- Canada

- /

- Capital Markets

- /

- TSX:IGM

Top TSX Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As the Canadian market navigates the complexities of new tariffs and shifting economic policies, investors are keenly observing how these factors might influence their portfolios. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for those looking to bolster their investments amidst uncertainty.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Sun Life Financial (TSX:SLF) | 4.09% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 3.84% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.41% | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | 7.44% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.59% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.35% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.26% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.92% | ★★★★★☆ |

| Atrium Mortgage Investment (TSX:AI) | 9.41% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.47% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top TSX Dividend Stocks screener.

We'll examine a selection from our screener results.

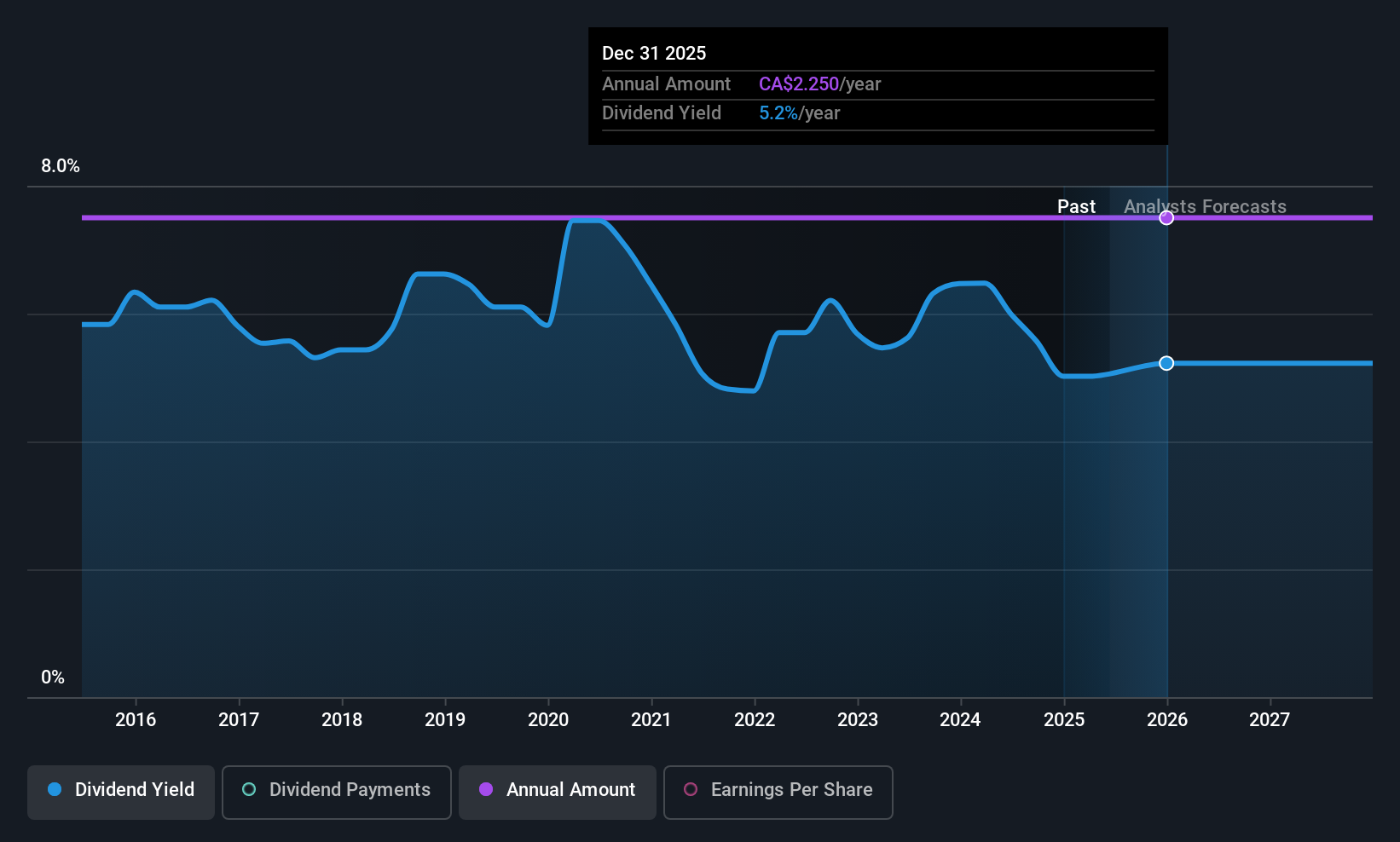

IGM Financial (TSX:IGM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IGM Financial Inc. operates in the asset management business in Canada with a market cap of approximately CA$10.01 billion.

Operations: IGM Financial Inc.'s revenue is primarily derived from its Wealth Management segment, generating CA$2.50 billion, and its Asset Management segment, contributing CA$1.28 billion.

Dividend Yield: 5.3%

IGM Financial's dividend payments are well-supported by both earnings and cash flows, with a payout ratio of 56.5% and a cash payout ratio of 54.8%. The company has consistently increased its dividends over the past decade, maintaining stability with minimal volatility. Although its current dividend yield of 5.26% is below the top quartile in Canada, IGM trades at a good value relative to peers and recently declared a CAD 0.5625 per share dividend payable on July 31, 2025.

- Delve into the full analysis dividend report here for a deeper understanding of IGM Financial.

- Upon reviewing our latest valuation report, IGM Financial's share price might be too pessimistic.

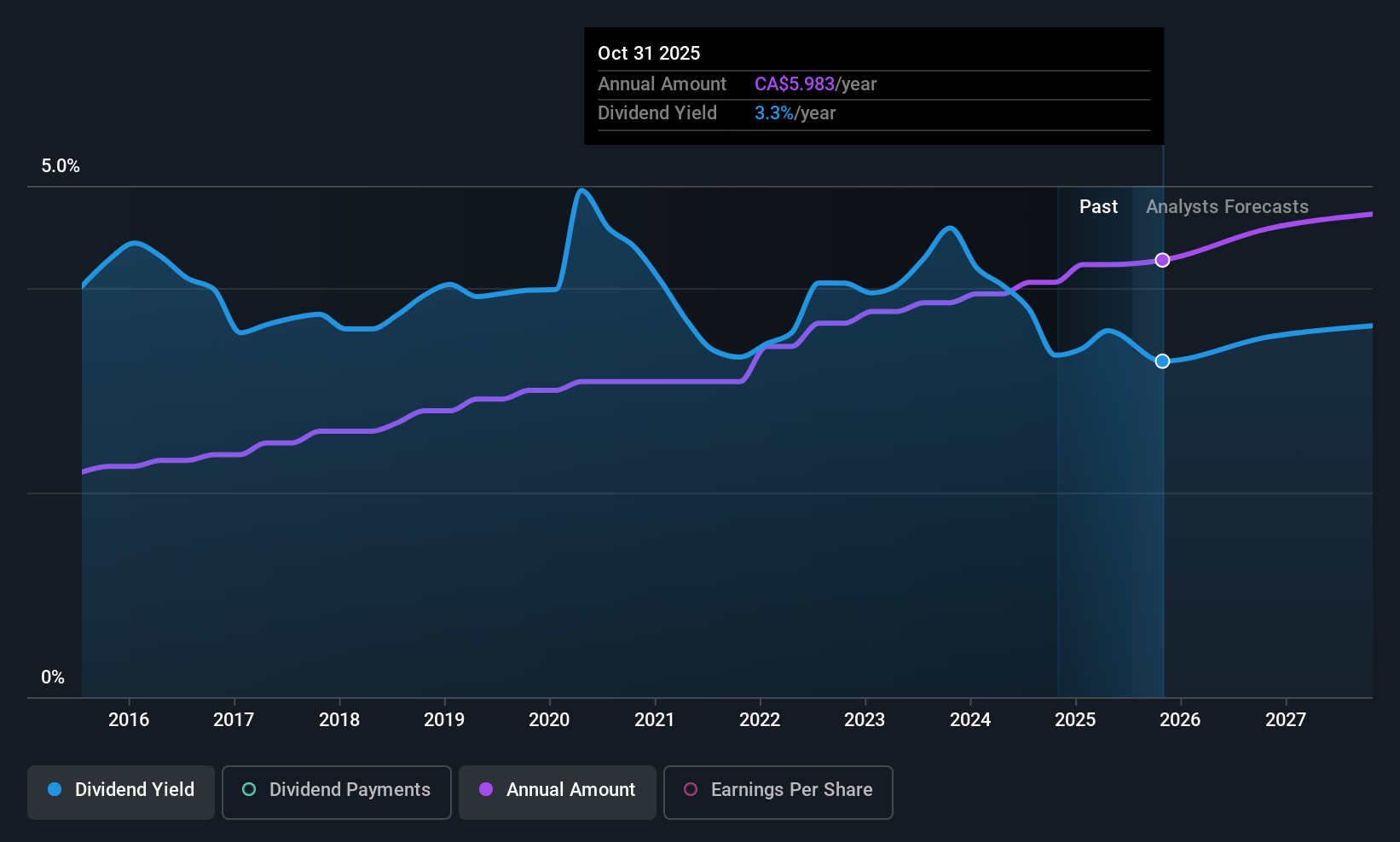

Royal Bank of Canada (TSX:RY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Royal Bank of Canada operates as a diversified financial services company worldwide, with a market cap of approximately CA$254.43 billion.

Operations: Royal Bank of Canada's revenue segments include Insurance at CA$1.31 billion, Capital Markets at CA$12.56 billion, Personal Banking at CA$16.75 billion, Wealth Management at CA$20.96 billion, and Commercial Banking at CA$6.91 billion.

Dividend Yield: 3.4%

Royal Bank of Canada's dividends are well-covered by earnings, with a current payout ratio of 46.1% and forecasted to improve to 42.7% in three years. Despite a lower dividend yield of 3.41% compared to top Canadian payers, RBC has consistently increased its dividends over the past decade with stable payouts. Recent financial activities include significant fixed-income offerings and insider selling, potentially impacting capital management strategies and shareholder value considerations.

- Click to explore a detailed breakdown of our findings in Royal Bank of Canada's dividend report.

- The analysis detailed in our Royal Bank of Canada valuation report hints at an inflated share price compared to its estimated value.

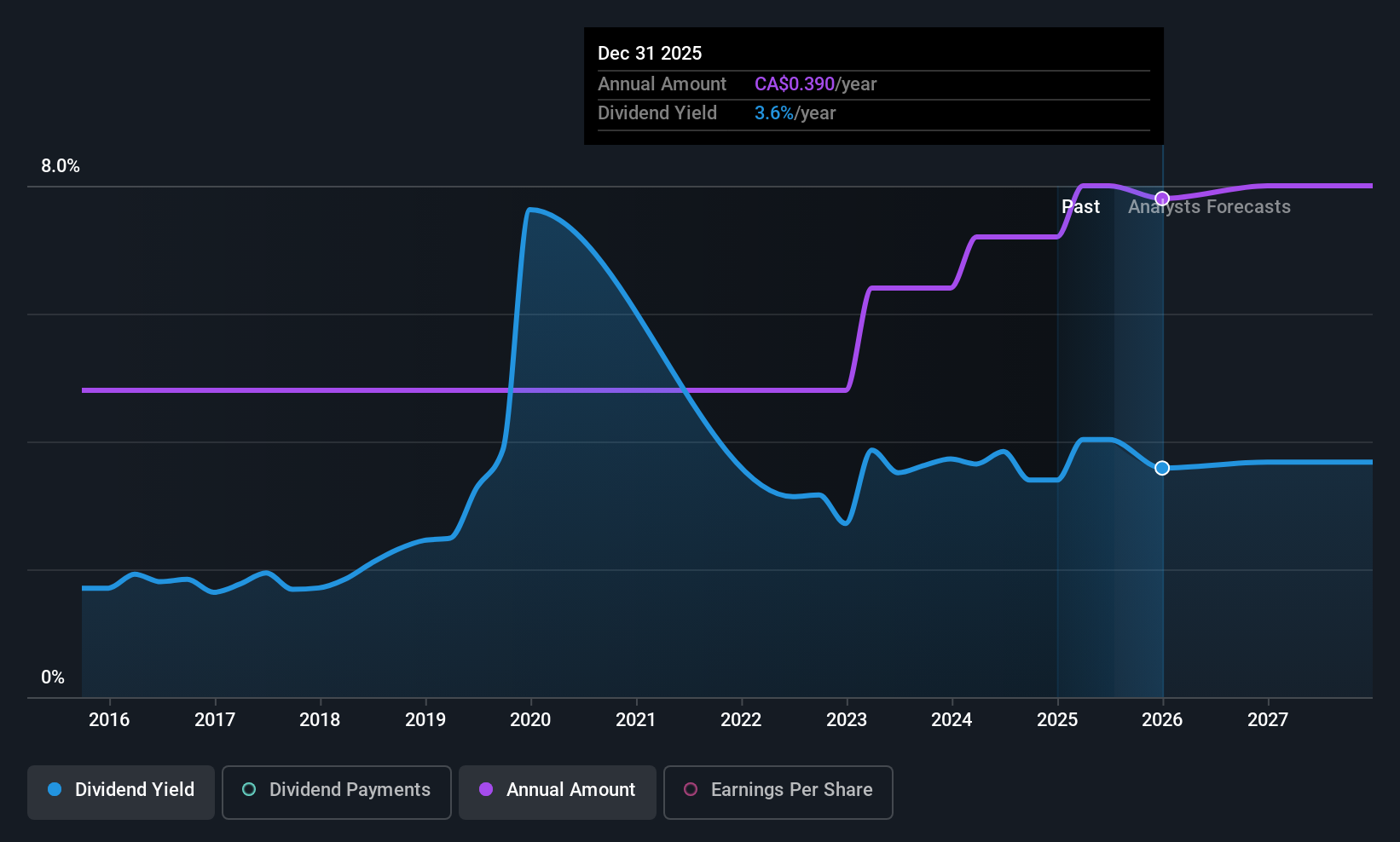

Total Energy Services (TSX:TOT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Total Energy Services Inc. is an energy services company operating in Canada, the United States, Australia, and internationally with a market cap of CA$399.61 million.

Operations: Total Energy Services Inc. generates revenue through its segments of Well Servicing (CA$102.65 million), Contract Drilling Services (CA$329.49 million), Compression and Process Services (CA$442.63 million), and Rentals and Transportation Services (CA$79.23 million).

Dividend Yield: 3.7%

Total Energy Services' dividends are well-supported by earnings and cash flows, with low payout ratios of 22.2% and 16.6% respectively. Despite a history of volatility, dividends have grown over the past decade. The company trades significantly below its estimated fair value but offers a modest dividend yield of 3.66%, lower than top Canadian payers. Recent financials show increased earnings, supporting dividend sustainability, while recent board changes may influence future strategic direction.

- Click here and access our complete dividend analysis report to understand the dynamics of Total Energy Services.

- The valuation report we've compiled suggests that Total Energy Services' current price could be quite moderate.

Turning Ideas Into Actions

- Explore the 28 names from our Top TSX Dividend Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IGM

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives