- Brazil

- /

- Real Estate

- /

- BOVESPA:NEXP3

Here's Why We're Not Too Worried About Brasil Brokers Participações' (BVMF:BBRK3) Cash Burn Situation

Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

Given this risk, we thought we'd take a look at whether Brasil Brokers Participações (BVMF:BBRK3) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for Brasil Brokers Participações

When Might Brasil Brokers Participações Run Out Of Money?

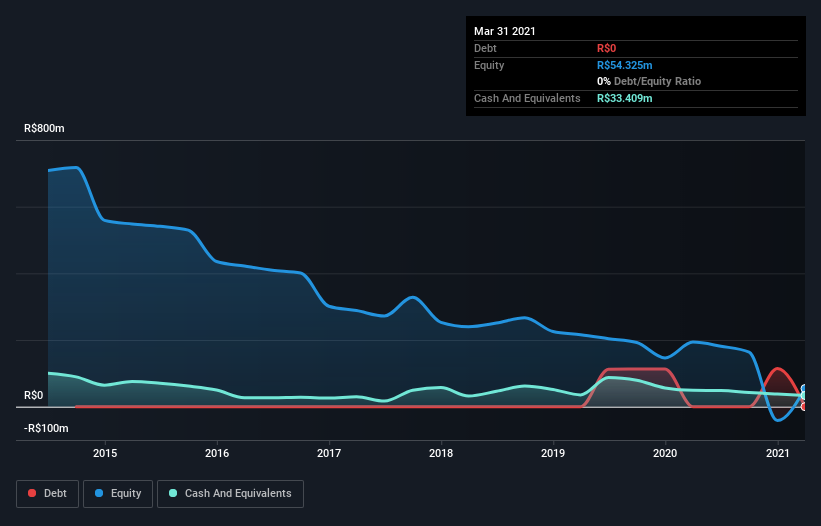

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at March 2021, Brasil Brokers Participações had cash of R$33m and no debt. In the last year, its cash burn was R$15m. That means it had a cash runway of about 2.2 years as of March 2021. Arguably, that's a prudent and sensible length of runway to have. The image below shows how its cash balance has been changing over the last few years.

How Well Is Brasil Brokers Participações Growing?

Brasil Brokers Participações managed to reduce its cash burn by 77% over the last twelve months, which suggests it's on the right flight path. Unfortunately, however, operating revenue dropped 16% during the same time frame. Considering the factors above, the company doesn’t fare badly when it comes to assessing how it is changing over time. Of course, we've only taken a quick look at the stock's growth metrics, here. This graph of historic earnings and revenue shows how Brasil Brokers Participações is building its business over time.

How Easily Can Brasil Brokers Participações Raise Cash?

Even though it seems like Brasil Brokers Participações is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of R$156m, Brasil Brokers Participações' R$15m in cash burn equates to about 9.6% of its market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

Is Brasil Brokers Participações' Cash Burn A Worry?

On this analysis of Brasil Brokers Participações' cash burn, we think its cash burn reduction was reassuring, while its falling revenue has us a bit worried. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. On another note, Brasil Brokers Participações has 3 warning signs (and 2 which shouldn't be ignored) we think you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nexpe Participações might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:NEXP3

Nexpe Participações

Through its subsidiaries, operates as a real estate brokerage and consulting company in Brazil.

Good value with proven track record.

Market Insights

Community Narratives