- Brazil

- /

- Tech Hardware

- /

- BOVESPA:POSI3

There's No Escaping Positivo Tecnologia S.A.'s (BVMF:POSI3) Muted Earnings

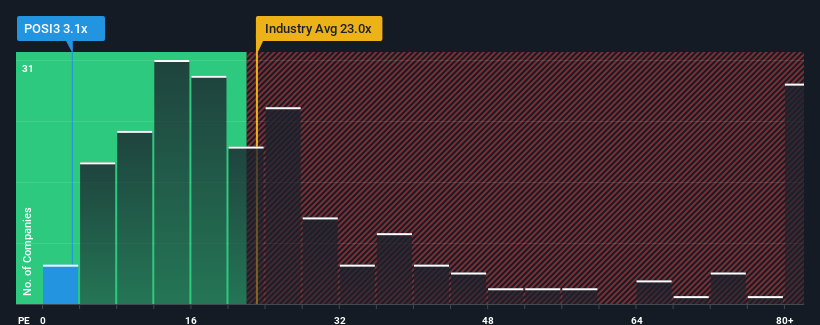

Positivo Tecnologia S.A.'s (BVMF:POSI3) price-to-earnings (or "P/E") ratio of 3.1x might make it look like a strong buy right now compared to the market in Brazil, where around half of the companies have P/E ratios above 10x and even P/E's above 17x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings growth that's inferior to most other companies of late, Positivo Tecnologia has been relatively sluggish. It seems that many are expecting the uninspiring earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Positivo Tecnologia

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Positivo Tecnologia's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 7.2% last year. The solid recent performance means it was also able to grow EPS by 21% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 1.5% per annum as estimated by the four analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 20% per annum, which is noticeably more attractive.

With this information, we can see why Positivo Tecnologia is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Positivo Tecnologia's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Positivo Tecnologia's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Positivo Tecnologia (1 doesn't sit too well with us!) that you should be aware of before investing here.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:POSI3

Positivo Tecnologia

Develops, manufactures, sells, and distributes hardware, software, and information technology (IT) solutions in Brazil and internationally.

Undervalued with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026