CIBC (TSX:CM) Net Interest Margin Gain Reinforces Bullish Profitability Narratives in Q3 2025

Reviewed by Simply Wall St

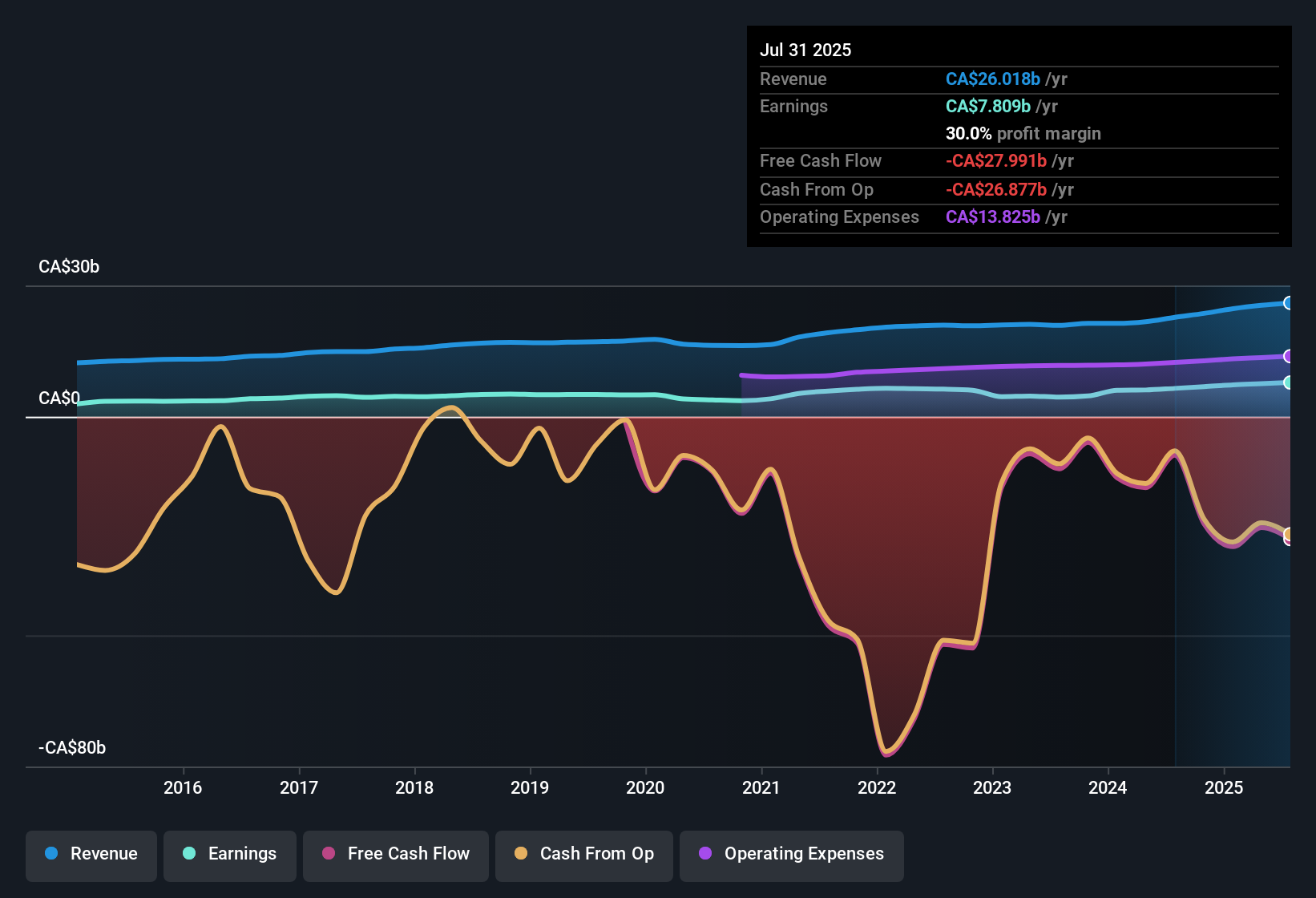

Canadian Imperial Bank of Commerce (TSX:CM) has put up another solid quarter, with Q3 2025 revenue of CA$6.7 billion and basic EPS of CA$2.16 as net income excluding extra items reached CA$2.0 billion. The bank has seen revenue move from CA$6.2 billion in Q4 2024 to CA$6.7 billion in Q3 2025, while trailing 12 month basic EPS climbed from CA$7.29 to CA$8.31, giving investors a cleaner read on how earnings power is tracking through the year. With net interest margin at 1.58% and costs holding a little above half of income, the story this quarter is all about how disciplined margins are shaping the quality of those headline profits.

See our full analysis for Canadian Imperial Bank of Commerce.With the latest earnings picture in place, the next step is to see how these numbers line up with the dominant narratives around CIBC and where the data quietly pushes back on the market’s usual story.

See what the community is saying about Canadian Imperial Bank of Commerce

Margins Strengthen as Costs Stay in Check

- Net interest margin has edged up from 1.5% in Q1 2025 to 1.58% in Q3, while the cost to income ratio has stayed in the mid 50s, moving from 53.1% to 54.7%. This lines up with a trailing net margin of 30% versus 28.5% a year ago.

- Analysts’ bullish points about efficiency gains and digital investments are partly backed by these numbers, but they also face some friction:

- On the supportive side, stable mid 50s cost to income and higher net interest margin fit the view that digital adoption and operational improvements are helping protect profitability.

- On the other hand, the forecast that net margin will ease slightly from 30% to 29.6% over the next few years suggests the recent margin strength may not keep rising at the same pace, which moderates the bullish story.

Valuation Juggles Premium P/E and DCF Upside

- The stock trades on a trailing P/E of 15.1 times versus 11.7 times for the North American Banks industry and 14.9 times for peers. A DCF fair value of CA$185.39 sits well above the current CA$126.46 share price, implying a sizable modeled discount.

- Critics who take the bearish angle focus on how this premium multiple could be challenged if growth underwhelms, and the figures give them some support:

- Forward earnings are expected to grow about 5.3% per year, which is slower than the 11.7% growth projected for the broader Canadian market, so paying more than the sector average P/E could become harder to justify if that gap persists.

- At the same time, the modeled upside to DCF fair value highlights a tension for bears, because it suggests that, despite the higher P/E, cash flow based assumptions still see room for long term value creation if management delivers on its plans.

Strong Profit Growth with Manageable Credit Risk

- Over the last year, earnings have grown 20.8% while trailing net income excluding extra items reached CA$7.8 billion, and non performing loans sit at CA$3.3 billion on a CA$585.9 billion loan book. This points to limited problem loans relative to total lending.

- The consensus narrative that CIBC can lean on a solid capital base and diversified earnings streams looks more grounded when set against this profit and credit profile:

- Year on year earnings growth near 21% and trailing EPS of CA$8.31 give some backing to the idea that investments in advisory, wealth, and U.S. growth are already feeding into the bottom line.

- At the same time, non performing loans have risen compared with earlier quarters, and the bank’s ongoing reliance on Canadian mortgages keeps the consensus view cautious about how credit trends could affect future profitability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Canadian Imperial Bank of Commerce on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a couple of minutes to turn that perspective into a concise narrative of your own and share it with the community: Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Canadian Imperial Bank of Commerce.

Explore Alternatives

CIBC’s richer valuation, slower forecast earnings growth, and rising non performing loans raise questions about how durable its current profitability and premium multiple really are.

If you want steadier prospects, use our stable growth stocks screener (2081 results) to quickly focus on businesses showing more consistent earnings expansion and less narrative tension around future performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CM

Canadian Imperial Bank of Commerce

A diversified financial institution, provides various financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026