- Brazil

- /

- Water Utilities

- /

- BOVESPA:SBSP3

Companhia de Saneamento Básico do Estado de São Paulo - SABESP Just Beat Analyst Forecasts, And Analysts Have Been Updating Their Predictions

Companhia de Saneamento Básico do Estado de São Paulo - SABESP (BVMF:SBSP3) investors will be delighted, with the company turning in some strong numbers with its latest results. Statutory earnings performance was extremely strong, with revenue of R$9.0b beating expectations by 58% and earnings per share (EPS) of R$3.12, an impressive 78%ahead of expectations. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

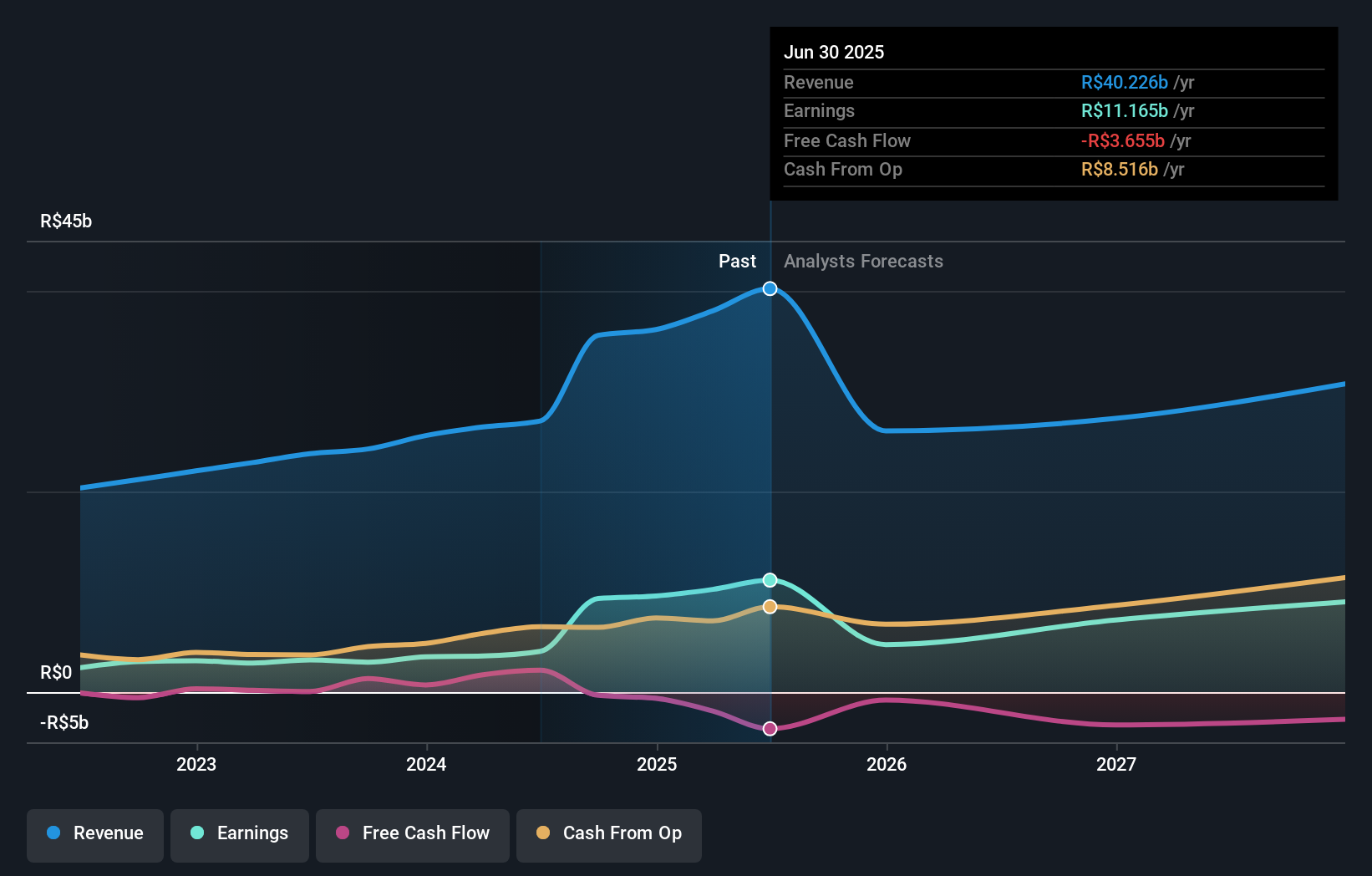

After the latest results, the consensus from Companhia de Saneamento Básico do Estado de São Paulo - SABESP's twelve analysts is for revenues of R$26.0b in 2025, which would reflect a stressful 35% decline in revenue compared to the last year of performance. Statutory earnings per share are expected to tumble 59% to R$6.74 in the same period. In the lead-up to this report, the analysts had been modelling revenues of R$23.1b and earnings per share (EPS) of R$7.22 in 2025. While revenue forecasts have increased substantially, the analysts are a little more pessimistic on earnings, suggesting that the growth does not come without cost.

Check out our latest analysis for Companhia de Saneamento Básico do Estado de São Paulo - SABESP

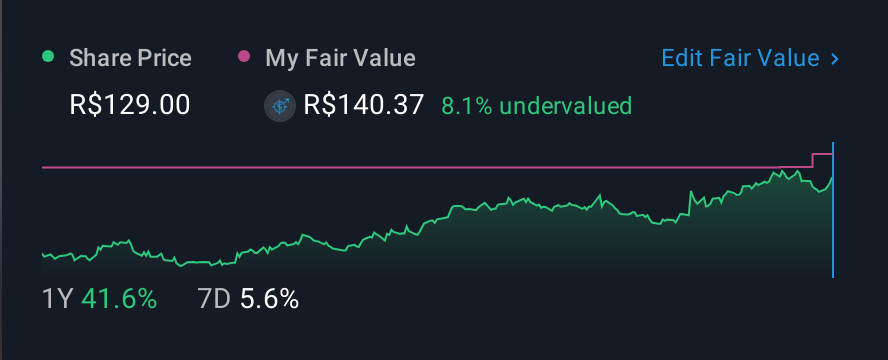

There's been no major changes to the price target of R$131, suggesting that the impact of higher forecast revenue and lower earnings won't result in a meaningful change to the business' valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Companhia de Saneamento Básico do Estado de São Paulo - SABESP analyst has a price target of R$144 per share, while the most pessimistic values it at R$101. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Companhia de Saneamento Básico do Estado de São Paulo - SABESP shareholders.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Companhia de Saneamento Básico do Estado de São Paulo - SABESP's past performance and to peers in the same industry. These estimates imply that revenue is expected to slow, with a forecast annualised decline of 58% by the end of 2025. This indicates a significant reduction from annual growth of 17% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 4.9% per year. It's pretty clear that Companhia de Saneamento Básico do Estado de São Paulo - SABESP's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Companhia de Saneamento Básico do Estado de São Paulo - SABESP. They also upgraded their revenue estimates for next year, even though it is expected to grow slower than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that in mind, we wouldn't be too quick to come to a conclusion on Companhia de Saneamento Básico do Estado de São Paulo - SABESP. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for Companhia de Saneamento Básico do Estado de São Paulo - SABESP going out to 2027, and you can see them free on our platform here..

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Companhia de Saneamento Básico do Estado de São Paulo - SABESP (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:SBSP3

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

Provides basic and environmental sanitation services in the São Paulo State, Brazil.

Mediocre balance sheet with limited growth.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026