If You Like EPS Growth Then Check Out National Bank of Canada (TSE:NA) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like National Bank of Canada (TSE:NA). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for National Bank of Canada

National Bank of Canada's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. Over the last three years, National Bank of Canada has grown EPS by 15% per year. That's a pretty good rate, if the company can sustain it.

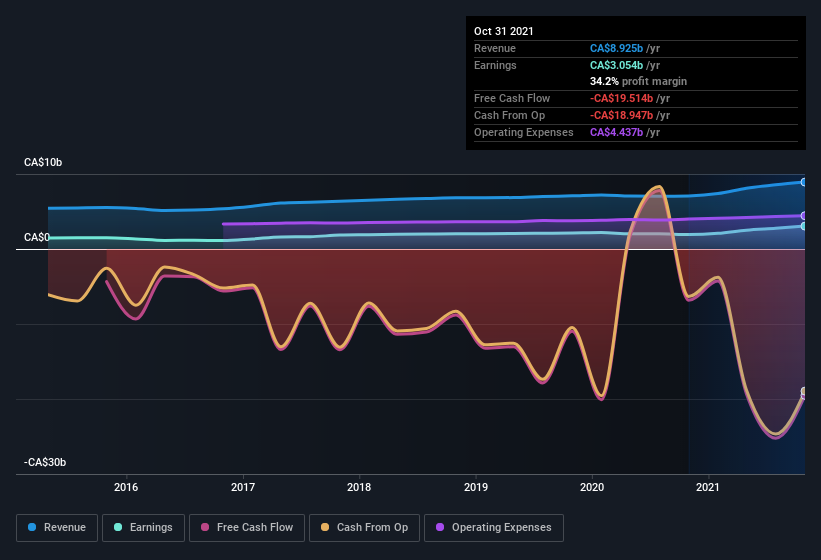

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that National Bank of Canada's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note National Bank of Canada's EBIT margins were flat over the last year, revenue grew by a solid 26% to CA$8.9b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for National Bank of Canada's future profits.

Are National Bank of Canada Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We do note that, in the last year, insiders sold -CA$384k worth of shares. But that's far less than the CA$2.5m insiders spend purchasing stock. This makes me even more interested in National Bank of Canada because it suggests that those who understand the company best, are optimistic. Zooming in, we can see that the biggest insider purchase was by President Laurent Ferreira for CA$1.4m worth of shares, at about CA$96.74 per share.

The good news, alongside the insider buying, for National Bank of Canada bulls is that insiders (collectively) have a meaningful investment in the stock. Given insiders own a small fortune of shares, currently valued at CA$67m, they have plenty of motivation to push the business to succeed. That's certainly enough to make me think that management will be very focussed on long term growth.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Laurent Ferreira, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like National Bank of Canada, with market caps over CA$10b, is about CA$7.5m.

National Bank of Canada offered total compensation worth CA$5.9m to its CEO in the year to . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add National Bank of Canada To Your Watchlist?

As I already mentioned, National Bank of Canada is a growing business, which is what I like to see. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Now, you could try to make up your mind on National Bank of Canada by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of National Bank of Canada, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if National Bank of Canada might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:NA

National Bank of Canada

Provides financial services to individuals, businesses, institutional clients, and governments in Canada and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives