- Canada

- /

- Diversified Financial

- /

- TSX:HCG

Do Home Capital Group's (TSE:HCG) Earnings Warrant Your Attention?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Home Capital Group (TSE:HCG). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Home Capital Group

How Fast Is Home Capital Group Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Who among us would not applaud Home Capital Group's stratospheric annual EPS growth of 50%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

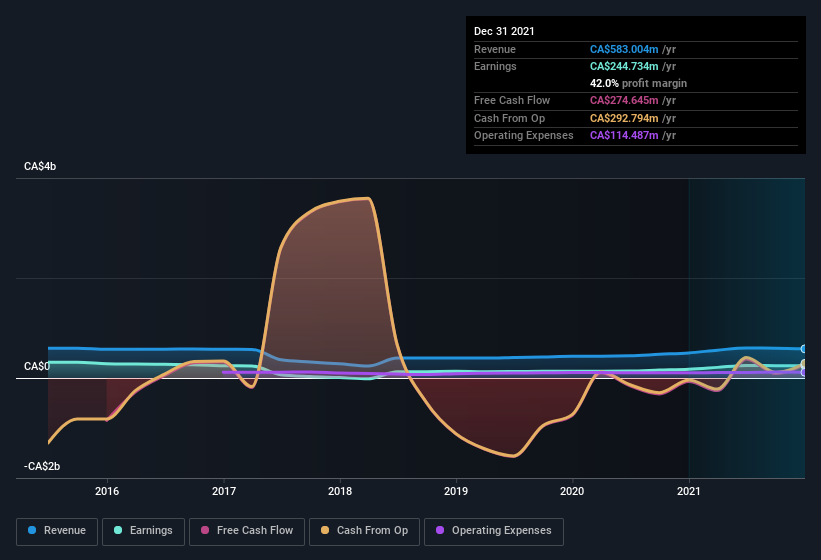

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that Home Capital Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Home Capital Group's EBIT margins were flat over the last year, revenue grew by a solid 16% to CA$583m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Home Capital Group's future profits.

Are Home Capital Group Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

In the last year insider at Home Capital Group were both selling and buying shares; but happily, as a group they spent CA$209k more on stock, than they netted from selling it. Although I don't particularly like to see selling, the fact that they put more capital in, than they extracted, is a positive in my mind. Zooming in, we can see that the biggest insider purchase was by Independent Director Claude Lamoureux for CA$113k worth of shares, at about CA$37.50 per share.

Is Home Capital Group Worth Keeping An Eye On?

Home Capital Group's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. If you're like me, you'll find it hard to ignore that sort of explosive EPS growth. And in fact, it could well signal a fundamental shift in the business economics. If that's the case, you may regret neglecting to put Home Capital Group on your watchlist. You still need to take note of risks, for example - Home Capital Group has 1 warning sign we think you should be aware of.

As a growth investor I do like to see insider buying. But Home Capital Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Home Capital Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Home Capital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:HCG

Home Capital Group

Home Capital Group Inc., through its subsidiary, Home Trust Company, provides residential and non-residential mortgage lending, securitization of residential mortgage products, consumer lending, and credit card services in Canada.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives