A Look at TD Bank’s (TSX:TD) Valuation After Recent Fixed-Income Offerings and Funding Moves

Reviewed by Simply Wall St

Toronto-Dominion Bank (TSX:TD) has been making headlines with a series of new fixed-income offerings, both announced and completed in recent weeks. For investors on the fence about what to do next, these moves shed light on the bank’s funding plans and its approach to managing capital in a shifting market environment. By issuing senior and junior unsecured notes with various maturities, TD appears focused on fine-tuning its balance sheet while locking in today’s rates.

This recent financing push follows a period of steady stock price momentum. Over the past year, TD has delivered a return of 35%, with its share price climbing more than 9% in the past 3 months alone. Even as executive appointments make headlines, market attention has largely centered on TD's ability to raise funds on favorable terms. That momentum has kept investor expectations positive for now.

After such a run, the real question is whether TD’s current valuation still leaves room for upside, or if the market has already accounted for its growth strategy in the share price.

Most Popular Narrative: Fairly Valued

According to community narrative, Toronto-Dominion Bank is considered fairly valued by market analysts when weighing its future earnings trajectory, growth projections, and risk factors. Analysts see only a small gap between the current share price and the average price target, signaling a consensus that the stock is priced accurately.

The analysts have a consensus price target of CA$102.267 for Toronto-Dominion Bank based on their expectations of its future earnings growth, profit margins, and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$117.0, and the most bearish reporting a price target of just CA$93.0.

Craving the hidden logic behind that “just right” price? This community narrative considers not just current results but also bold projections about future profits, revenue trends, and profit margins that may surprise you. The central question is what assumptions are baked into the analyst consensus and what secret number underpins their fair value call. Discover how these estimates shape the narrative and what could make them unravel.

Result: Fair Value of $102.27 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, regulatory costs or delays in U.S. compliance efforts could quickly dampen forecasts and change analysts' view on TD’s fair value.

Find out about the key risks to this Toronto-Dominion Bank narrative.Another View: The SWS DCF Model

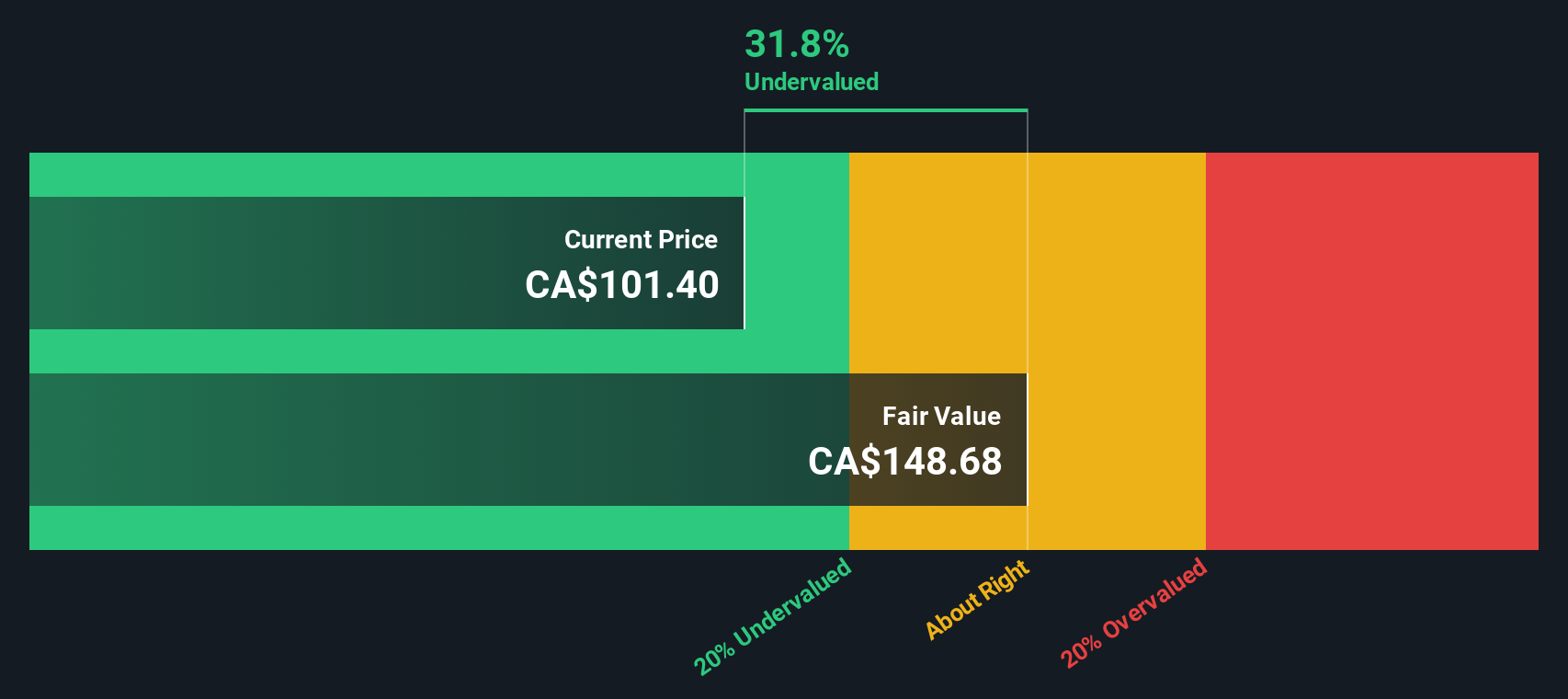

Looking at Toronto-Dominion Bank from another perspective, the SWS DCF model suggests the stock is undervalued. This longer-term approach challenges the earlier “about right” call and raises the question: could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Toronto-Dominion Bank Narrative

If you have a different perspective or want to dig into the numbers on your own, you can craft your personal take in just a few minutes. So why not do it your way?

A great starting point for your Toronto-Dominion Bank research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Expand your portfolio with confidence and seize timely opportunities that other investors might miss. The Simply Wall Street Screener opens the door to new strategies and sectors that could fit your goals perfectly. Here are three powerful places to start:

- Tap into game-changing medical breakthroughs by checking out healthcare AI stocks, where healthcare meets cutting-edge artificial intelligence.

- Boost your income potential and seek reliable payouts with dividend stocks with yields > 3%. This screener features companies known for consistently high dividend yields above 3%.

- Catch the next wave of digital finance by exploring opportunities with cryptocurrency and blockchain stocks. This section focuses on companies making strides in cryptocurrency and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toronto-Dominion Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TD

Toronto-Dominion Bank

Provides various financial products and services in Canada, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives