A Fresh Look at TD Bank (TSX:TD) Valuation Following Major Leadership Changes

Reviewed by Simply Wall St

If you're holding or watching Toronto-Dominion Bank (TSX:TD), the news feed has been anything but quiet. In a flurry of high-profile leadership changes, TD has welcomed Taylan Turan as Chief Operating Officer and Simon Fish as General Counsel. Marc Womack has also stepped into a pivotal U.S. leadership seat. These moves represent more than executive shuffling, as they reflect a deliberate plan to build out TD’s talent and reinforce its ability to deliver growth, efficiency, and sharper execution in an intensely competitive banking landscape.

Markets have already started to take notice. Over the past month, TD shares gained more than 4%, and the last quarter has seen returns edge close to double digits. Looking at the bigger picture, the year so far has produced a steady climb, suggesting that confidence might be building after a prolonged period of transformation. This all comes amid broader initiatives, such as a $750 million debt offering and multiple leadership transitions, that hint at a bank trying to shift gears and better position for the next phase of industry change.

With so much momentum and renewed leadership signaling TD’s commitment to operational excellence, is there more value to unlock here, or are investors already pricing in future gains?

Most Popular Narrative: Fairly Valued

According to the most widely followed narrative, TD Bank is currently seen as fairly valued, with the consensus analyst price target almost matching the current share price and future earnings projections broadly supporting this view.

Persistent investment in compliance (notably elevated AML remediation, cyber, and fraud prevention costs) is expected to drive higher structural expenses, weighing on net margins and overall earnings growth well into 2026 and 2027 as regulatory scrutiny and associated operational costs remain elevated.

Curious what's behind this razor-thin margin between analyst targets and today's price? Dive into the full narrative and see which projections for future revenue, shrinking profit margins, and dramatic shifts in operating costs are moving the needle. There's one assumption about profit multiples that's especially bold. Find out which bet on the future is keeping the spotlight on TD's valuation.

Result: Fair Value of $106 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, sustained growth in TD’s core banking and digital segments, along with capital strength, could surprise investors and lead to a more positive outlook.

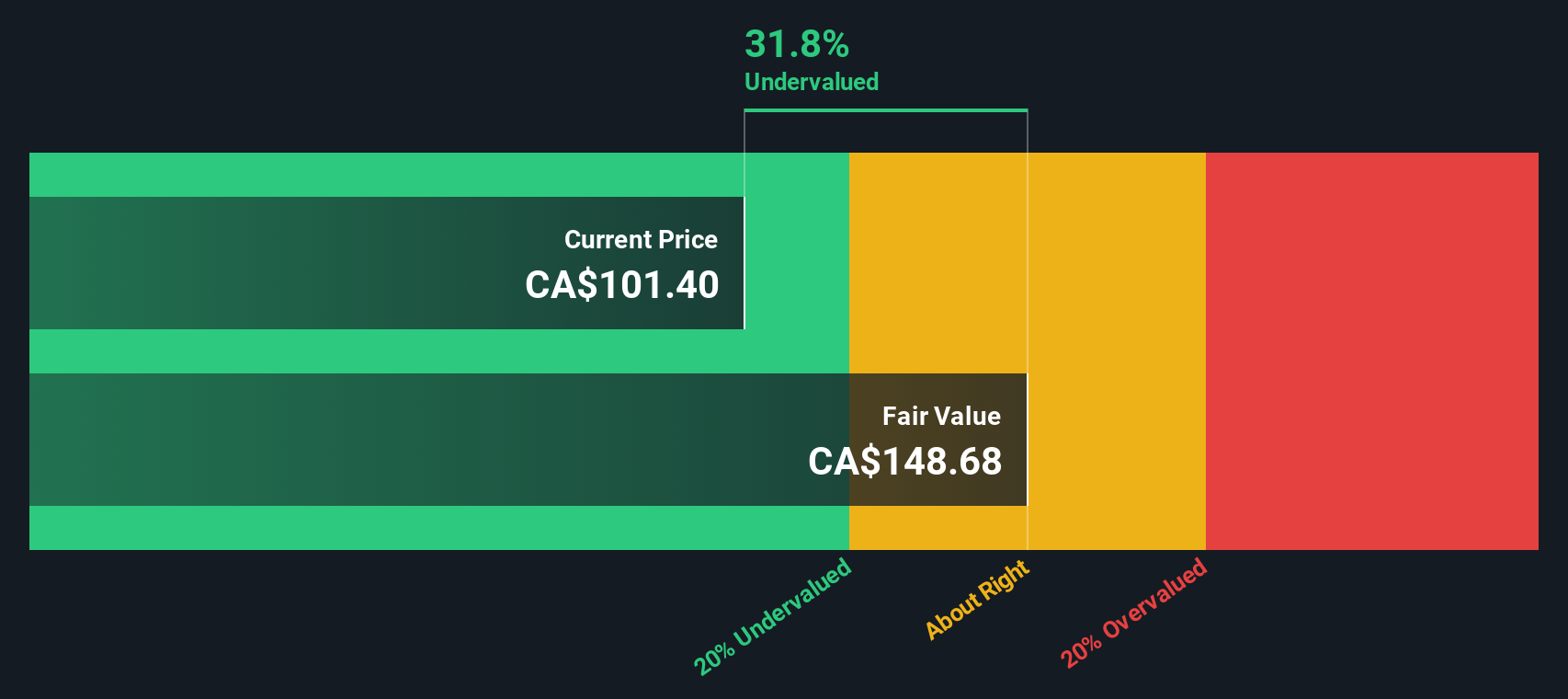

Find out about the key risks to this Toronto-Dominion Bank narrative.Another View: DCF Model Suggests There’s More Upside

While analysts see Toronto-Dominion Bank as fairly valued based on current market trends and future earnings projections, our DCF model yields a much more optimistic result. This indicates the potential for significant undervaluation. Does this alternate approach reveal hidden value that the market consensus is missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Toronto-Dominion Bank Narrative

If you see things differently, or want to dig into the numbers yourself, you can put together your own view quickly and easily by using Do it your way.

A great starting point for your Toronto-Dominion Bank research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more actionable investment ideas?

Smart investors don’t wait on the sidelines. Use Simply Wall Street’s powerful screeners to find hidden gems and breakthrough opportunities you might have missed elsewhere.

- Spot undervalued businesses ready for a turnaround by tapping into undervalued stocks based on cash flows and seize value that others may be overlooking.

- Uncover tomorrow’s tech leaders at the intersection of healthcare and artificial intelligence with healthcare AI stocks. Get ahead of the next innovation wave by staying informed and prepared.

- Accelerate your income strategy by targeting growth-focused companies offering strong yields through dividend stocks with yields > 3%. This can help to supercharge your portfolio’s cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toronto-Dominion Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TD

Toronto-Dominion Bank

Provides various financial products and services in Canada, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives