Royal Bank of Canada (TSX:RY): Evaluating Valuation as Healthcare Tech Initiatives Gain Spotlight

Reviewed by Simply Wall St

A new study released by Dr.Bill, a medical billing tool developed with support from Royal Bank of Canada (TSX:RY), sheds light on how administrative tasks are impacting Canadian doctors. This development is drawing attention to RBC’s role in healthcare.

See our latest analysis for Royal Bank of Canada.

The study also comes as Royal Bank of Canada continues to make headlines with a series of fixed-income offerings and high-profile conference appearances. These moves demonstrate its dynamic presence both in finance and, increasingly, in healthcare innovation. While recent share price fluctuations have been minor, the bank’s momentum over the last quarter is hard to miss, capped by a 13.99% 90-day share price return and an impressive 22.58% total shareholder return over the past year. Long-term shareholders have seen outstanding gains, with a 169.6% total return over five years, underscoring both resilience and growth potential.

If the bank’s broadening reach has you curious, now’s a great time to discover fast growing stocks with high insider ownership.

Yet with Royal Bank of Canada’s strong recent returns, high-profile initiatives, and only a modest 2.8% discount to analyst price targets, investors may be wondering if there is real value left or if the stock already reflects future growth.

Most Popular Narrative: 2.7% Undervalued

With Royal Bank of Canada last closing at CA$205.27 and the most-followed narrative placing fair value at CA$211.07, the market price remains just below consensus expectations. Investors are closely watching the drivers behind this valuation to see whether optimism is warranted.

Strategic investments in AI and digitalization, such as the ATOM Foundation and Lumina platform, expanded use of data analytics, and digital banking product launches, are driving cost efficiencies, deeper customer engagement, and higher transaction volumes, which should support future revenue and net margin growth.

Want to unlock the formula behind this premium valuation? The story hinges on forward-looking growth bets and higher profitability expectations. Find out which bold forecast is responsible for this subtle but notable edge on today’s price. One misleading assumption could change everything.

Result: Fair Value of $211.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic pressures and rising credit losses could quickly shift the outlook. This may make recent optimism more difficult to sustain.

Find out about the key risks to this Royal Bank of Canada narrative.

Another View: What Do Market Ratios Say?

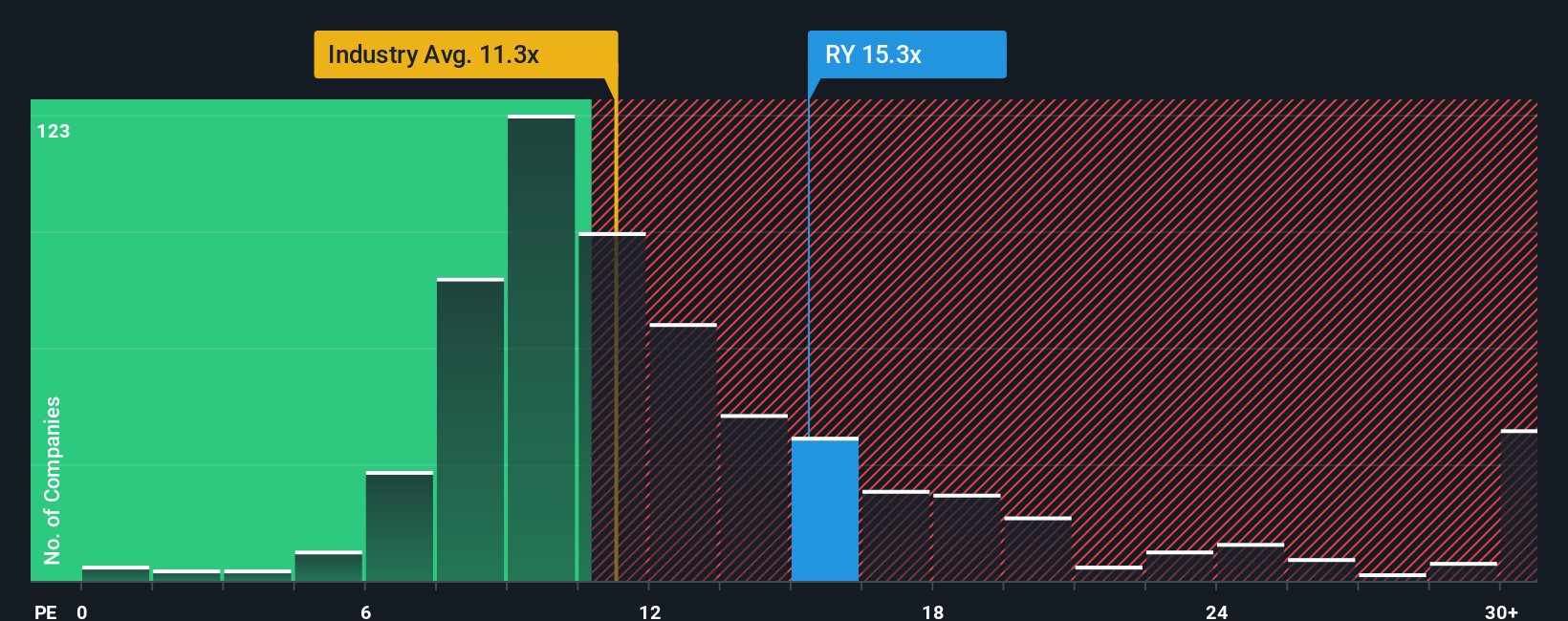

While some see Royal Bank of Canada as attractively priced, market ratios tell a more cautious story. Its price-to-earnings ratio is 15.4x, which is higher than both the North American Banks industry average of 11.3x and the peer average of 13.7x, and also above its own fair ratio of 14.1x. That premium suggests investors may be paying up for perceived stability or future growth, but what happens if those expectations fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Royal Bank of Canada Narrative

If you want to see the finer details for yourself or have your own perspective, it takes less than three minutes to create your personalized view and analysis. Why not Do it your way?

A great starting point for your Royal Bank of Canada research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself an edge by jumping on the smartest trends. Don’t let the next big opportunity slip through your fingers. The Simply Wall Street Screener puts it all at your fingertips.

- Supercharge your passive income plans and scan these 17 dividend stocks with yields > 3% offering reliable yields above 3% across resilient sectors.

- Stay ahead of the curve by sizing up these 27 quantum computing stocks that are poised to transform computing, cryptography, and more.

- Uncover bargains in the market by targeting these 871 undervalued stocks based on cash flows priced below their intrinsic value, ready for your smart, timely moves.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RY

Royal Bank of Canada

Operates as a diversified financial service company worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives