- Brazil

- /

- Electric Utilities

- /

- BOVESPA:LIGT3

Light (BVMF:LIGT3 investor five-year losses grow to 75% as the stock sheds R$201m this past week

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We don't wish catastrophic capital loss on anyone. Imagine if you held Light S.A. (BVMF:LIGT3) for half a decade as the share price tanked 76%. And we doubt long term believers are the only worried holders, since the stock price has declined 45% over the last twelve months. Shareholders have had an even rougher run lately, with the share price down 11% in the last 90 days.

After losing 11% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Light

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

We know that Light has been profitable in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics may better explain the share price move.

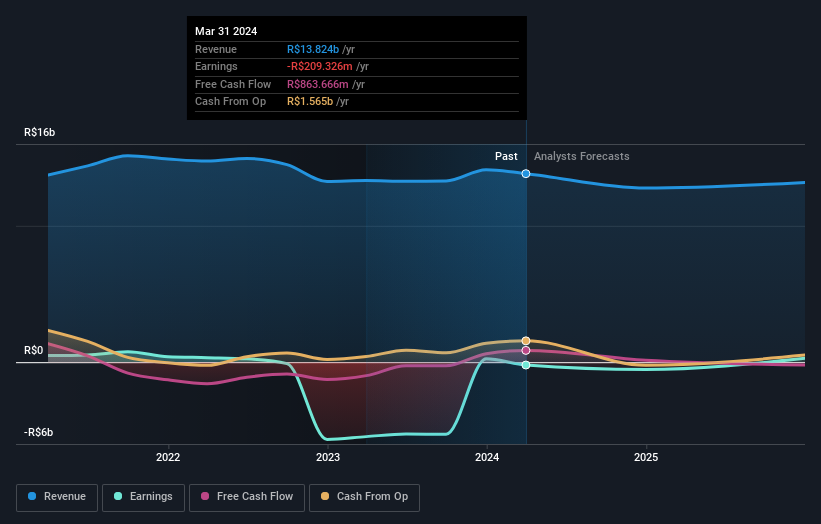

In contrast to the share price, revenue has actually increased by 2.1% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Light's financial health with this free report on its balance sheet.

A Different Perspective

Light shareholders are down 45% for the year, but the market itself is up 6.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Light is showing 1 warning sign in our investment analysis , you should know about...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:LIGT3

Light

Engages in the generation, transmission, distribution, and sale of electric power in Brazil.

Fair value with moderate growth potential.

Market Insights

Community Narratives