If you're on the fence about buying, holding, or selling Laurentian Bank of Canada stock, you're definitely not alone. As investors see fresh gains or unexpected dips, the decision about what to do next can feel both exciting and daunting. Over the past year, Laurentian Bank’s shares have surged 30.9%, and they’re up a strong 58.6% over five years. Even just in 2024, the stock has climbed 13.3% year-to-date. But growth hasn’t been completely linear. The last week saw a drop of 1.0%, while the past month recorded a more hopeful 3.5% boost. Some of these movements are just part of the regular market rhythm, with little direct link to the more dramatic stories making headlines around other financial institutions.

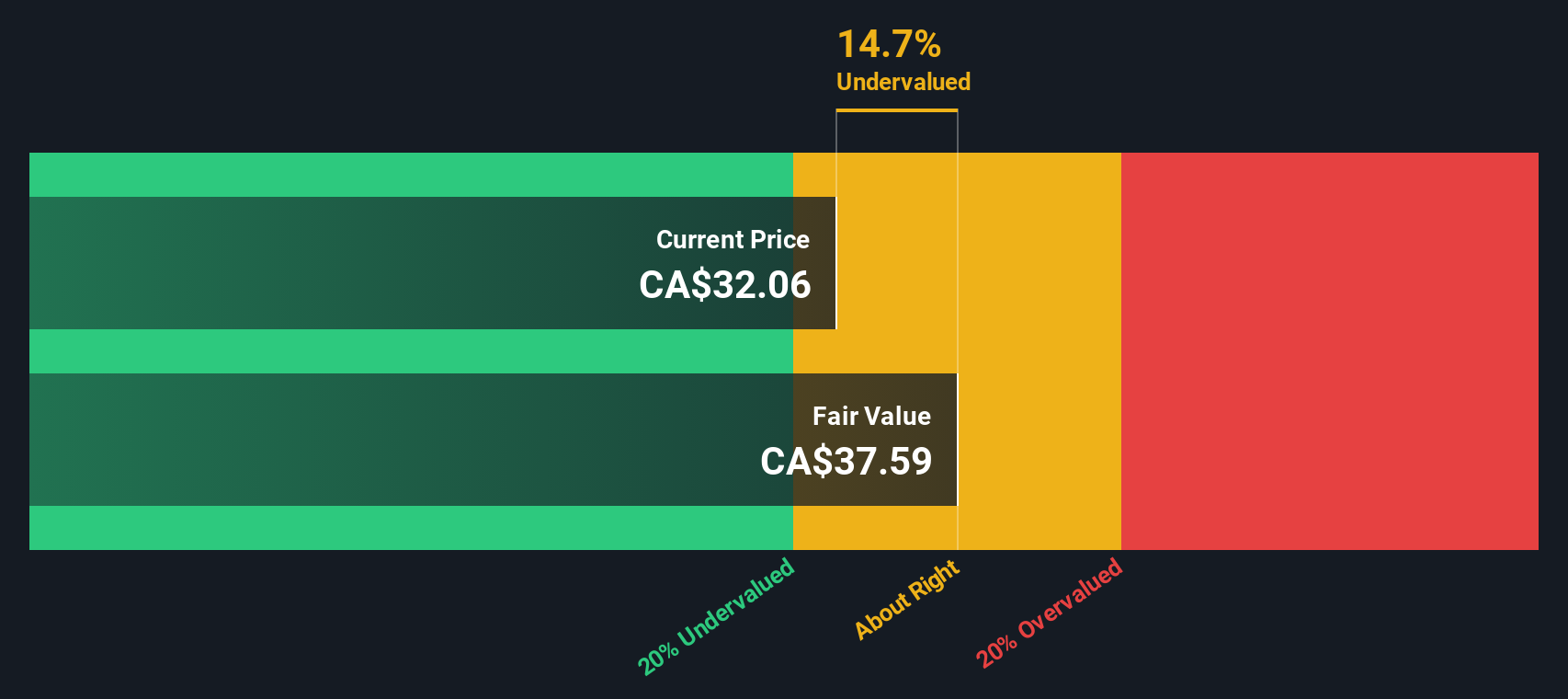

So, is Laurentian Bank's share price still playing catch-up to its true worth, or is there a solid value hiding beneath the surface? According to our multi-check valuation approach, which looks at six key metrics to gauge if a stock is undervalued, Laurentian Bank scores a 3. That means the company appears undervalued in half of our standardized criteria. This is a signal that could make value-focused investors sit up and pay attention.

Next, let’s dive into the individual valuation checks we use and see how Laurentian Bank fares on each. And just when you think you’ve got the full picture, stay tuned for an even better way to think about valuation that reveals what traditional metrics can sometimes miss.

Why Laurentian Bank of Canada is lagging behind its peers

Approach 1: Laurentian Bank of Canada Excess Returns Analysis

The Excess Returns approach measures whether the company is generating returns above its cost of equity, which can signal real value creation for shareholders. It does this by tracking the profit that Laurentian Bank produces in excess of what investors require as a minimum return, while also considering growth prospects for the business.

According to the latest estimates, Laurentian Bank of Canada has a Book Value of CA$58.90 per share and a Stable Earnings Per Share (EPS) of CA$3.32, based on weighted future Return on Equity projections from seven analysts. The bank’s average Return on Equity is 5.52%, while its Cost of Equity is CA$4.36 per share. This results in an Excess Return of CA$-1.05 per share. Over time, the Stable Book Value is forecast to rise slightly to CA$60.03 per share, based on projections from six analysts.

Based on this model, the intrinsic value per share is estimated at CA$37.57. With the current market price trading at a 12.9% discount to this value, Laurentian Bank appears to be undervalued according to the Excess Returns model.

Result: UNDERVALUED

Our Excess Returns analysis suggests Laurentian Bank of Canada is undervalued by 12.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

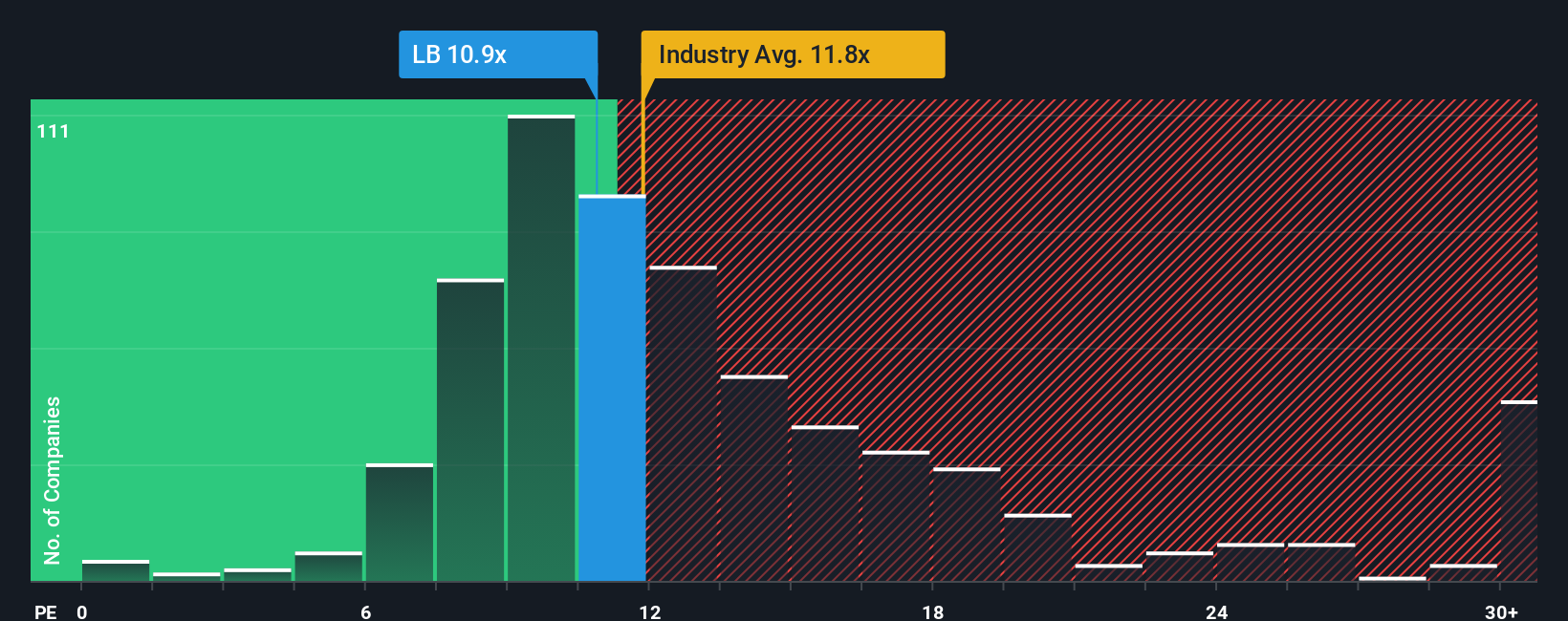

Approach 2: Laurentian Bank of Canada Price vs Earnings

The price-to-earnings (PE) ratio is one of the most popular benchmarks for valuing profitable companies like Laurentian Bank of Canada because it compares the company’s current share price to its earnings per share. For banks and other established businesses that consistently generate profits, the PE ratio provides a straightforward measure of how much investors are willing to pay for each dollar of earnings.

What counts as a “normal” or “fair” PE ratio often depends on how quickly the company is expected to grow and the risks involved. High-growth, low-risk companies tend to command higher PE multiples, while those facing slow growth or greater uncertainties might trade at lower ratios.

Currently, Laurentian Bank trades at a PE ratio of 10.8x. This stands slightly above the industry average of 10.4x, while remaining below the peer group average of 15.5x. Beyond simple comparisons, we also look at the proprietary Fair Ratio, calculated by Simply Wall St, which factors in company-specific details like earnings growth, industry context, profit margin, market cap, and individual risks. For Laurentian Bank, the Fair Ratio is 10.8x, almost exactly matching the current PE ratio. This tailored approach is more insightful than a broad industry or peer comparison because it reflects the bank’s unique outlook and risk profile.

Given that Laurentian Bank’s actual PE and its Fair Ratio are essentially in sync, this suggests the stock is valued appropriately at current levels.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Laurentian Bank of Canada Narrative

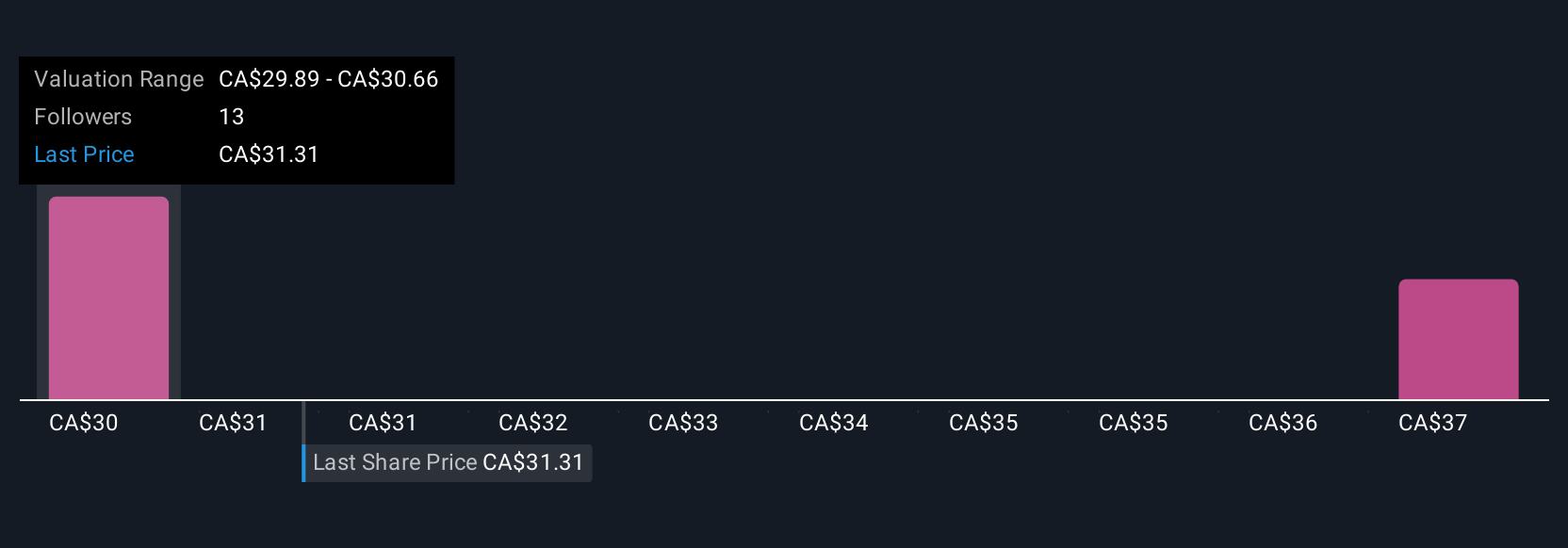

Earlier we mentioned that there’s an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is the story you tell about a company. It connects your perspective on the business, future prospects, and risks directly to specific forecasts for things like revenue, earnings, and profit margins. By forming a Narrative, you link what you believe about a company’s journey to a financial forecast, and then to a fair value, all in one place.

Narratives make investment decisions more powerful and adaptive because, unlike static metrics, they evolve as new information comes in. Whether it’s an earnings announcement or a major news development, Narratives can be updated. On Simply Wall St’s platform, millions of investors use the easy Community page to build and compare Narratives, helping them see how Fair Value stacks up against the current Price and spot opportunities to buy or sell right as the facts change.

For Laurentian Bank of Canada, for instance, some investors see strong technology modernization and specialized lending as reasons for a bullish Narrative with a CA$35.00 fair value, while others focus on continued expense pressure and rising credit risk, setting a cautious Narrative with fair value as low as CA$25.00.

Do you think there's more to the story for Laurentian Bank of Canada? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LB

Laurentian Bank of Canada

Provides various financial services to personal, business, and institutional customers in Canada and the United States.

Adequate balance sheet and fair value.

Market Insights

Community Narratives