Should Recent Fixed-Income Issuances Require Action From TD Bank (TSX:TD) Investors?

Reviewed by Simply Wall St

- In recent days, Toronto-Dominion Bank completed and announced several fixed-income offerings, including the issuance of callable Eurobonds and Eurodollar bonds with varying maturities, coupon rates, and principal amounts, as well as a private placement of AU$30 million in subordinated notes expected to qualify as Tier 2 capital.

- This series of debt financings highlights the bank’s efforts to optimize its capital structure and funding strategy in support of general corporate needs and regulatory requirements.

- We will examine how Toronto-Dominion Bank’s expanded fixed-income activity may influence its outlook and investment narrative, particularly regarding capital management.

Toronto-Dominion Bank Investment Narrative Recap

To be a Toronto-Dominion Bank shareholder, you need to believe in its ability to balance capital strength, steady dividend payments, and disciplined risk management, especially as it navigates regulatory and restructuring efforts. The recent wave of fixed-income offerings adds to TD’s already robust funding profile but does not materially alter the near-term focus, which remains on successfully executing its U.S. AML remediation program, still the most important catalyst, and also the biggest risk, for the stock at present.

Among the announcements, the appointment of Andrew Jensen to manage financial crime risk is the most relevant, given the regulatory pressures TD faces. Strengthening leadership in this area supports confidence in the bank’s ongoing AML improvements, which directly tie back to both near-term catalysts and risks for investors.

Yet, while positive changes are underway, investors should also be mindful that even with these enhancements, the cost and complexity of AML compliance can still...

Read the full narrative on Toronto-Dominion Bank (it's free!)

Toronto-Dominion Bank is projected to reach CA$61.2 billion in revenue and CA$14.2 billion in earnings by 2028. This outlook assumes a 4.7% annual revenue growth rate and an earnings increase of about CA$5.9 billion from the current CA$8.3 billion.

Exploring Other Perspectives

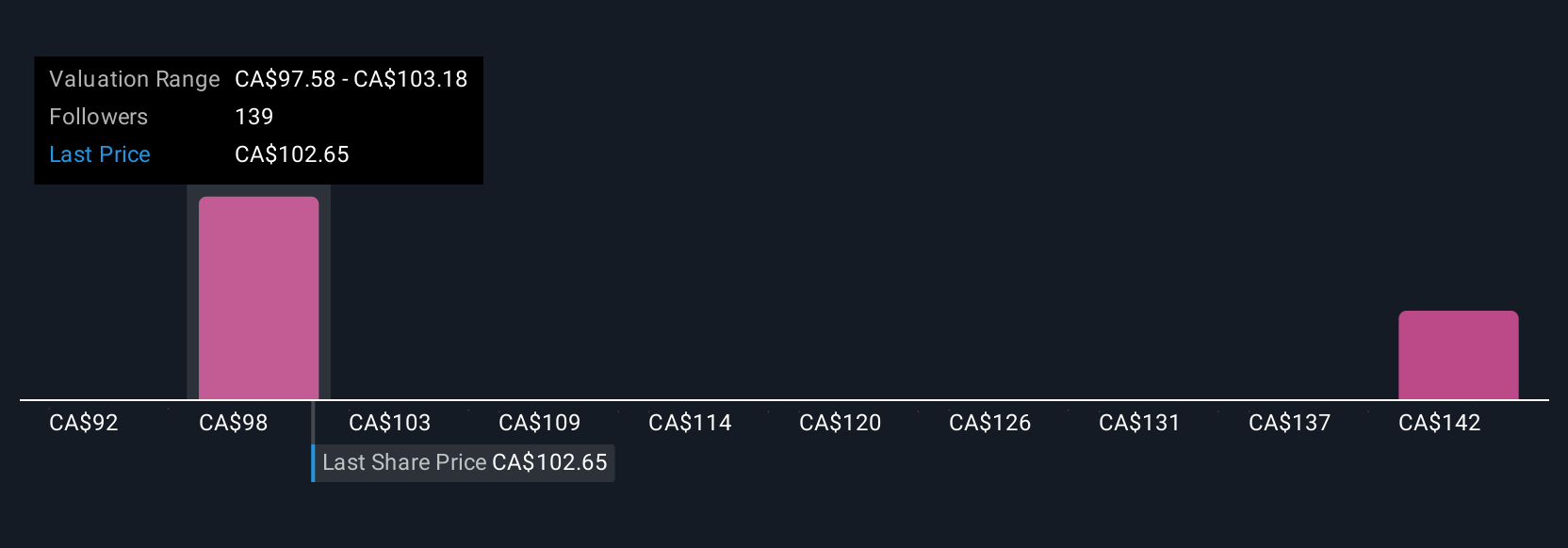

Six fair value estimates from the Simply Wall St Community range sharply from CA$91.97 to CA$148.18 per share. While many see upside, the pressing issue of AML remediation expenses could weigh on returns, making it crucial to assess several alternative viewpoints before deciding.

Build Your Own Toronto-Dominion Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Toronto-Dominion Bank research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Toronto-Dominion Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Toronto-Dominion Bank's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toronto-Dominion Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TD

Toronto-Dominion Bank

Provides various financial products and services in Canada, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives