- Brazil

- /

- Renewable Energy

- /

- BOVESPA:AURE3

New Forecasts: Here's What Analysts Think The Future Holds For Auren Energia S.A. (BVMF:AURE3)

Auren Energia S.A. (BVMF:AURE3) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The revenue forecast for this year has experienced a facelift, with analysts now much more optimistic on its sales pipeline.

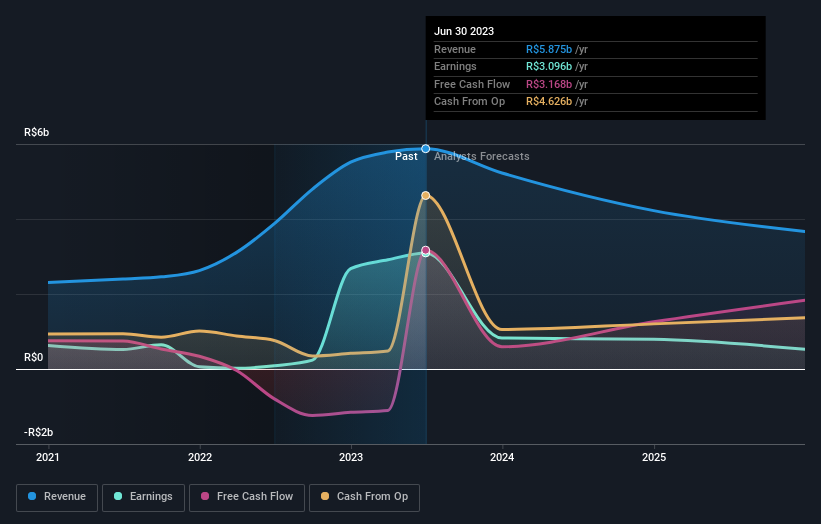

Following the upgrade, the consensus from nine analysts covering Auren Energia is for revenues of R$5.2b in 2023, implying a considerable 11% decline in sales compared to the last 12 months. Statutory earnings per share are anticipated to crater 73% to R$0.82 in the same period. Prior to this update, the analysts had been forecasting revenues of R$4.7b and earnings per share (EPS) of R$0.81 in 2023. The forecasts seem more optimistic now, with a nice gain to revenue and a small lift in earnings per share estimates.

View our latest analysis for Auren Energia

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that sales are expected to reverse, with a forecast 21% annualised revenue decline to the end of 2023. That is a notable change from historical growth of 52% over the last year. Yet aggregate analyst estimates for other companies in the industry suggest that industry revenues are forecast to decline 3.5% per year. The forecasts do look bearish for Auren Energia, since they're expecting it to shrink faster than the industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Notably, analysts also upgraded their revenue estimates, with sales performing well although Auren Energia's revenue growth is expected to trail that of the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at Auren Energia.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Auren Energia going out to 2025, and you can see them free on our platform here..

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:AURE3

Auren Energia

Engages in the investment platform for the management, operation, acquisition, development and construction of energy generation, transmission and trading assets in Brazil.

Good value with moderate growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026