Toronto-Dominion Bank (TSX:TD): Assessing Valuation Following Launch of AI-Powered Wealth Virtual Assistant

Reviewed by Simply Wall St

Toronto-Dominion Bank (TSX:TD) just took another step into AI with the launch of its Wealth Virtual Assistant, a tool designed by its own Layer 6 team. The new assistant is aimed at helping colleagues quickly find policy details and client resources. This reflects TD's broader push toward technology-driven efficiency.

See our latest analysis for Toronto-Dominion Bank.

Momentum is clearly building for Toronto-Dominion Bank, with shares up over 47% year to date and the total shareholder return reaching 51% in the past 12 months. Recent executive changes and the continued focus on AI-driven efficiency appear to be reinforcing investor confidence in both the bank's growth potential and its operational agility.

If this wave of digital transformation has you curious about what else is rising in the market, it might be the perfect time to discover fast growing stocks with high insider ownership.

Yet with shares rallying sharply in 2025, investors now face an important question: does TD offer meaningful upside from here, or has the market already priced in the bank’s next phase of digital-led growth?

Most Popular Narrative: Fairly Valued

Toronto-Dominion Bank’s most popular narrative places its fair value at CA$111.93, which is only slightly below the last close price of CA$113.11. This suggests that the market is closely aligned with analysts’ expectations. The narrative presents forward-looking financial assumptions that underpin this valuation and sets the stage for deeper debate about TD’s future profitability.

Persistent investment in compliance (notably elevated AML remediation, cyber, and fraud prevention costs) is expected to drive higher structural expenses. This is anticipated to weigh on net margins and overall earnings growth well into 2026 and 2027, as regulatory scrutiny and associated operational costs remain elevated.

Curious what bold assumptions and future banking shifts were factored into that valuation? The most followed narrative hints at financial forecasts and margin changes far from what TD’s recent momentum suggests. If you want to uncover the shockers behind this “fair value” call, take a closer look—there is more nuance in the projections than meets the eye.

Result: Fair Value of $111.93 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, consistent fee-based growth and strong execution in digital initiatives could still propel TD’s revenue and profit margins beyond these cautious forecasts.

Find out about the key risks to this Toronto-Dominion Bank narrative.

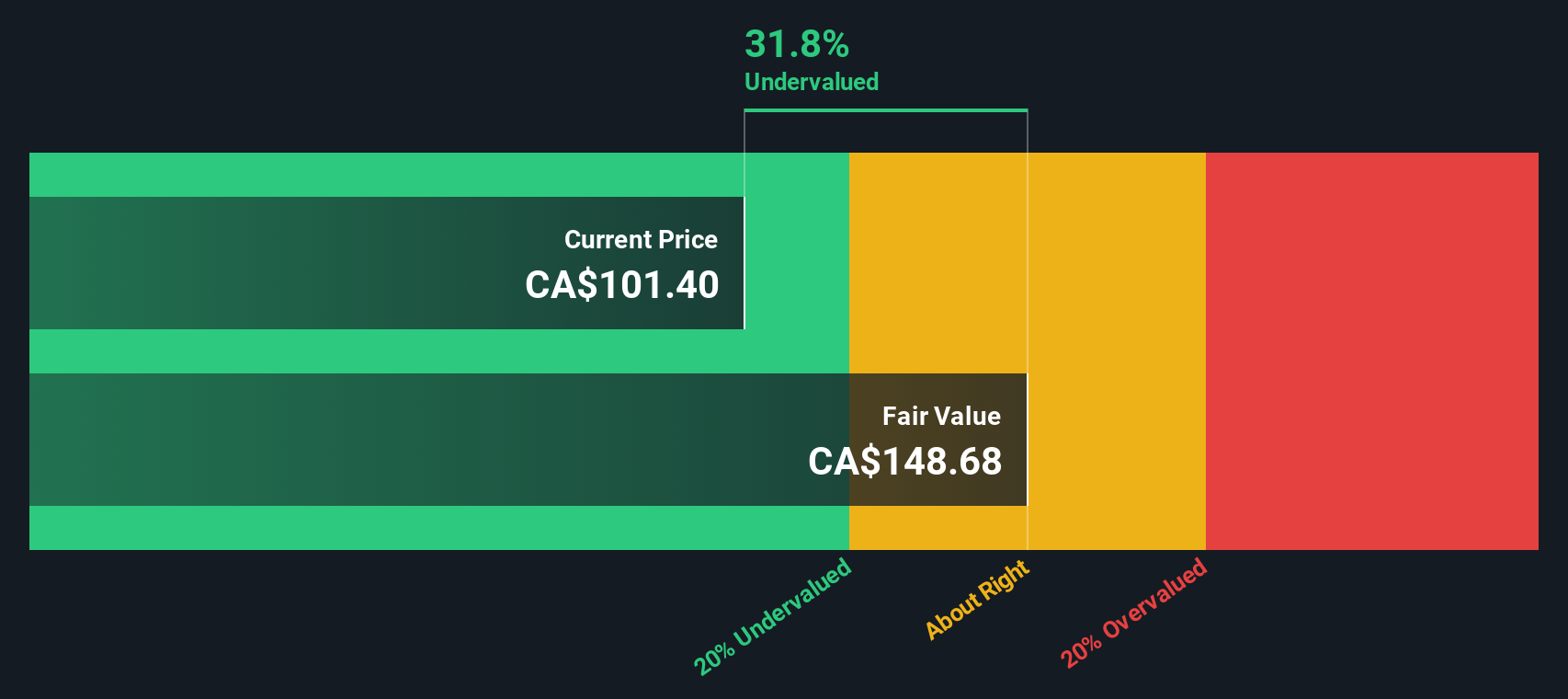

Another View: SWS DCF Model Sees Deeper Value

While market watchers peg Toronto-Dominion Bank’s fair value close to its current share price, our DCF model tells a more optimistic story. This method values TD at CA$152.02, which is well above where it is trading now. Could the market be overlooking hidden long-term potential, or is the DCF model too optimistic in an uncertain landscape?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Toronto-Dominion Bank Narrative

If you think the analysis misses a key angle or want to dig into the numbers on your own terms, you can shape your own Toronto-Dominion Bank narrative in just a few minutes. Do it your way.

A great starting point for your Toronto-Dominion Bank research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let promising opportunities slip by. With a few clicks, you can zero in on stocks making waves in the market and tailor your watchlist to your interests.

- Tap into strong dividend yields above 3% by checking out these 17 dividend stocks with yields > 3%, which offers steady income potential during uncertain times.

- Seize the chance to spot undervalued companies with healthy cash flows by browsing these 875 undervalued stocks based on cash flows, designed for investors seeking bargain buys.

- Explore the momentum shaping healthcare’s future as you assess innovative companies with advanced technology through these 33 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toronto-Dominion Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TD

Toronto-Dominion Bank

Provides various financial products and services in Canada, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives