- Canada

- /

- Construction

- /

- TSX:BDT

3 Top TSX Dividend Stocks Yielding Up To 4.9%

Reviewed by Simply Wall St

The Canadian market has been navigating a period of heightened volatility and uncertainty, largely driven by global trade tensions and fluctuating tariff policies. Amidst this backdrop, dividend stocks on the TSX can offer investors a measure of stability and income, as they tend to be less volatile and provide regular payouts even when market conditions are challenging.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 9.44% | ★★★★★★ |

| SECURE Waste Infrastructure (TSX:SES) | 3.20% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.42% | ★★★★★☆ |

| Savaria (TSX:SIS) | 3.42% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 6.88% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.70% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.40% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.64% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.85% | ★★★★★☆ |

| Richards Packaging Income Fund (TSX:RPI.UN) | 6.04% | ★★★★★☆ |

Click here to see the full list of 22 stocks from our Top TSX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

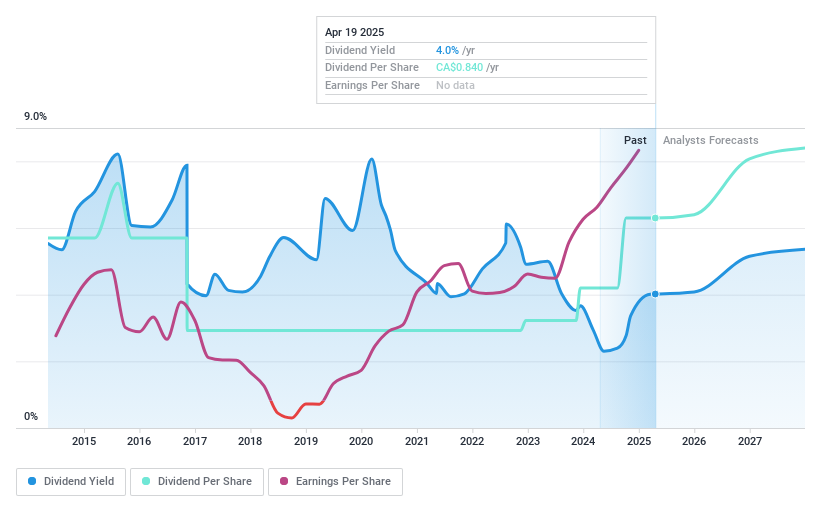

Bird Construction (TSX:BDT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bird Construction Inc. is a Canadian company that offers construction services, with a market cap of CA$1.08 billion.

Operations: Bird Construction Inc. generates revenue of CA$3.40 billion from its operations in the general contracting sector of the construction industry in Canada.

Dividend Yield: 4.2%

Bird Construction's dividends are well-covered by earnings, with a payout ratio of 31.9%, and cash flows, with a cash payout ratio of 57.8%. While its dividend yield is lower than the top Canadian payers, recent earnings growth and strategic project wins signal potential stability. The company announced regular dividends of C$0.07 for March and April 2025. Despite past volatility in dividend payments, Bird's current financial health supports its dividend sustainability.

- Dive into the specifics of Bird Construction here with our thorough dividend report.

- Our expertly prepared valuation report Bird Construction implies its share price may be lower than expected.

Bank of Montreal (TSX:BMO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Montreal provides diversified financial services primarily in North America and has a market cap of CA$92.07 billion.

Operations: Bank of Montreal's revenue is generated through several key segments, including BMO Capital Markets (CA$6.56 billion), BMO Wealth Management (CA$5.89 billion), U.S. Personal and Commercial Banking (CA$8.20 billion), and Canadian Personal and Commercial Banking (CA$9.82 billion).

Dividend Yield: 5%

Bank of Montreal's dividend payments are well-covered with a payout ratio of 58.3%, indicating sustainability. Despite not being among the top Canadian dividend payers, its yield remains attractive at C$1.59 per share for Q2 2025. The bank's earnings have shown significant growth, enhancing its ability to maintain stable dividends over the past decade. Recent fixed-income offerings and strategic appointments reflect ongoing efforts to strengthen financial positioning and market presence, supporting long-term dividend reliability.

- Take a closer look at Bank of Montreal's potential here in our dividend report.

- Our valuation report here indicates Bank of Montreal may be undervalued.

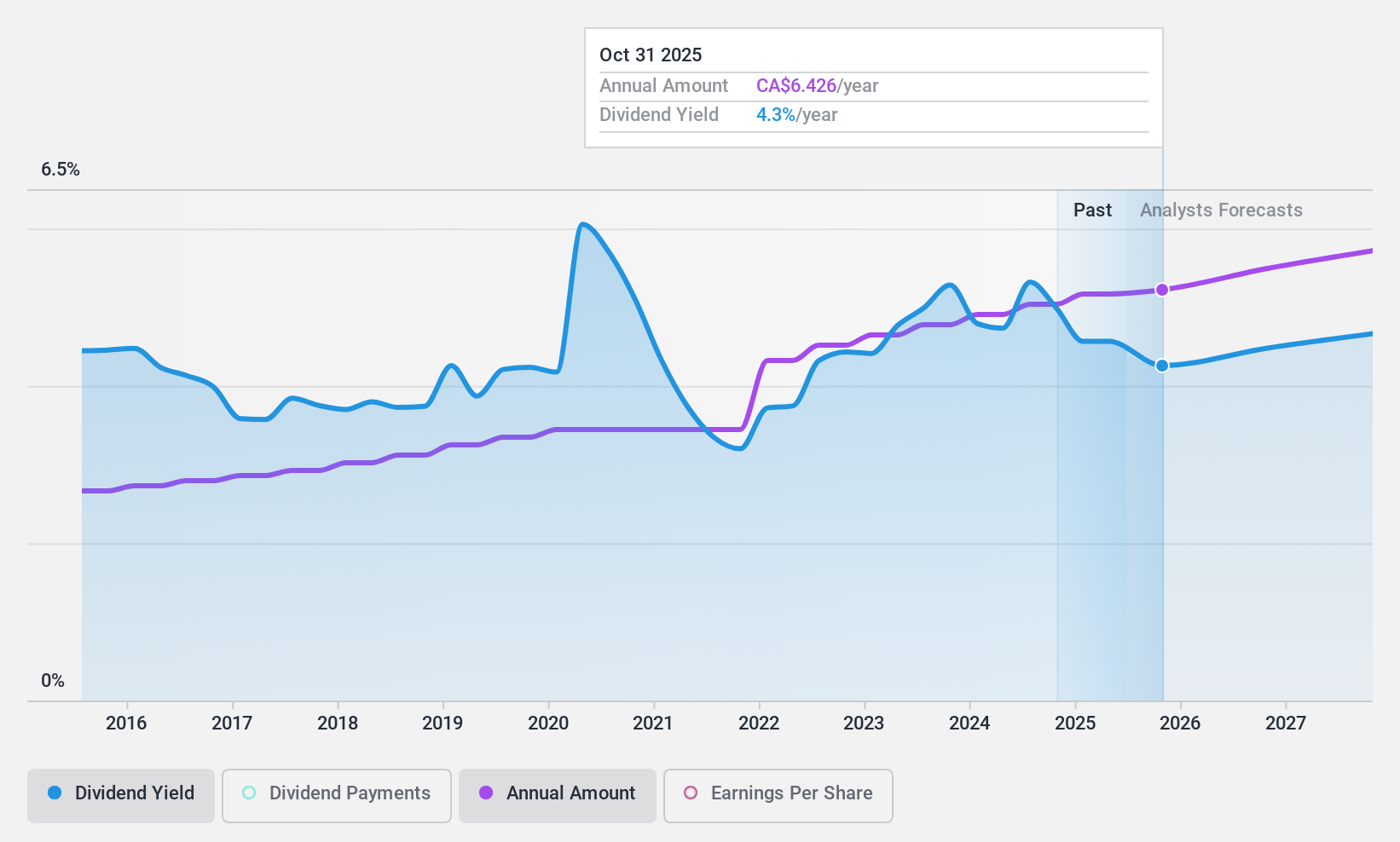

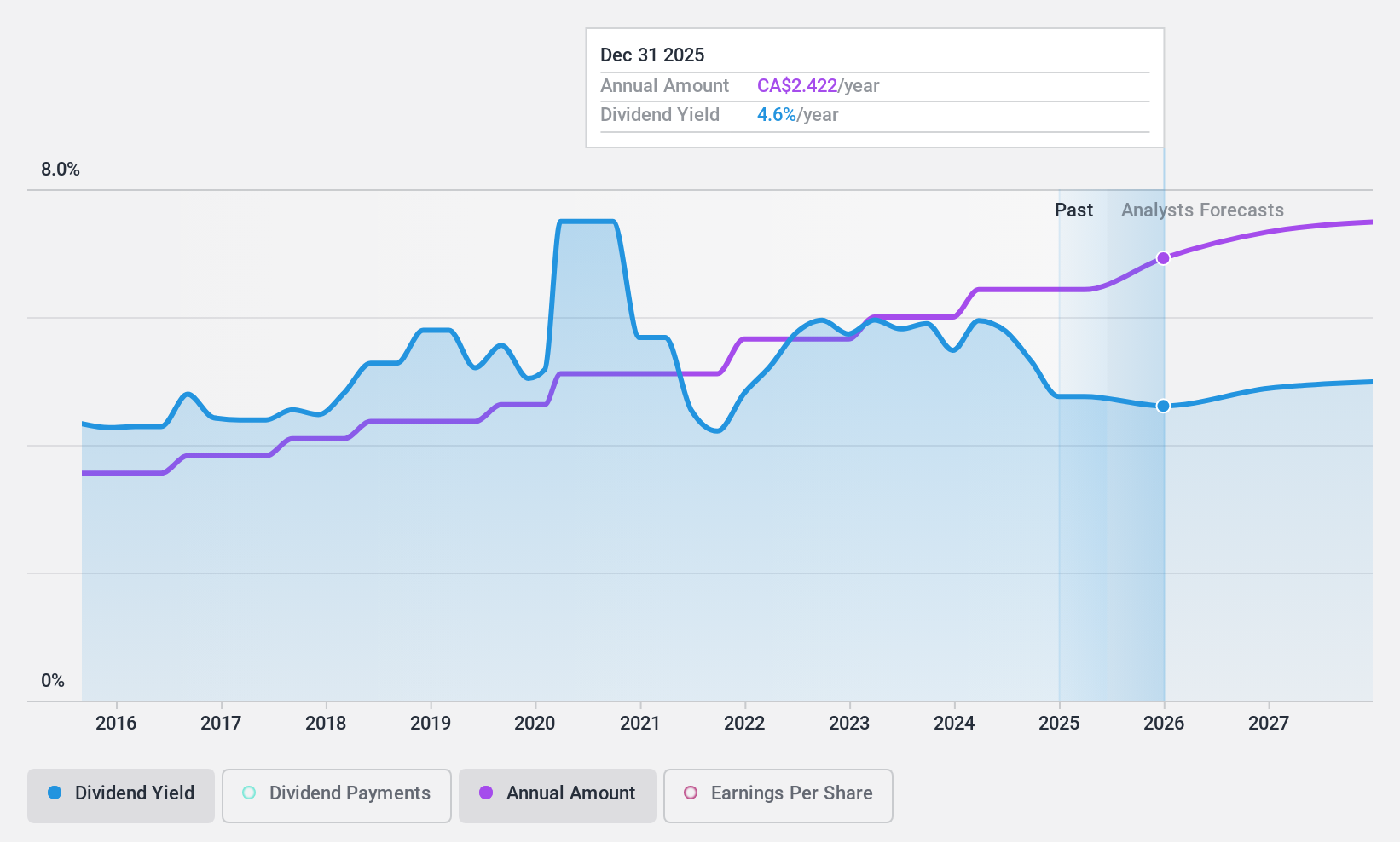

Power Corporation of Canada (TSX:POW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Power Corporation of Canada is an international management and holding company offering financial services across North America, Europe, and Asia with a market cap of CA$30.52 billion.

Operations: Power Corporation of Canada's revenue is primarily derived from its Lifeco segment at CA$30.87 billion, followed by Power Financial - IGM at CA$3.49 billion, and Alternative Asset Investment Platforms at CA$2.17 billion.

Dividend Yield: 4.6%

Power Corporation of Canada offers a reliable dividend, recently increased by 8.9% to C$0.6125 per share, supported by a sustainable payout ratio of 51% and cash flow coverage at 28.5%. Trading below estimated fair value, it provides good relative value within the industry despite its yield being lower than top-tier Canadian payers. With earnings growth and strategic share buybacks enhancing shareholder value, the company maintains stable dividends with low volatility over the past decade.

- Click here to discover the nuances of Power Corporation of Canada with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Power Corporation of Canada is trading behind its estimated value.

Seize The Opportunity

- Unlock our comprehensive list of 22 Top TSX Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bird Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BDT

Very undervalued with outstanding track record and pays a dividend.

Market Insights

Community Narratives