Laurentian Bank of Canada (TSE:LB) has announced that it will pay a dividend of CA$0.47 per share on the 1st of February. The dividend yield will be 6.2% based on this payment which is still above the industry average.

View our latest analysis for Laurentian Bank of Canada

Laurentian Bank of Canada's Earnings Will Easily Cover The Distributions

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable.

Laurentian Bank of Canada has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. But while this history shows that the company was able to sustain its dividend for a decent period of time, its most recent earnings report shows that the company did not make enough earnings to cover its dividend payout. This is an alarming sign for the sustainability of its dividends, as it may mean that Laurentian Bank of Canadais pulling cash from elsewhere to keep its shareholders happy.

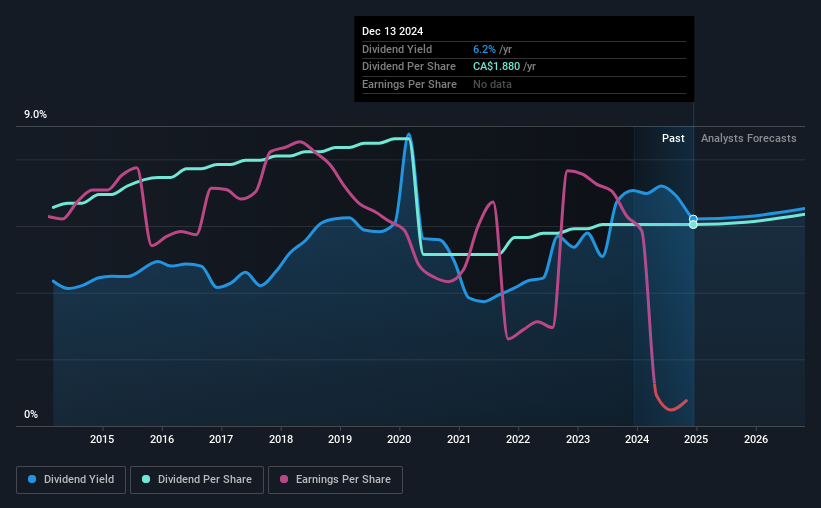

Looking forward, earnings per share is forecast by analysts to rise exponentially over the next 3 years. They also estimate that the future payout ratio will be 51% in the same time horizon, so there isn't too much pressure on the dividend.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The dividend has gone from an annual total of CA$2.04 in 2014 to the most recent total annual payment of CA$1.88. The dividend has shrunk at a rate of less than 1% a year over this period. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Limited Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Earnings per share has been sinking by 12% over the last five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

We're Not Big Fans Of Laurentian Bank of Canada's Dividend

In summary, while it is good to see that the dividend hasn't been cut, we think that at current levels the payment isn't particularly sustainable. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. We don't think that this is a great candidate to be an income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 1 warning sign for Laurentian Bank of Canada that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:LB

Laurentian Bank of Canada

Provides various financial services to personal, commercial, and institutional customers in Canada and the United States.

Mediocre balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026