- Brazil

- /

- Communications

- /

- BOVESPA:INTB3

Intelbras S.A. - Indústria de Telecomunicação Eletrônica Brasileira's (BVMF:INTB3) Share Price Could Signal Some Risk

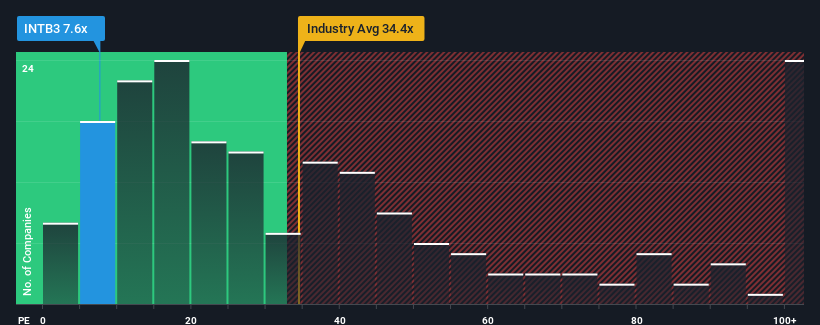

It's not a stretch to say that Intelbras S.A. - Indústria de Telecomunicação Eletrônica Brasileira's (BVMF:INTB3) price-to-earnings (or "P/E") ratio of 7.6x right now seems quite "middle-of-the-road" compared to the market in Brazil, where the median P/E ratio is around 8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Intelbras - Indústria de Telecomunicação Eletrônica Brasileira could be doing better as it's been growing earnings less than most other companies lately. It might be that many expect the uninspiring earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Intelbras - Indústria de Telecomunicação Eletrônica Brasileira

What Are Growth Metrics Telling Us About The P/E?

Intelbras - Indústria de Telecomunicação Eletrônica Brasileira's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a worthy increase of 13%. The solid recent performance means it was also able to grow EPS by 20% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 4.7% during the coming year according to the ten analysts following the company. Meanwhile, the rest of the market is forecast to expand by 16%, which is noticeably more attractive.

With this information, we find it interesting that Intelbras - Indústria de Telecomunicação Eletrônica Brasileira is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Intelbras - Indústria de Telecomunicação Eletrônica Brasileira's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 1 warning sign for Intelbras - Indústria de Telecomunicação Eletrônica Brasileira you should be aware of.

If you're unsure about the strength of Intelbras - Indústria de Telecomunicação Eletrônica Brasileira's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:INTB3

Intelbras - Indústria de Telecomunicação Eletrônica Brasileira

Provides safety, network, communication, and energy solutions to residences, small and mid-size companies, industries, and large-size businesses in Brazil.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives