- Brazil

- /

- Infrastructure

- /

- BOVESPA:TPIS3

Triunfo Participações e Investimentos S.A. (BVMF:TPIS3) Held Back By Insufficient Growth Even After Shares Climb 45%

Triunfo Participações e Investimentos S.A. (BVMF:TPIS3) shares have had a really impressive month, gaining 45% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 45% in the last year.

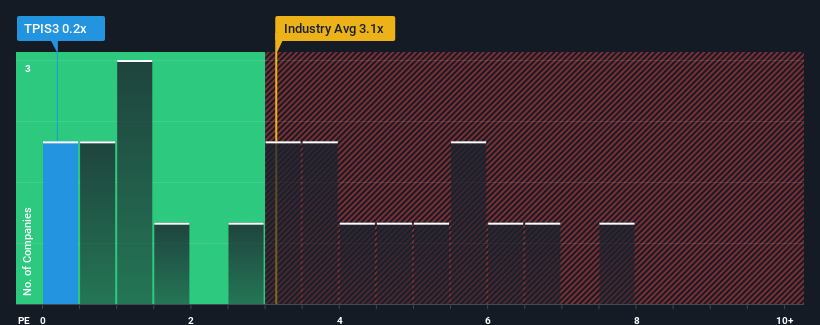

In spite of the firm bounce in price, when close to half the companies operating in Brazil's Infrastructure industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Triunfo Participações e Investimentos as an enticing stock to check out with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Triunfo Participações e Investimentos

What Does Triunfo Participações e Investimentos' Recent Performance Look Like?

Triunfo Participações e Investimentos certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Triunfo Participações e Investimentos' earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

Triunfo Participações e Investimentos' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 42%. As a result, it also grew revenue by 25% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing that to the industry, which is predicted to deliver 14% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's understandable that Triunfo Participações e Investimentos' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Key Takeaway

The latest share price surge wasn't enough to lift Triunfo Participações e Investimentos' P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Triunfo Participações e Investimentos confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Before you settle on your opinion, we've discovered 3 warning signs for Triunfo Participações e Investimentos (1 makes us a bit uncomfortable!) that you should be aware of.

If you're unsure about the strength of Triunfo Participações e Investimentos' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Triunfo Participações e Investimentos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:TPIS3

Triunfo Participações e Investimentos

Triunfo Participações e Investimentos S.A.

Good value with mediocre balance sheet.

Market Insights

Community Narratives