- Brazil

- /

- Electric Utilities

- /

- BOVESPA:ALUP11

Alupar Investimento S.A. (BVMF:ALUP11) Passed Our Checks, And It's About To Pay A R$1.11 Dividend

Readers hoping to buy Alupar Investimento S.A. (BVMF:ALUP11) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date generally occurs two days before the record date, which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade can take two business days or more to settle. Accordingly, Alupar Investimento investors that purchase the stock on or after the 17th of April will not receive the dividend, which will be paid on the 16th of July.

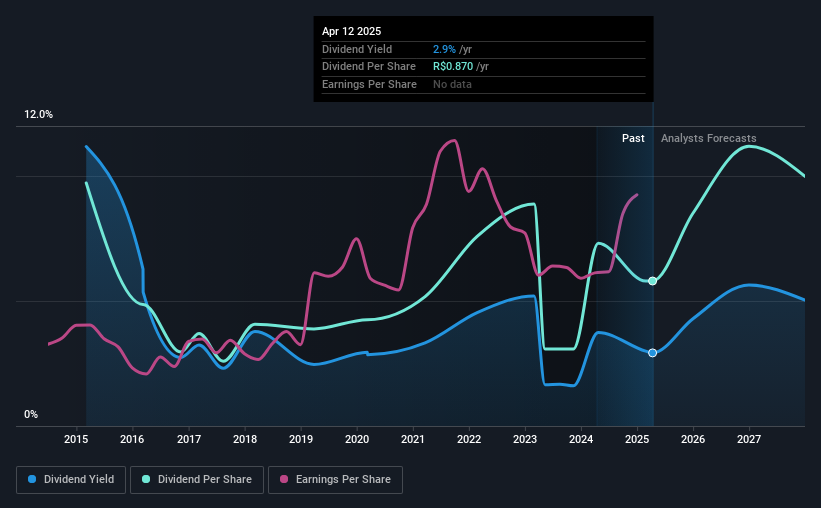

The company's upcoming dividend is R$1.11 a share, following on from the last 12 months, when the company distributed a total of R$0.87 per share to shareholders. Last year's total dividend payments show that Alupar Investimento has a trailing yield of 2.9% on the current share price of R$29.75. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Fortunately Alupar Investimento's payout ratio is modest, at just 25% of profit. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It distributed 44% of its free cash flow as dividends, a comfortable payout level for most companies.

It's positive to see that Alupar Investimento's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Check out our latest analysis for Alupar Investimento

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. With that in mind, we're encouraged by the steady growth at Alupar Investimento, with earnings per share up 4.1% on average over the last five years. Earnings per share growth in recent times has not been a standout. Yet there are several ways to grow the dividend, and one of them is simply that the company may choose to pay out more of its earnings as dividends.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Alupar Investimento's dividend payments per share have declined at 5.0% per year on average over the past 10 years, which is uninspiring. It's unusual to see earnings per share increasing at the same time as dividends per share have been in decline. We'd hope it's because the company is reinvesting heavily in its business, but it could also suggest business is lumpy.

To Sum It Up

Has Alupar Investimento got what it takes to maintain its dividend payments? Earnings per share have been growing moderately, and Alupar Investimento is paying out less than half its earnings and cash flow as dividends, which is an attractive combination as it suggests the company is investing in growth. We would prefer to see earnings growing faster, but the best dividend stocks over the long term typically combine significant earnings per share growth with a low payout ratio, and Alupar Investimento is halfway there. Overall we think this is an attractive combination and worthy of further research.

On that note, you'll want to research what risks Alupar Investimento is facing. Our analysis shows 2 warning signs for Alupar Investimento and you should be aware of them before buying any shares.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:ALUP11

Alupar Investimento

Engages in the transmission, generation, and commercialization of energy in Brazil, Colombia, Peru, and Chile.

Proven track record with imperfect balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion