- Brazil

- /

- Specialty Stores

- /

- BOVESPA:LJQQ3

Take Care Before Jumping Onto Lojas Quero-Quero S.A. (BVMF:LJQQ3) Even Though It's 28% Cheaper

The Lojas Quero-Quero S.A. (BVMF:LJQQ3) share price has fared very poorly over the last month, falling by a substantial 28%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 31% share price drop.

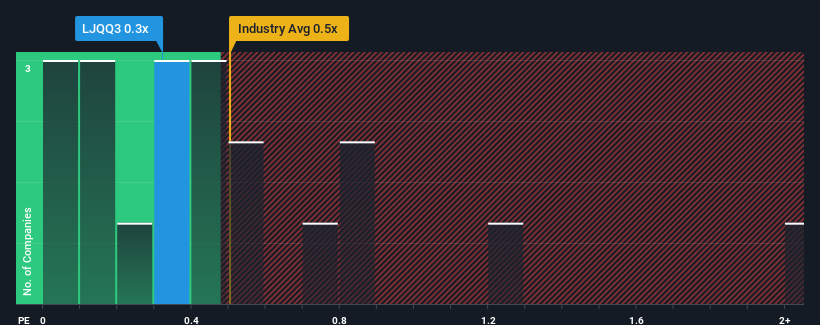

Even after such a large drop in price, it's still not a stretch to say that Lojas Quero-Quero's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Specialty Retail industry in Brazil, where the median P/S ratio is around 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Lojas Quero-Quero

What Does Lojas Quero-Quero's P/S Mean For Shareholders?

Recent times have been pleasing for Lojas Quero-Quero as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Lojas Quero-Quero's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

Lojas Quero-Quero's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.9% last year. The latest three year period has also seen an excellent 39% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 16% each year as estimated by the five analysts watching the company. With the industry only predicted to deliver 3.2% per annum, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Lojas Quero-Quero is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Following Lojas Quero-Quero's share price tumble, its P/S is just clinging on to the industry median P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Lojas Quero-Quero's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Lojas Quero-Quero (at least 2 which shouldn't be ignored), and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Lojas Quero-Quero, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:LJQQ3

Lojas Quero-Quero

Engages in the general retail trade activities in Brazil.

Medium-low and good value.

Market Insights

Community Narratives