- Brazil

- /

- Transportation

- /

- BOVESPA:MOVI3

Movida Participações S.A. (BVMF:MOVI3) Soars 29% But It's A Story Of Risk Vs Reward

Movida Participações S.A. (BVMF:MOVI3) shares have continued their recent momentum with a 29% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 41%.

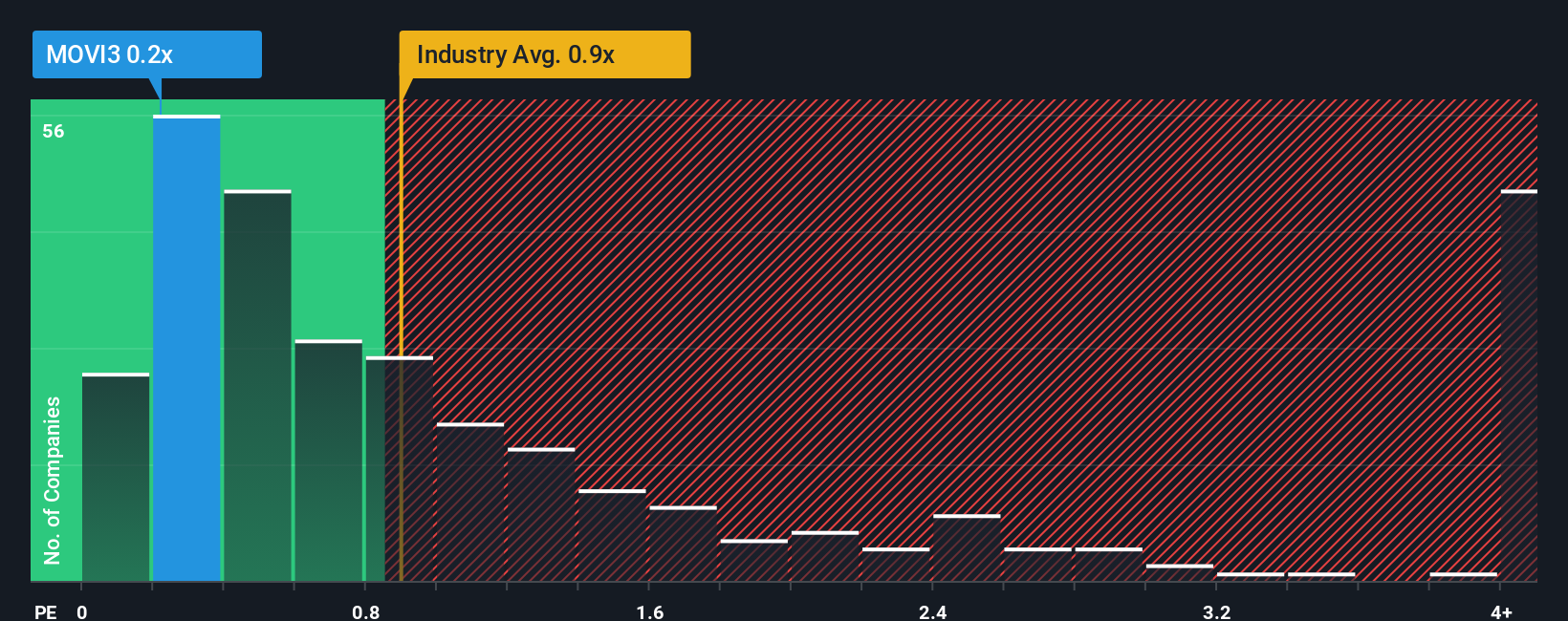

Even after such a large jump in price, when close to half the companies operating in Brazil's Transportation industry have price-to-sales ratios (or "P/S") above 1x, you may still consider Movida Participações as an enticing stock to check out with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Movida Participações

How Has Movida Participações Performed Recently?

Recent times have been advantageous for Movida Participações as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Movida Participações will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Movida Participações' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 32% gain to the company's top line. Pleasingly, revenue has also lifted 118% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 13% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 12% per year, which is not materially different.

With this in consideration, we find it intriguing that Movida Participações' P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

The latest share price surge wasn't enough to lift Movida Participações' P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Movida Participações' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Movida Participações that you should be aware of.

If you're unsure about the strength of Movida Participações' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:MOVI3

Movida Participações

Through its subsidiaries, provides car rental services in Brazil.

Undervalued with high growth potential.

Market Insights

Community Narratives