- Brazil

- /

- Transportation

- /

- BOVESPA:RENT3

Top Growth Companies With High Insider Ownership For September 2024

Reviewed by Simply Wall St

As global markets navigate mixed trading and economic indicators, investors are increasingly focused on finding resilient growth opportunities. In this environment, companies with high insider ownership can signal strong management confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 20.3% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 27.4% |

| Medley (TSE:4480) | 34% | 30.4% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95.9% |

| Calliditas Therapeutics (OM:CALTX) | 12.7% | 51.9% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

Here's a peek at a few of the choices from the screener.

Raia Drogasil (BOVESPA:RADL3)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Raia Drogasil S.A. operates in Brazil, focusing on the retail sale of medicines, personal care and beauty products, cosmetics, dermocosmetics, and specialty medicines with a market cap of R$46.82 billion.

Operations: Revenue from the retail sale of medicines, cosmetics, and hygiene products amounts to R$36.39 billion.

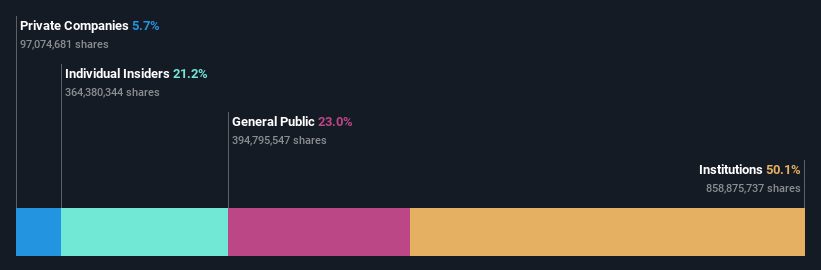

Insider Ownership: 21.2%

Earnings Growth Forecast: 24.3% p.a.

Raia Drogasil's earnings are forecast to grow 24.3% annually, outpacing the Brazilian market's 14.3%. Despite high debt levels, its Return on Equity is expected to reach 26.5% in three years. Recent earnings reports show a mixed picture: Q2 sales rose to BRL 9.69 billion from BRL 8.44 billion, but net income slightly declined from BRL 338.19 million to BRL 326.63 million year-over-year, reflecting challenges despite growth prospects.

- Take a closer look at Raia Drogasil's potential here in our earnings growth report.

- The analysis detailed in our Raia Drogasil valuation report hints at an inflated share price compared to its estimated value.

Localiza Rent a Car (BOVESPA:RENT3)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Localiza Rent a Car S.A. operates in the car and fleet rental business both in Brazil and internationally, with a market cap of R$44.53 billion.

Operations: Localiza Rent a Car S.A. generates revenue primarily from fleet rental, amounting to R$13.53 billion.

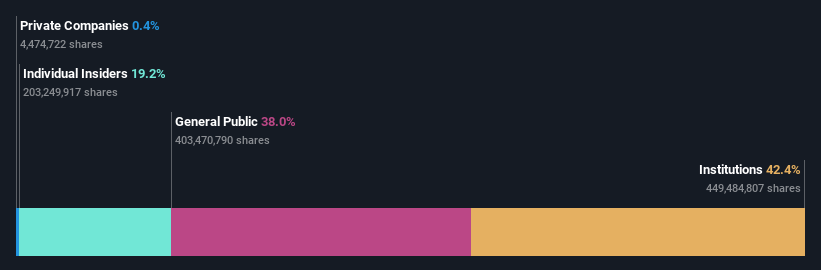

Insider Ownership: 19.1%

Earnings Growth Forecast: 39.2% p.a.

Localiza Rent a Car's earnings are forecast to grow 39.2% annually, surpassing the Brazilian market's 14.3%. Despite high revenue growth (15.7% per year), recent financials show a net loss for Q2 2024 at BRL 569.47 million, up from BRL 88.07 million last year, and its dividend is not well covered by earnings or free cash flows. Additionally, the company's removal from the Brazil Valor BM&FBOVESPA Index indicates potential market challenges ahead.

- Delve into the full analysis future growth report here for a deeper understanding of Localiza Rent a Car.

- In light of our recent valuation report, it seems possible that Localiza Rent a Car is trading beyond its estimated value.

Ninebot (SHSE:689009)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ninebot Limited designs, develops, produces, sells, and services transportation and robot products globally with a market cap of CN¥33.18 billion.

Operations: Ninebot Limited's revenue segments include the design, research and development, production, sale, and servicing of transportation and robot products globally.

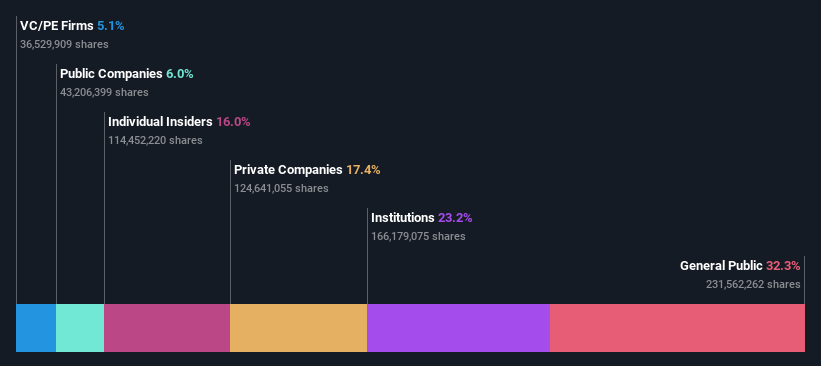

Insider Ownership: 16%

Earnings Growth Forecast: 23.4% p.a.

Ninebot's revenue is forecast to grow 22.4% annually, outpacing the CN market's 13.3%. Earnings are expected to increase significantly over the next three years, with a projected annual growth of 23.38%, exceeding the market average of 23.1%. Recent financials show strong performance, with half-year sales reaching CNY 6.63 billion and net income rising to CNY 595.66 million from CNY 222.41 million last year, indicating robust growth potential despite some large one-off items affecting results.

- Click here and access our complete growth analysis report to understand the dynamics of Ninebot.

- Upon reviewing our latest valuation report, Ninebot's share price might be too optimistic.

Summing It All Up

- Click through to start exploring the rest of the 1512 Fast Growing Companies With High Insider Ownership now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:RENT3

Localiza Rent a Car

Engages in car and fleet rental business in Brazil and internationally.

Reasonable growth potential with acceptable track record.

Market Insights

Community Narratives