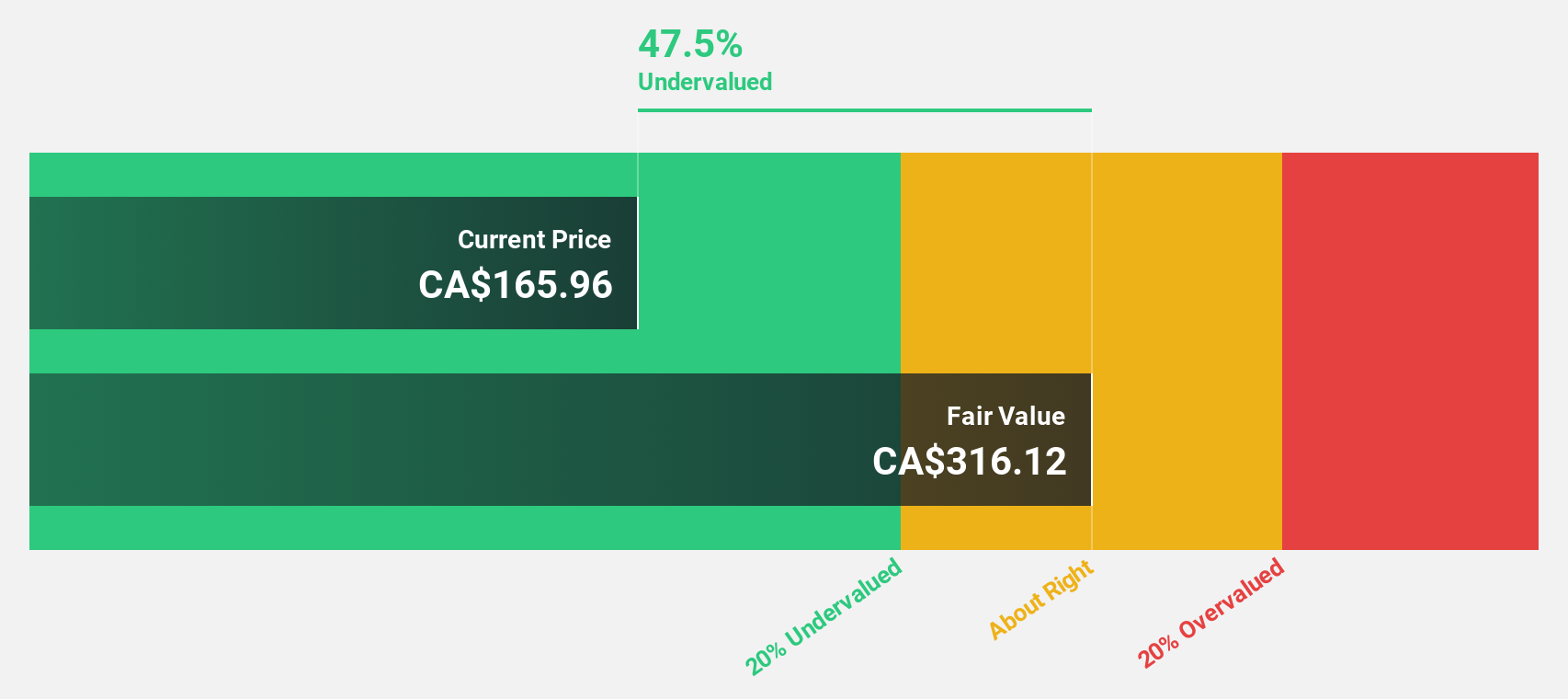

Estimated Discount To Fair Value: 48.3%

TerraVest Industries, priced at CA$164.41, is significantly undervalued with a fair value estimate of CA$318.23 and expected revenue growth of 28.5% annually, outpacing the Canadian market. Despite recent insider selling and debt coverage concerns, its earnings are anticipated to grow substantially over the next three years. Recent equity offerings totaling CA$278.92 million could impact cash flow positively as the company reported increased Q2 revenues and net income compared to last year.

- Upon reviewing our latest growth report, TerraVest Industries' projected financial performance appears quite optimistic.

- Navigate through the intricacies of TerraVest Industries with our comprehensive financial health report here.

Key Takeaways

- Unlock our comprehensive list of 27 Undervalued TSX Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TerraVest Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TVK

TerraVest Industries

Manufactures and sells goods and services to agriculture, mining, energy production and distribution, chemical, utilities, transportation and construction, and other markets in Canada, the United States, and internationally.

Proven track record and fair value.

Market Insights

Community Narratives