- Canada

- /

- Diversified Financial

- /

- TSX:HCG

Here's Why We Think Home Capital Group (TSE:HCG) Might Deserve Your Attention Today

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Home Capital Group (TSE:HCG). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Home Capital Group

How Quickly Is Home Capital Group Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Home Capital Group's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 48%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors. It's also worth noting that the EPS growth has been assisted by share buybacks, indicating the company is in a position to return capital to shareholders.

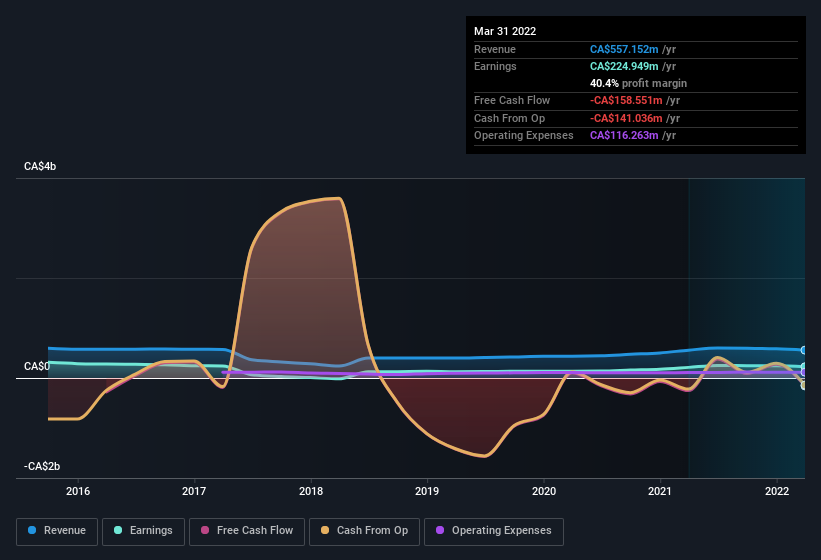

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that Home Capital Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. It seems Home Capital Group is pretty stable, since revenue and EBIT margins are pretty flat year on year. That's not bad, but it doesn't point to ongoing future growth, either.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Home Capital Group's future EPS 100% free.

Are Home Capital Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Despite CA$32k worth of sales, Home Capital Group insiders have overwhelmingly been buying the stock, spending CA$588k on purchases in the last twelve months. You could argue that level of buying implies genuine confidence in the business. It is also worth noting that it was company insider Edward Waitzer who made the biggest single purchase, worth CA$288k, paying CA$28.75 per share.

Is Home Capital Group Worth Keeping An Eye On?

Home Capital Group's earnings have taken off in quite an impressive fashion. Growth-minded people will be intrigued by the incredible movement in EPS growth. And may very well signal a significant inflection point for the business. If this is the case, then keeping a watch over Home Capital Group could be in your best interest. You should always think about risks though. Case in point, we've spotted 1 warning sign for Home Capital Group you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Home Capital Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Home Capital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:HCG

Home Capital Group

Home Capital Group Inc., through its subsidiary, Home Trust Company, provides residential and non-residential mortgage lending, securitization of residential mortgage products, consumer lending, and credit card services in Canada.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives