- Brazil

- /

- Electric Utilities

- /

- BOVESPA:CPFE3

Pinning Down CPFL Energia S.A.'s (BVMF:CPFE3) P/E Is Difficult Right Now

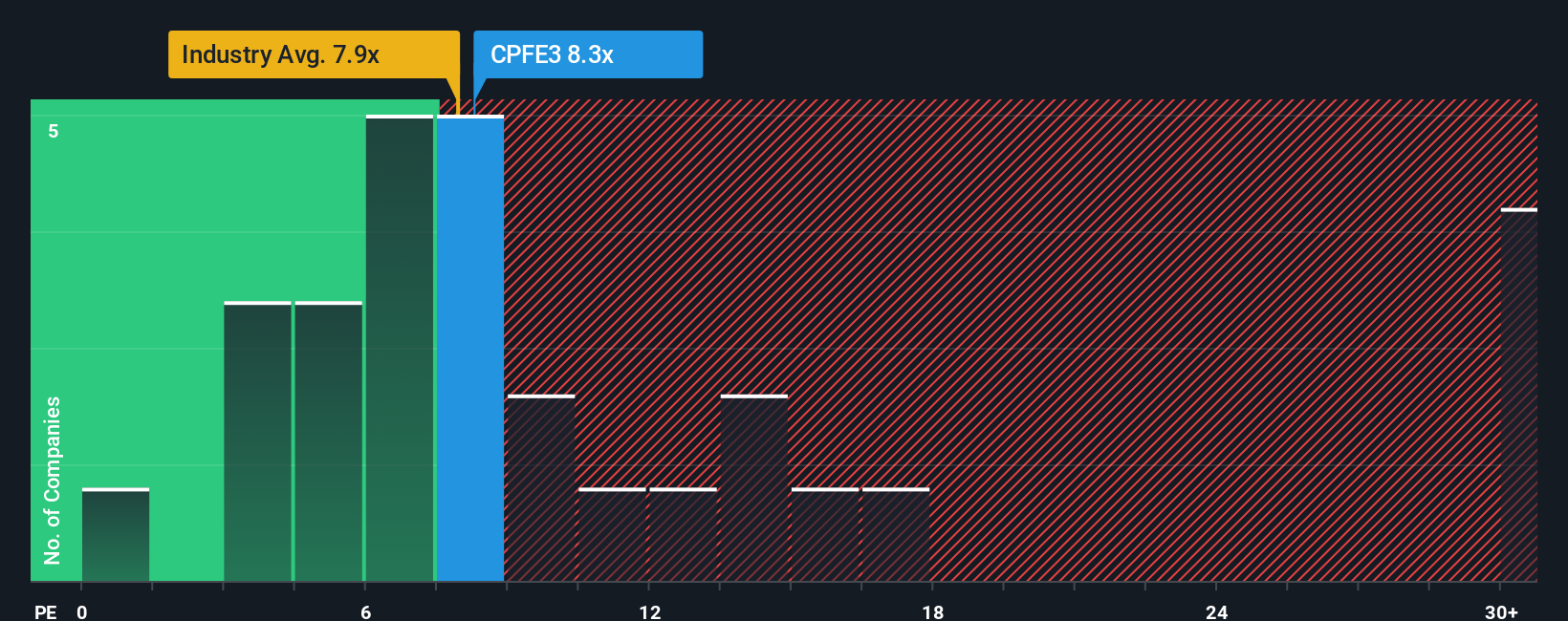

With a median price-to-earnings (or "P/E") ratio of close to 9x in Brazil, you could be forgiven for feeling indifferent about CPFL Energia S.A.'s (BVMF:CPFE3) P/E ratio of 8.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

CPFL Energia hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

See our latest analysis for CPFL Energia

Is There Some Growth For CPFL Energia?

In order to justify its P/E ratio, CPFL Energia would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 4.9%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 8.8% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to slump, contracting by 2.5% per year during the coming three years according to the ten analysts following the company. With the market predicted to deliver 20% growth each year, that's a disappointing outcome.

In light of this, it's somewhat alarming that CPFL Energia's P/E sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

What We Can Learn From CPFL Energia's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that CPFL Energia currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for CPFL Energia you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:CPFE3

CPFL Energia

Through its subsidiaries, engages in the electric power business in Brazil.

Good value with mediocre balance sheet.

Market Insights

Community Narratives